[ad_1]

Conditions can change rapidly in the stock market.

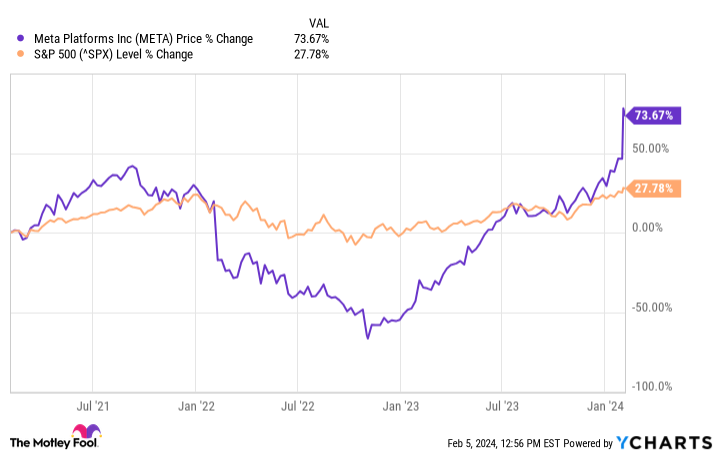

It wasn’t that long ago meta platform (NASDAQ:Meta)Facebook’s parent company was in serious trouble. Revenues were increasing steadily, but to put it bluntly, expenses were increasing and revenues were moving in the wrong direction. As a result of these headwinds, Metaplatforms’ stock price fell significantly from mid-2021 to 2022.

But the tech giant has since rebounded significantly. Let’s take a look at why the company’s stock is worth buying and keeping in your growth-oriented portfolio forever.

Great Q4 results for Meta Platforms

One of the reasons Meta Platforms was able to bounce back was because it initiated cost-cutting initiatives, from downsizing its workforce to reducing its real estate footprint. The technology company has also enhanced its use of AI on its platform. For example, Meta’s Reels on Instagram and Facebook (his wildly popular TikTok-style short videos) use AI recommendation algorithms to keep users glued to their screens. Meta Platforms was also confident that although the advertising market was suffering, things would return to normal.

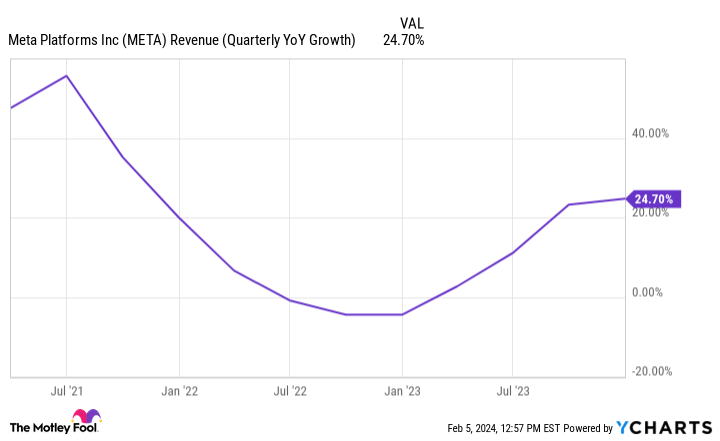

Mehta’s hopes and efforts paid off in spades. The company’s fourth quarter financial results make this clear. Meta’s revenue was his $40.1 billion, up almost 25% year over year.

We need to go back to 2021 to see the company’s sales growth even higher. Meanwhile, Meta Platforms’ costs and expenses decreased 8% to $23.7 billion. The tech giant’s net income was about $14 billion, a huge 201% increase from the same period last year.

Abundant growth opportunities

Metaplatforms’ stock price soared after the company’s disastrous fourth-quarter results, and its market cap once again exceeded $1 trillion. This feat has only been achieved by a small group of people, but that doesn’t mean it’s the limit for this tech company. There’s still plenty of fuel left in the meta’s growth engine. The company’s monthly active users at the end of 2023 were 3.98 billion, an increase of 6% from the previous year. This is equivalent to more than half of the world’s population.

This large ecosystem is the meta platform’s secret weapon, as it can be monetized in a variety of ways. Meta still makes most of its revenue from advertising. Advertising revenue for the fourth quarter was $38.7 billion, accounting for 96.5% of the company’s total revenue. Advertising sales increased by 23.8% year-on-year. Meta Platforms’ “other” revenue was $334 million, up 81.5% year over year.

This growth was primarily driven by business messaging on WhatsApp. The company is ramping up its efforts to monetize WhatsApp, especially through business messaging. And while they still represent a small portion of total revenue, this could be a huge opportunity given Meta Platforms’ large ecosystem. And that’s just one of the company’s growth initiatives.

The company is also trying to make waves in the rapidly growing generative AI market, but it won’t contribute significantly to sales right away. Still, Meta Platforms should be able to successfully complement its strong advertising business with other meaningful revenue streams.

Meta is now a dividend stock

Meta Platforms gave another reason to like the stock during its fourth quarter earnings call. That means the company will begin paying a quarterly dividend. It is too early to tell whether meta-platforms will become popular in the future. wonderful It’s a dividend stock, but it has some characteristics that make it so. Meta Platforms’ underlying business is strong, generating generally stable revenue and profit growth, boasting multiple avenues of growth, and benefits from a strong moat of network effects.

These factors make Metaplatform a good stock to buy and hold forever. The technology company may face problems similar to what happened in 2021 and 2022. But in the long run, Metaplatform should deliver market-beating returns for patient and loyal investors.

Should you invest $1,000 in Metaplatform now?

Before purchasing Metaplatform stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and the Meta platform wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of February 5, 2024

Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. Prosper Junior Bakiny is in charge of the meta position on his platform. The Motley Fool owns a position in and recommends Meta Platform. The Motley Fool has a disclosure policy.

1 Great Artificial Intelligence (AI) Stocks to Buy and Hold Forever was originally published by The Motley Fool.

[ad_2]

Source link