[ad_1]

High-quality growth stocks have the potential to generate significant returns for long-term shareholders, especially during bull markets. To benefit from the potential for significant upside over time, it’s important to always identify companies that are growing at a high pace compared to the overall market.

Most growth stocks trade at a premium, as investors expect strong revenue and profit increases, ultimately leading to higher valuations.

One such mid-cap growth stock is Elf Beauty (New York Stock Exchange:Elf) has already delivered significant returns to shareholders over the past five years. Elf Beauty has soared more than 1,800% since January 2019 and is trading near all-time highs.

Despite the market-beating earnings, I’m bullish on the company’s widening competitive moat, strong earnings growth, and recession-proof business, so I expect the stock to deliver solid returns over the next 10 years. are doing.

Overview of Elf Beauty

Valued at $8.8 billion, Elf Beauty offers a portfolio of cosmetics and skin care products to consumers around the world. These products are sold through a network of domestic and international retailers and direct-to-consumer sales.

elf has a family of brands including elf Cosmetics, elf SKIN, Well People and Keys Soulcare. These brands can be purchased online or at big box stores or specialty retailers such as Walmart (New York Stock Exchange:WMT), the goal (New York Stock Exchange:TGT), and Ulta Beauty (NASDAQ:ULTA) will allow the company to expand distribution in the United States and other international markets.

Its high-quality products have universal appeal, especially among Millennials and Gen Z.

Customer-centric marketing model

elf Beauty is focused on building brand equity by driving traffic to e-commerce platforms and retail partners through digital and social media, deploying a consumer-centric marketing model.

Comparatively, traditional cosmetics brands acquire customers through traditional media such as celebrity endorsements, television advertisements, and magazines.

In fiscal year 2023 (ending March 2023), elf Beauty spent $126 million on marketing, representing 22% of net sales. Some of our customers are active on social media, writing product reviews online and generating content on platforms like Instagram, TikTok, and YouTube, and in the process reinventing Elf Beauty’s social media flywheel. I am creating it.

Focus on supply chain

elf Beauty has successfully developed a scalable, asset-light supply chain. Its products are sourced and manufactured in China in collaboration with a network of third-party manufacturers.

elf Beauty is committed to a broad supply base that allows us to meet our product requirements and remain cost competitive by continuing to work with our suppliers on product innovation and quality.

The company has two major distribution centers in California serving retail customers across the United States, and another distribution center in Ohio serving e-commerce demand. Additionally, these distribution centers are operated by large third-party logistics providers. We also use third-party logistics partners in Canada and the United Kingdom to distribute our products to certain international markets. elf has invested heavily in capital equipment to automate processes and reduce costs.

How did Elf Beauty perform in the second quarter of 2024?

elf Beauty reported second quarter 2024 revenue of $215.5 million, an increase of 76% year-over-year. The company’s sales growth was driven by strong sales in retail and e-commerce channels.

The company reported second-quarter gross profit margin of 71%, up from 65.3% in the same period last year, due to lower inventory, cost savings, a stronger U.S. dollar and improved transportation costs. Operating expenses increased at a much slower pace and accounted for 52% of net sales at $112.2 million.

Elf Beauty reported second-quarter adjusted net income of $47.1 million, or $0.82 per share. In comparison, net income for the same period last year was $20 million or $0.36 per share. Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) more than doubled to $60.4 million in the second quarter, for a profit margin of 28%.

Elf Beauty ended the quarter with $167.8 million in cash and $57.7 million in long-term debt. Improving margins have enabled elf Beauty to nearly double its balance sheet cash over the past 12 months, giving it the flexibility to reinvest in growth and pursue expansionary acquisitions. For example, Elf Beauty completed his $355 million acquisition of high-performance skin care brand Naturium last October.

With strong second quarter results and the acquisitions mentioned above, Elf Beauty now aims to close fiscal year 2024 with sales of $896 million to $906 million, which is higher than the previous mid-year This significantly exceeds the current sales forecast of $797 million.

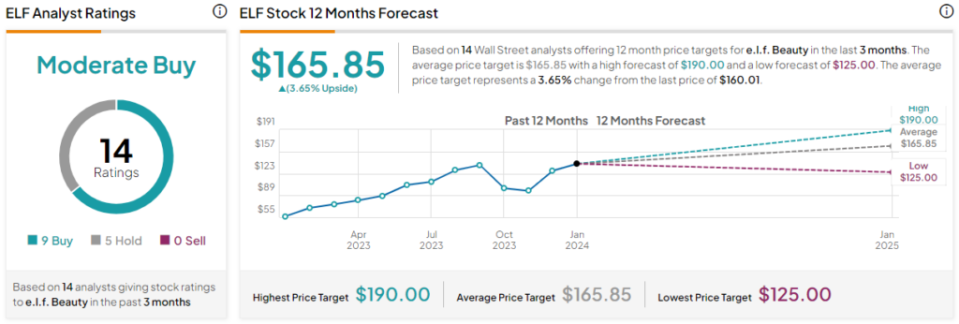

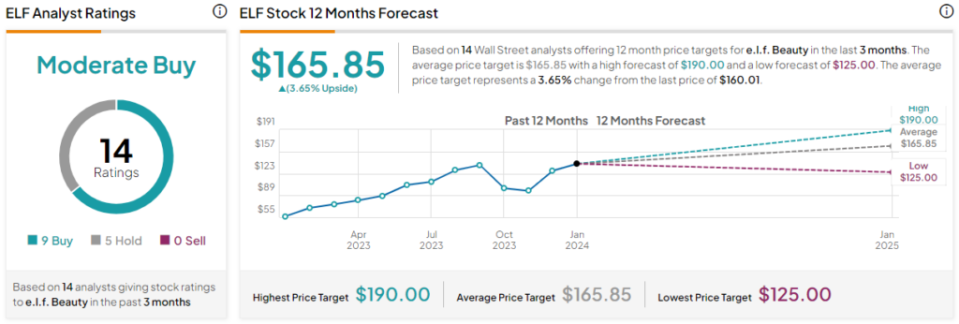

Is ELF stock a buy, according to analysts?

Of the 14 analysts covering ELF stock, 9 recommend a buy, 5 recommend a hold, and none recommend a sell, giving the consensus rating a medium buy. ing. ELF’s average price target is $165.85, 3.7% above the current price.

Analysts also expect ELF stock’s 2025 adjusted earnings to widen to $3.22 per share, a forward P/E ratio of 17.9x, given the sector’s much lower median multiple of 17.9x. It is 49.7 times, which indicates a fairly high level.

However, ELF stock has been growing at a much faster pace than its peers, allowing for a premium valuation.

Important points

The personal cosmetics industry is fairly recession-proof, so Elf Beauty should enjoy predictable cash flow throughout market cycles. A lower cost base should also help the company improve its profit margins once inflation subsides.

elf Beauty is a digitally disruptive brand that has significant upside potential as it has yet to gain traction in emerging economies, making it an attractive investment today.

disclosure

[ad_2]

Source link