[ad_1]

2024 has finally started. As investors warm to the idea that a new bull market has begun, there’s been a flurry of interest in the semiconductor industry, with names like: Nvidia and Advanced Micro Devices and its artificial intelligence (AI) system assembler partners super microcomputer Rapidly rising.

small cap stocks ACM Research (NASDAQ:ACMR) has also grown significantly, increasing by 50% so far in 2024 alone and approximately 270% since the beginning of 2023 (as of March 6, 2024). Chip manufacturing equipment companies are gaining momentum with better-than-expected growth and profit prospects. But will he be able to keep running?

A strange business model hidden behind a great stock chart

The United States is tightening export controls to China of cutting-edge semiconductors used in AI systems and the cutting-edge equipment used to manufacture them. But beyond these AI chips, there is a world of other types of semiconductors needed for things like electric cars and industrial machinery. China has built its own chip manufacturing industry to support these more “mature” types of less cutting edge chips.

Enter ACM Research (ACMR), which provides critical equipment for chip manufacturing. Specifically, ACMR offers machines that “clean” silicon wafers between steps in the manufacturing process. From power management devices to sensors to more basic logic and memory, silicon wafers go through dozens of steps before they’re broken into chips. ACMR can help facilitate nearly all of these steps, regardless of the individual processes for each type of semiconductor.

The company’s sales grew 43% to $558 million in 2023, with fourth-quarter sales up 56% year-over-year. This is impressive considering that the ACMR equipment type is dominated by industry giants such as: ram research and Tokyo Electron. Management believes that revenue will increase by another 30% in 2024, reaching the range of $650 million to $725 million.

But some strange things happen here. ACMR is a Silicon Valley-based company that operates through a majority-owned subsidiary called ACM Shanghai (which held an initial public offering in China several years ago), which accounts for nearly all of its revenue. ACMR has been quite transparent about this, pointing out this fact at the top of its investor relations homepage.

At this point, there is no reason to believe that ACMR is circumventing U.S. export controls, given that most of its machines are used for more “mature” chips rather than for AI. Nevertheless, geopolitical risk (or perhaps the threat thereof at some point) is of particular concern to would-be ACMR investors.

Is it too late to buy this semiconductor stock?

Geopolitical machinations aside, ACMR is making solid financial progress. The stock trades at 24 times trailing 12-month earnings per share (EPS), and just 19 times EPS based on Wall Street’s consensus forecast for 2024. For a company that is growing this fast, even one that participates in the highly cyclical semiconductor manufacturing field, ACMR looks cheap.

And given investors’ current interest in semiconductors in general, it’s hard to call a stock like ACMR a top pick. The market is focused on the industry’s long-term potential as China, the U.S. and other countries try to bring chip manufacturing domestically in response to the pandemic. As a result, ACMR could continue to grow for years.

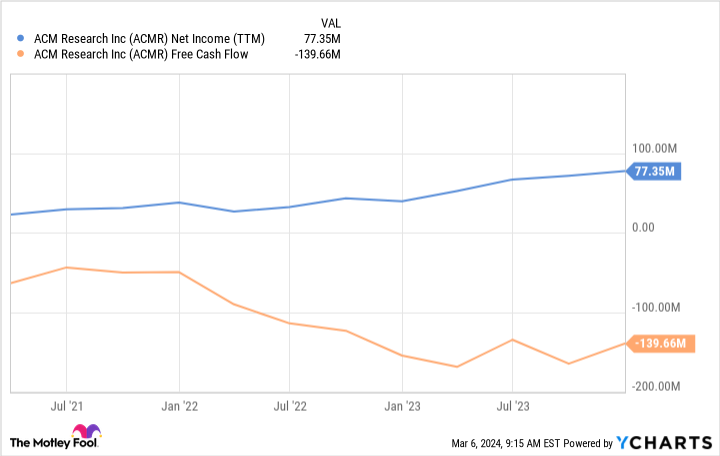

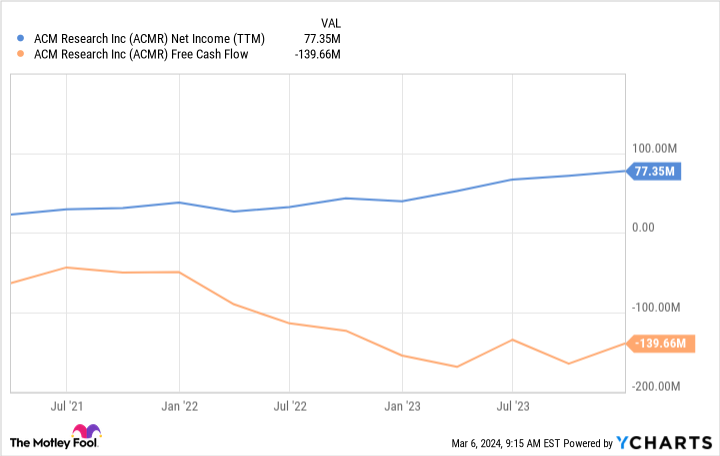

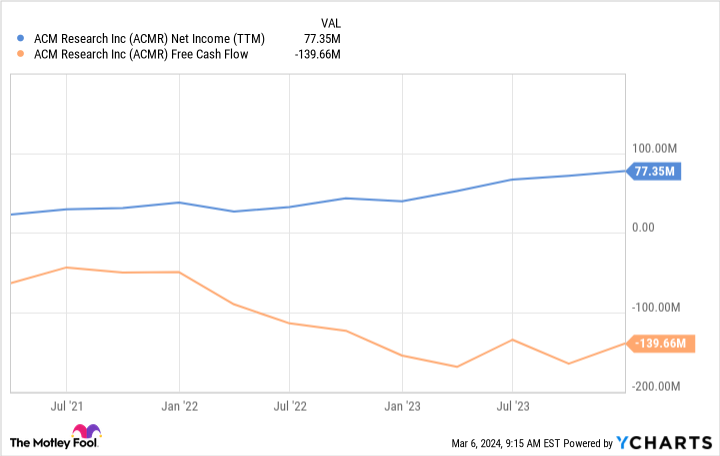

Keep in mind that this growth comes at a cost. ACMR is operating at a loss on a free cash flow (FCF) basis because it is spending cash at a rapid pace of expansion. Note that generally accepted accounting principles (GAAP) net income and EPS are positive because the capital expenditures used to calculate FCF are amortized over time.

Either way, there are plenty of reasons to be optimistic about this stock. Given the heightened political uncertainty, I’m going to sit back and watch, but ACM Research is nonetheless an interesting story to watch unfold.

Should you invest $1,000 in ACM Research now?

Before buying ACM Research stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and ACM Research wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 8, 2024

Nicholas Rossolillo and his clients hold positions at Advanced Micro Devices and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Lam Research, and Nvidia. The Motley Fool recommends Super Micro Computers. The Motley Fool has a disclosure policy.

1 Small-Cap Semiconductor Stocks to Grow 50% in 2024 Alone — Is It Too Late to Buy? Originally published by The Motley Fool

[ad_2]

Source link