[ad_1]

- Trust in the CEO is low. 3 out of 3 people answered that the economic situation has worsened.Sales and profit forecasts decline

- 29% are considering employment. Only 13% think there is an adequate supply of workers. The majority give harsh evaluations to applicants. 75% continue to have problems recruiting

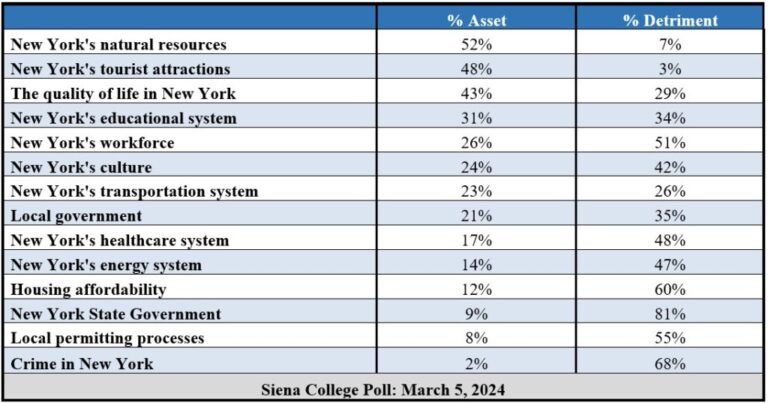

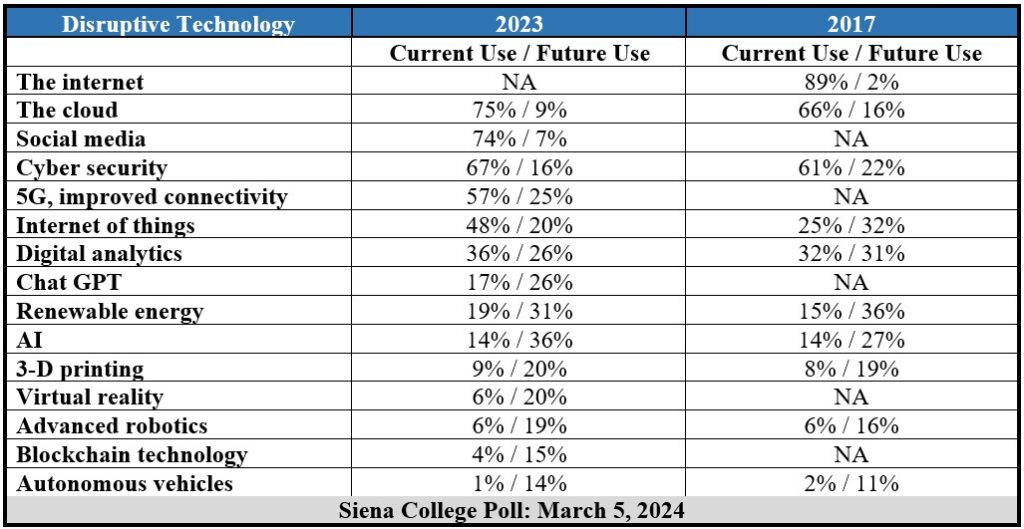

- Doing business in New York: Assets include quality of life, tourist attractions, and natural resources. Disadvantages include state government, permitting processes, crime, and lack of affordable housing.

Press release crosstab

Loudonville, New York. Sixty-seven percent of upstate New York CEOs say their business conditions are getting worse, while 29% say their current situation remains the same, according to Siena College Research Institute’s 17th annual Upstate New York Business Leaders Survey. (SCRI) is sponsored by the New York State Business Council, UHY Advisors, Inc., and HVEDC. Only 18% of CEOs expect the economy to improve in 2024, while 55% expect the situation to worsen next year.

29% (down from 38% last year and 47% two years ago) expect revenue to increase in 2024, while 21% (down from 26% last year and 34% two years ago) expect profits next year. is expected to increase. The CEO Sentiment Index, calculated by considering all CEOs’ assessments of both current and future conditions across New York and within industry sectors, fell 8 points, the lowest the survey found since its all-time low in 2008. The point has been reached.

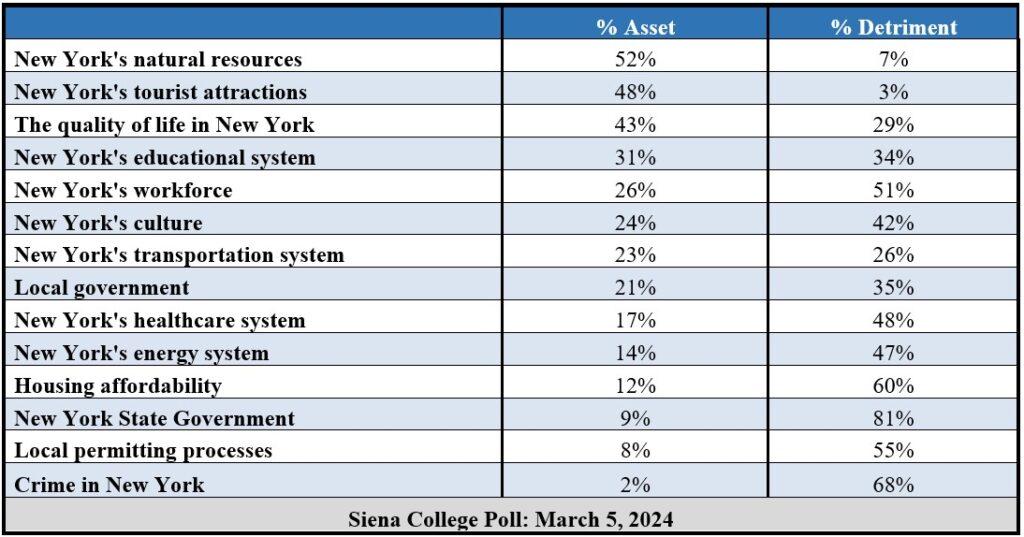

While 29% of CEOs plan to expand their workforce this year, down from 33% last year and 44% the year before, 80% continue to plan to expand their workforce with properly trained local employees. Respondents say there is not enough supply. . And for the second year in a row, 75% are having trouble filling open positions. When asked to rate the quality of recent job applicants on seven job skills, the majority of CEOs gave each one a negative rating: realistic about compensation (77%) and work ethic (73%). , initiative (73%), writing skills (69%), professionalism (67%), language skills (60%), technical skills (60%). While 26% say New York’s workforce is an asset to doing business here, a majority, 51%, say the workforce is detrimental to doing business here.

“Despite rising consumer sentiment, easing inflation, and recent stock market gains, upstate New York CEOs’ optimism about the economy has waned,” said Don Levy, director of the Siena College Research Institute. “Less than one in five people expect the economy to recover this year.” “CEOs who are struggling with a lack of properly trained employees and feel that federal and state governments are not helping their employees succeed are anticipating lower revenues and profits this year.”

Percentage of CEOs who believe each is an advantage or disadvantage to doing business in New York

“When asked to weigh a range of factors of living in New York, more CEOs cited natural resources, tourist attractions, , quality of life are the only three,” Levy said. “On the other hand, the majority say state government, crime, housing affordability, and local permitting processes are to blame. More and more CEOs are saying that our local governments, and even our culture, are more of a hindrance than an asset.”

“CEOs continue to critically evaluate the quality of job applicants these days, with a majority giving them negative ratings on important qualities such as technical skills, self-motivation, and work ethic,” Levy said. “This is due to the fact that almost 1 in 3 people want to hire this year. Unfortunately, 80% of CEOs have the proper training to contribute to the success of their business. We conclude that there is not an adequate supply of employees.”

CEO Ratings of Recent Job Applicants, 2023 and 2019

attitude towards government

81% of CEOs say the New York state government has a negative impact on doing business in New York. Only 11% of people think New York state government is doing a good or good job of creating a business environment where companies like theirs can thrive. More than half want the governor and Legislature to focus on tax reform and spending cuts for businesses and individuals, and more than 40% want incentives for infrastructure development, workforce development, and business development. Looking to the future, only 14% of people are confident that New York state government will improve the business climate over the next year, down from 17% a year ago.

Almost 90% of Upstate CEOs say the federal government is doing a fair or poor job of creating a business environment in which they can thrive and have little confidence in the federal government’s ability to do so. They say it’s the same. Improve business conditions. 21% of CEOs see local government as an asset, while 35% see it as a disadvantage.

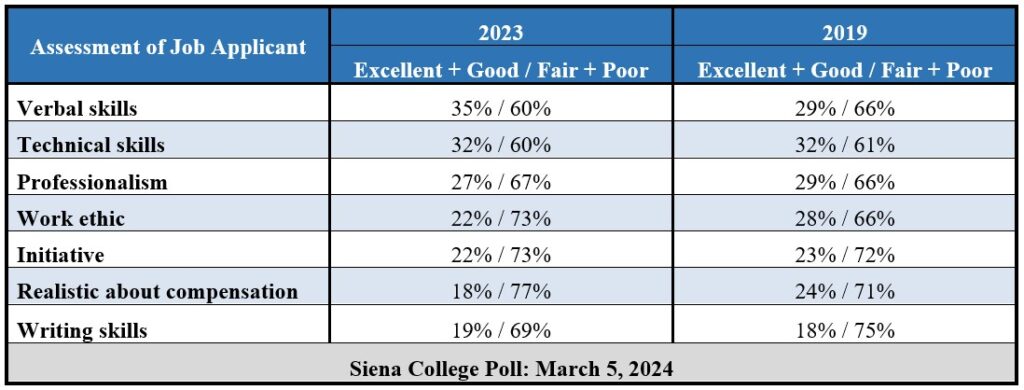

disruptive technology

Forty-three percent of CEOs say they are very (12%) or somewhat knowledgeable (37%) about “disruptive technologies,” innovations that significantly change the way consumers, industries, and companies operate. Current use of disruptive technologies has increased since SCRI last measured CEO adoption in his 2017 study.

Percentage of CEOs currently using or planning to use disruptive technologies (2023 and 2017)

“More CEOs and their companies are using a variety of disruptive technologies today than five years ago,” Levy said. “With virtually everyone using the internet and the ‘cloud’ now, we are seeing an increase in the use of cybersecurity. But while CEOs describe the growth in the use of the Internet of Things, digital analytics, and 3D printing, many CEOs still see these technologies as: Not the present, but the future. ”

70% of CEOs now see disruptive technology as an opportunity rather than a threat, and 40% say the COVID-19 pandemic has increased their use of disruptive technology.

Odds and consequences

- 50% plan to invest in fixed assets this year to meet demand, reduce costs, and improve productivity.

- Government regulation (65%) is the most commonly cited issue of concern, surpassing unfavorable economic conditions (58%), healthcare costs (58%), taxes (57%) and rising supplier costs (56%). Masu.

- A series of actions under the state’s CLCPA focused on reducing greenhouse gas emissions include eliminating fossil fuels from new construction (down 56%) and requirements for reduced-emission vehicles (down 60%). is believed to have far more negative than positive impacts on business. ), greenhouse gas performance standards for existing buildings (54%) are negative, and greenhouse gas “allowances” (48%) are negative.

- 74% said a reduction in unemployment insurance taxes would have a positive impact on their business, and 67% said an increase in workers’ compensation benefits would have a negative impact.

- Technology (54%) is seen as the industry with the most positive impact on the region’s economic vitality, followed by education (45%) and tourism (42%).

- Between 56% and 44% of CEOs believe that immigration has been more of a burden than a benefit to New York over the past 20 years or so. 63% think the recent influx of immigrants is a big problem, and 61% feel New Yorkers are already doing enough to accommodate new immigrants and need to slow the current influx. Still, 46% believe immigrants to New York can provide needed workers for businesses like theirs. This is especially true for technology, manufacturing, food/beverage, tourism, and construction.

From the New York State Business Council

“The results of this survey show that every day, employers are showing us concerns that harmful policies are negatively impacting their companies’ ability to grow and prosper. They face higher taxes, tougher mandates, and less cooperation from legislators, driving businesses and their employees out of New York State. “Instead of encouraging us, we continue to pass bills and accept policies that add burden to the already growing challenges of doing business in New York. This must end.” – Heather Mulligan, President and CEO, New York State Business Council

******

The Siena College poll polled 585 business leaders from across the Upstate, including the Capital Region, Central New York/Mohawk Valley, Finger Lakes Region, Mid-Hudson Region, and Western Region, from October 10 to January 24, 2024. The survey was conducted via mail and internet interviews. new york. The 2023 Upstate Business Leaders Survey was sponsored by the New York State Business Council, UHY Advisors, and HVEDC. The Siena College Research Institute, directed by Dr. Donald Levy, conducts political, economic, social, and cultural research primarily in New York State. SCRI is an independent, nonpartisan research organization that subscribes to the American Institute for Public Opinion Research’s Code of Professional Ethics and Practice. For more information, please call Don Levy at (518) 783-2901 or dlevy@siena.edu. The survey crosstabs and frequencies are as follows. click here

[ad_2]

Source link