[ad_1]

The artificial intelligence (AI) boom started last year and has become a major driver in the world. Nasdaq CompositeWall Street has rallied around the tech stocks most likely to profit from the industry in the coming years.

Despite the AI market’s meteoric rise, it doesn’t seem to have reached its ceiling yet. According to Grand View Research, the market size of this sector is expected to reach nearly $200 billion in 2023 and develop at a compound annual growth rate of 37% until at least 2030. For reference, this trajectory would see the market skyrocket to nearly $2 trillion by 2023. End of the decade.

The AI market has created many millionaires in the last year, but it’s not over yet. As AI powers countless industries, from consumer technology to cloud computing, self-driving cars, e-commerce, and more, there’s still plenty of room for action.

Here are two artificial intelligence stocks that could make you a millionaire.

1. Advanced microdevices

Chip stocks are attracting attention as interest in AI increases. The increased demand for AI services has led to a surge in sales of graphics processing units (GPUs), the chips needed to train and run AI models.

As a GPU leader, Nvidia has been the most successful in the space so far, enjoying a sharp rise in revenue, with its stock up 296% in the past 12 months thanks to increased chip sales. However, Nvidia’s competitors have more room to play in the long term and may be better investment options.

A great option is Advanced Micro Devices (NASDAQ: AMD). The company has the second largest market share in GPUs and also has good prospects in the AI field.

Last December, the company announced the MI300X AI GPU. The new chip is designed to compete directly with Nvidia’s products and has already attracted the attention and contracts of some of the technology industry’s most prominent players. microsoft and meta platform as a client.

Additionally, AMD wants to lead its own space in the AI space by ramping up the development of AI-powered PCs. According to research firm IDC, PC shipments are expected to increase significantly this year, with AI integration acting as a key catalyst.

Additionally, a report from Canalys predicts that 60% of all PCs shipped in 2027 will be AI-enabled.

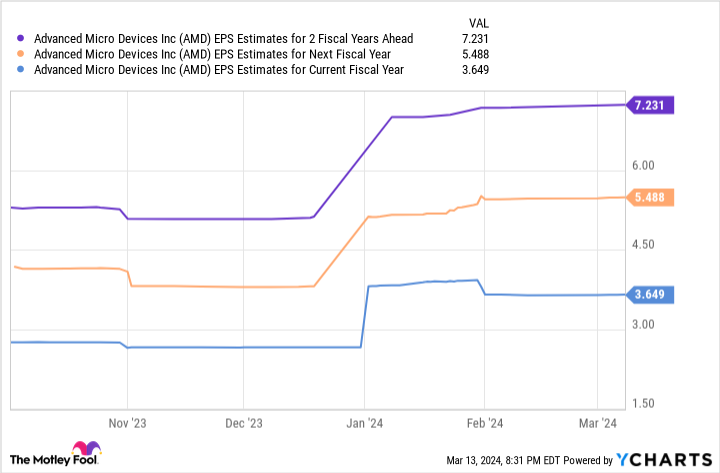

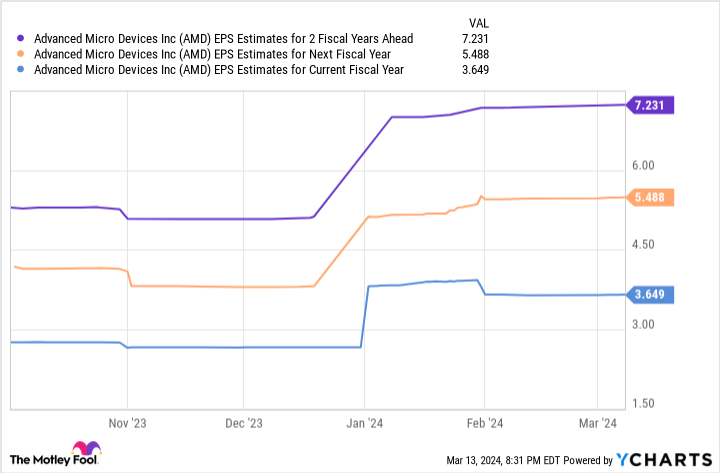

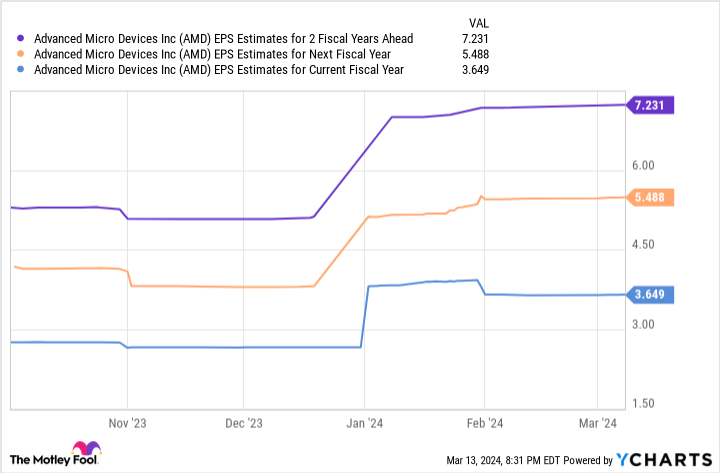

Additionally, this chart shows that AMD stock has great potential in the coming years. The company’s earnings could reach just over $7 per share over the next two fiscal years. Multiplying this number by AMD’s forward price/earnings ratio (P/E) of 53 yields a stock price of $383.

Considering AMD’s current position, the company’s stock price will rise 96% by FY2026, according to these projections. Along with its growth prospects in the AI space, AMD is a stock that could make you a millionaire with the right investment.

2. Intel

intel (NASDAQ:INTC) It hasn’t been easy in recent years. The company has been a major chip supplier for at least a decade, accounting for more than 80% of the central processing unit (CPU) market. apple‘s long-standing MacBook lineup. However, Intel’s dominance has led to complacency and left the company vulnerable to more innovative competitors.

Chip rival AMD began to gradually eat away at Intel’s CPU market share starting in 2017, and Intel’s share has now fallen to 69%. Then, in 2020, Apple severed ties with Intel in favor of more powerful in-house hardware designs. As a result, Intel’s stock price has fallen 31% over the past three years.

However, that downfall appears to have reignited Inter’s management, and they are poised to come back strong in the coming years. Last June, Intel announced a “fundamental shift” in its business model, adopting an in-house foundry model that it believes could save the company $10 billion by 2025.

This transition will see Intel pivot from being primarily an integrated device manufacturer to a similar business. taiwan semiconductor manufacturing, has become the leading provider of foundry capacity in North America and Europe. Intel says FoundryStyle’s relationships with its manufacturing groups can improve efficiency and profitability, with the potential to achieve non-GAAP (adjusted) gross margins of 60% and operating margins of 40%. There is.

In addition to changing business models, Intel is investing heavily in AI. The company debuted a range of AI chips last December, including his Gaudi3, a graphics processing unit (GPU) designed to compete with similar products from Nvidia. Intel also showed off new Core Ultra processors and Xeon server chips, which include neural processing units to run AI programs more efficiently.

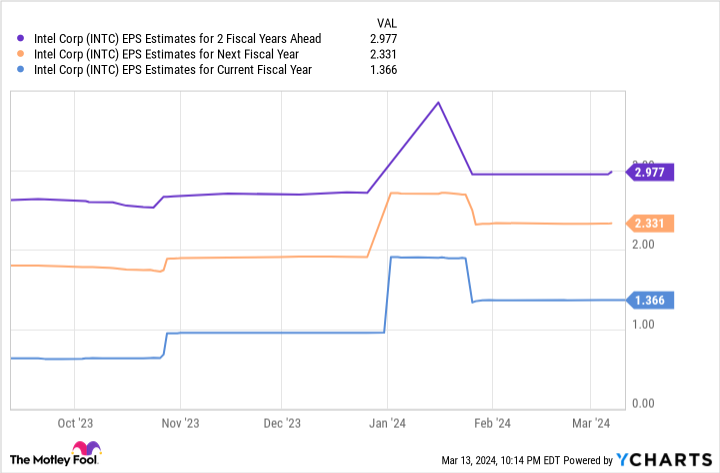

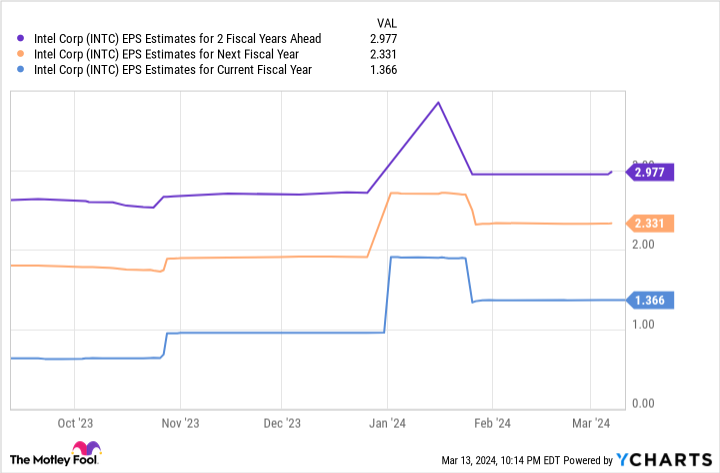

The table above shows that Intel’s earnings are expected to reach just under $3 per share by fiscal year 2026. Using a similar calculation for AMD, multiplying this number by Intel’s forward P/E ratio of 32 yields a stock price of $96 and predicts stock growth. 123% in next two financial years.

It will take time, but Intel has huge potential over the next few years, making it worth buying now and potentially making you a millionaire.

Where you can invest $1,000 now

When our analyst team has a stock tip, it’s worth listening. After all, the newsletter they’ve been running for 20 years is Motley Fool Stock Advisorhas more than tripled its market. *

they just made it clear what they believe Best 10 stocks Advanced Micro Devices made the list of stocks that investors should buy right now. But there are nine other stocks he has that you may have overlooked.

See 10 stocks

*Stock Advisor returns as of March 11, 2024

Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. Dani Cook has no position in any stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: Long January 2023 $57.50 call on Intel, Long January 2025 $45 call on Intel, Long January 2026 $395 call on Microsoft, Short January 2026 $405 call on Microsoft. call, and a May 2024 $47 short call. Intel. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Can Make You a Millionaire was originally published by The Motley Fool.

[ad_2]

Source link