[ad_1]

When it comes to investing in artificial intelligence (AI), you may be wondering: Nvidia is the main focus of investors. The company claims to hold 80% to 95% of the AI chip market, and is boldly moving forward with its entry into the “Magnificent Seven.”

However, NVIDIA’s price-to-sales (P/S) has grown to 36 times, leading some to wonder if the stock is overvalued. While investors may want to focus on other AI stocks, these two stocks have the potential to generate huge returns for investors.

1. Taiwan Semiconductor

Investors may need to look no further than Nvidia’s manufacturers. taiwan semiconductor manufacturing (TSMC) (NYSE:TSM). TSMC enables Nvidia’s success as a leading manufacturer of the world’s most advanced chips. Additionally, the company is a leading manufacturer of chips for companies such as: apple and AMD And it’s also attracting business from emerging competitors in the industry. intel.

As a result of this business book, TSMC captured 61% of the third-party foundry market in the fourth quarter of 2023, according to TrendForce.

Indeed, many investors, including Warren Buffett, are reluctant to invest in TSMC stock amid geopolitical tensions in its home country of Taiwan. Still, the company has alleviated this problem by building more factories outside Taiwan. Additionally, China, a source of geopolitical tension, relies on TSMC’s chips and is less likely to compromise its supply chain.

The company appears to be recovering from the recent downturn in the chip market. Sales were $69 billion, down 5% from the same period last year. This brought his comprehensive net income to $27 billion, down 22% year over year.

Still, analysts expect sales to rise 22% this year and another 20% next year. That optimism has helped drive the stock up 55% in the last year.

As a result, the company’s P/E ratio is currently approximately 26 times. That’s not a low number for the company, but it’s comparable to the earnings multiples of other chip stocks. And TSMC stock is likely to continue its upward trajectory as demand from companies like Nvidia leads to increased production.

2. Micron

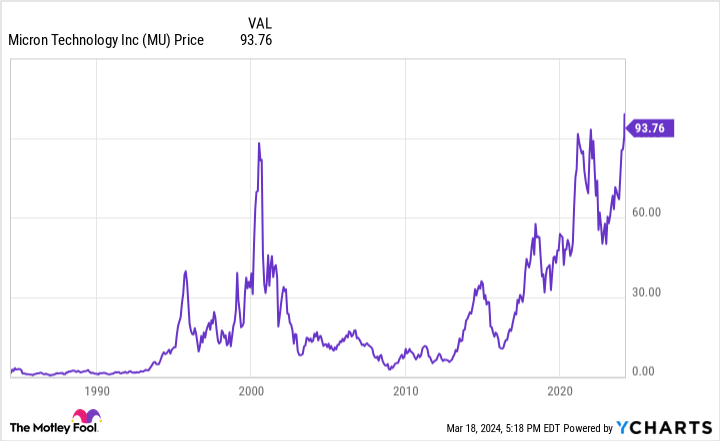

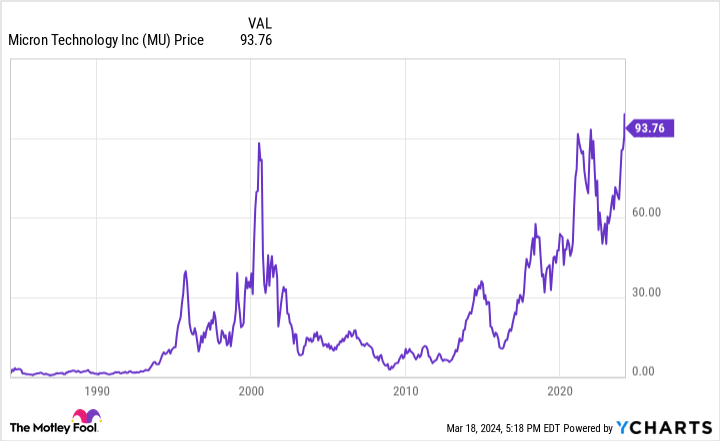

AI has also changed the game for other chip makers. micron technologies (NASDAQ:MU). Micron makes memory chips that help power the AI revolution. In fact, the memory chip industry has historically experienced more volatility than other industries that make CPUs and GPUs. As a result, stock prices did not rise at all from the mid-1990s to the mid-2010s.

Nevertheless, the long-term bull market in AI chips has changed the landscape for this stock, leading to continued growth in demand for memory chips. As a result, the stock price has risen 140% over the past five years; S&P500The total return of the company has increased, leading to Micron becoming a dividend stock.

Revenues for the first quarter of 2024 (ending November 30, 2023) increased 16% annually to $4.7 billion. This signals a recovery in the memory market, as Micron’s sales in fiscal 2023 were down 49%. Amid the struggles, the company posted a net loss of $1.2 billion in the fiscal first quarter, an improvement from a loss of $1.4 billion a year earlier.

Still, analysts predict that sales will increase by 34% in fiscal year 2024 and 42% in the next fiscal year. This could spur a dramatic recovery for Micron, returning it to profitability as early as this fiscal year.

Investors are optimistic, with the stock selling near all-time highs and bidding P/S multiples around 7x sales, the highest since the early 2000s. As the AI revolution continues, growing need for memory chips and rising revenues will likely mean Micron stock maintains its upward trajectory.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before buying Taiwan Semiconductor Manufacturing stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Investors should buy now…and Taiwan Semiconductor Manufacturing was not among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 21, 2024

Will Healy holds positions at Advanced Micro Devices and Intel. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: These are a long call on Intel at $57.50 in January 2023, a long call on Intel at $45 in January 2025, and a short call on Intel at $47 in May 2024. The Motley Fool has a disclosure policy.

“Forget Nvidia: 2 Artificial Intelligence (AI) Stocks to Buy Instead” was originally published by The Motley Fool.

[ad_2]

Source link