[ad_1]

Artificial intelligence (AI) is one of the hottest technology trends right now, and investors are widely looking to invest in companies that have the potential to make significant profits from this technology. This makes sense, as AI has the ability to transform multiple industries and contribute significantly to the global economy for the next decade and beyond.

According to Bloomberg Intelligence projections, the generative AI market could generate a staggering $1.3 trillion in revenue in 2032 and account for 12% of all technology spending that year. This would significantly exceed the estimated $137 billion in generated AI spending this year. With this outlook in mind, now is a good time for investors to buy and hold stocks in solid companies that are positioned to take advantage of the impending growth in this lucrative market.

Nvidia (NASDAQ:NVDA) and Palantir Technologies (NYSE:PLTR) We are already taking advantage of this huge opportunity. While Nvidia’s graphics processing units (GPUs) are essential hardware for training and enriching large-scale language models (LLMs), Palantir is helping customers integrate AI into their operations and use its software platform. We help you use it to improve your productivity.

Here’s why investors should consider buying and holding these two AI stocks for the next 10 years.

1. Nvidia

Demand for chips that can power AI applications is expected to increase significantly over the next decade. According to Allied Market Research, the annual revenue of the AI chip market could reach approximately $384 billion in 2032, compared to just $15 billion in 2022. NVIDIA currently has a strong position in the AI chip market, with an approximately 90% share. To make the most of this opportunity.

The good thing is that Nvidia is already witnessing incredible growth. The company is scheduled to report its fiscal 2024 results next week, and analysts expect it to report a 119% increase in revenue to $59 billion. Furthermore, thanks to the strong pricing power that NVIDIA enjoys in its AI chips, earnings per share in 2023 are expected to jump from $3.34 to $12.33 in 2024. .

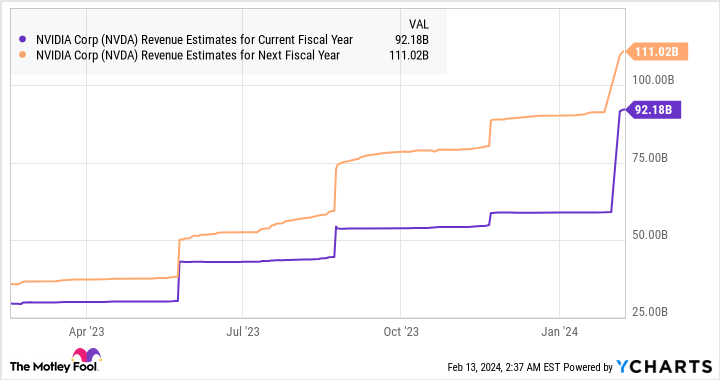

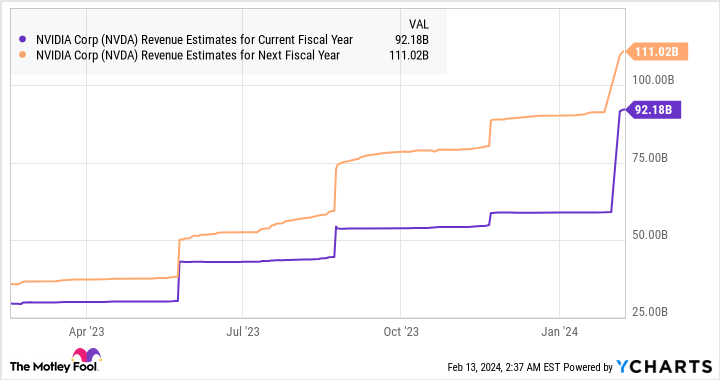

More importantly, Nvidia’s business is expected to grow at a healthy rate. That’s clear from the chart below, which also shows that analysts are raising growth expectations.

Once again, Nvidia’s revenue is projected to grow at an impressive annual rate of 102% over the next five years. All of this explains why Nvidia is one of the top AI stocks to buy right now, especially considering the company is moving quickly to remain a top player in this market. Masu.

For example, Nvidia updated its product roadmap last year ahead of its competitors. The company plans to release updated AI chips every year, rather than on a two-year cycle. This schedule could help Nvidia maintain a nice share of his AI chip market. And now, according to reports, Nvidia is also considering manufacturing custom AI chips.

Reuters reports that NVIDIA is launching a new business unit to make custom AI chips for cloud infrastructure service providers and others. Demand for Nvidia’s GPUs is so strong that customers may have to wait as long as a year to get them, but some companies are looking to tackle certain AI-related workloads. We develop custom his chips in-house. Entering this market opens up another lucrative revenue opportunity for Nvidia. The custom chip market was estimated to be worth $30 billion last year.

Overall, considering the growth potential and the company’s current market share, it’s safe to say that Nvidia could remain the leader in AI semiconductors for the next decade. Also, NVIDIA’s forward price/earnings multiple of 35x is cheap compared to the company’s average forward earnings multiple of 42x over the past five years. That’s why it’s a good idea for investors to buy the company now. The company’s bright AI outlook could lead to a healthy price-to-earnings ratio increase. Next 10 years.

2. Palantir Technologies

While Nvidia is one of the best ways to tap into the AI hardware market, Palantir Technologies offers investors an opportunity to profit from the software side. Precedence Research, a market research provider, predicts that the AI software market could generate as much as $1 trillion in revenue in 2032. To achieve this, it will need to record a compound annual growth rate of almost 23% over the next 10 years.

Market research firm IDC ranked Palantir first in the global AI software platform market in 2021, both in terms of market share and revenue. The company’s latest results show that the AI software opportunity will soon begin to drive meaningful growth.

Palantir’s fourth quarter 2023 revenue increased 20% year over year to $608 million, while its commercial business increased 32% to $284 million. The rapid growth of the commercial business was the result of increased adoption of his Palantir Artificial Intelligence Platform (AIP) by customers.

Palantir saw a 44% year-over-year increase in the number of commercial customers last quarter. In addition, AIP’s hiring helped Palantir close 103 deals over $1 million for him in the last quarter. This is double his number from the same period last year. Ryan Taylor, Chief Revenue Officer and Chief Legal Officer, said, “Demand for AIP was unexpected and we believe AIP will be a key focus with bootcamps as a delivery mechanism for AIP. “We believe that we are promoting the expansion of this market.” Conference call regarding latest financial results.

So Palantir could be at the beginning of a huge growth curve. Some analysts claim that the company could be seizing a potential $1 trillion revenue opportunity in its AI software field. Analyst consensus forecasts are for Palantir’s revenue to grow at an average annual rate of 85% over the next five years.

Given the company’s large end-market opportunities, it has the potential to maintain impressive growth over the long term and deliver healthy profits over the next decade. That’s why investors should consider buying this tech stock before its share price rises on strong performance. Profits over the past year.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Nvidia wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 12, 2024

Harsh Chauhan has no position in any stocks mentioned. The Motley Fool has a position in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

“2 Artificial Intelligence Stocks to Buy and Hold for the Next 10 Years” was originally published by The Motley Fool.

[ad_2]

Source link