[ad_1]

Buying companies with high dividend yields and generating cash when stock prices are low is a proven strategy for accumulating wealth in the stock market. If you’re interested in implementing this approach into your own portfolio, here are two stocks he recommends considering investing in today.

1. Verizon Communications

verizon (NYSE:VZ) This stock is popular among investors looking for income. The reason is simple. The telecom giant’s shares currently offer him an attractive yield of 6.5% on invested funds.

5G wireless and broadband internet services are quickly becoming a necessity as people spend more time online. Verizon has earned a reputation for fast, reliable service among both businesses and consumers and is a leader in these increasingly essential fields.

Verizon’s broadband business is particularly strong. The company added 413,000 broadband customers in the fourth quarter, driven by strong demand for fixed wireless services. This brings the company’s total number of broadband subscribers to 10.7 million.

Verizon’s rapidly growing broadband business and loyal wireless customers helped it generate free cash flow of $18.7 billion in 2023, up from $14.1 billion in 2022. That’s enough cash to cover Verizon’s roughly $11 billion in annual dividends, leaving enough surplus for further investment. Debt reduction. Verizon reduced its unsecured debt burden by more than $2 billion in 2023 to $128.5 billion as of December 31, 2023.

Impressively, Verizon has increased cash dividends to shareholders for 17 consecutive years. Even better, you can get this reliable source of income at a bargain price. The company’s stock, which has a reputation for dividends, currently trades at just about 9 times free cash flow.

2. Altria Group

Investors looking for yield may also want to consider: altria group (NYSE:MO). Tobacco giants have consistently increased cash payments for more than 50 years. Its surprisingly high yield is currently around 9.7%.

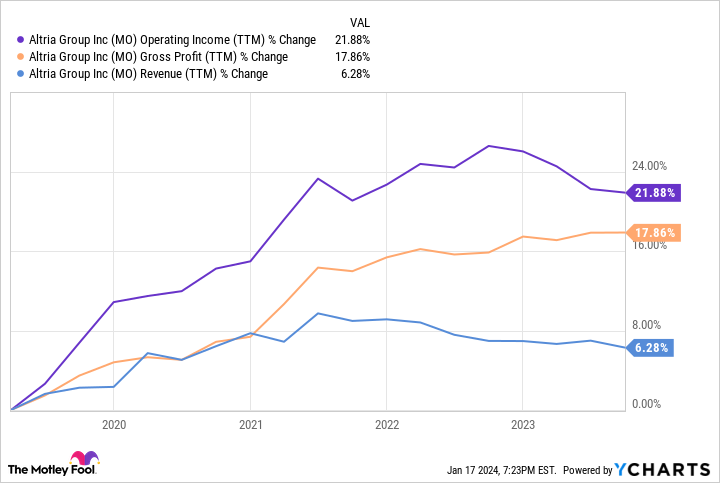

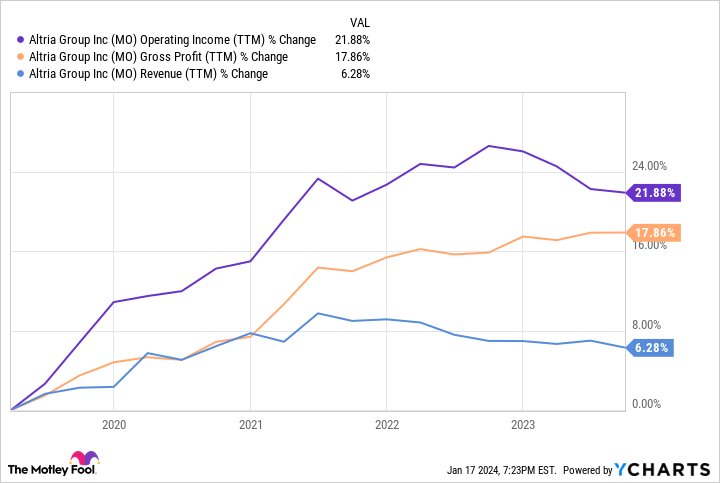

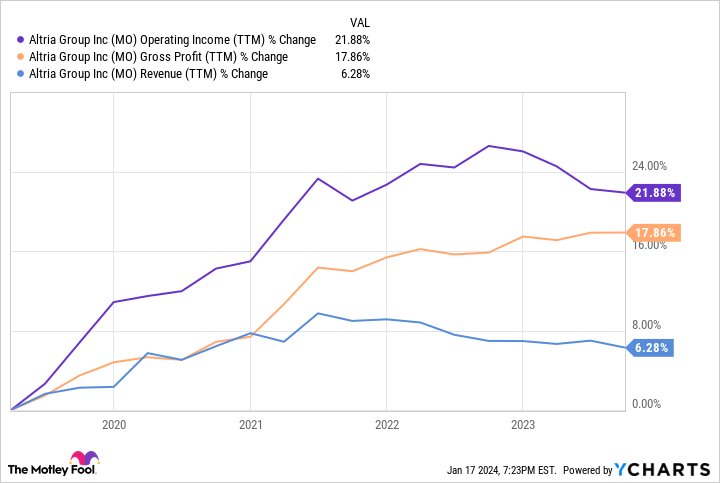

The number of Americans who smoke is decreasing every year. This trend is likely to continue. But tobacco can still be a lucrative business. Altria has largely offset the volume decline by steadily raising prices on popular brands like Marlboro. These price increases, coupled with the company’s cost-cutting efforts, have also helped boost Altria’s profit margins over the past five years.

Altria’s traditional tobacco business will continue to be a cash cow business for some time to come. Nevertheless, the company is working to diversify its product range by expanding its range of smoke-free products.

Altria “On!” tobacco-free oral nicotine pouches are one of the company’s fastest growing business lines, with shipments in the third quarter of 29 million units, up 37% from the same period last year. To further expand its line of smoking cessation products, Altria acquired e-cigarette and e-cigarette product maker Njoy Holdings in June for $2.8 billion. We also entered into a joint venture with JT Group The company plans to develop heated tobacco stick products in the second half of 2022. Overall, management expects Altria’s smoke-free sales to increase from $2.6 billion in 2022 to $5.0 billion by 2028.

Cannabis could be another powerful growth driver. Altria holds a 41% stake. chronos group. The growing likelihood that regulators will reclassify marijuana as a less dangerous drug could make it easier and potentially more lucrative for cannabis producers like Cronos to do business in the United States. This could increase the value of Altria’s stock.

In the meantime, you can buy Altria stock while it’s still on sale. Shares of this solid dividend payer are currently only worth around 8 times expected 2023 earnings.

Should you invest $1,000 in Altria Group right now?

Before buying Altria Group stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Altria Group was not among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of January 22, 2024

Joe Tenebruso has no position in any stocks mentioned. The Motley Fool recommends his Verizon Communications. The Motley Fool has a disclosure policy.

2 Super Dividend Stocks to Buy in 2024 was originally published by The Motley Fool.

[ad_2]

Source link