[ad_1]

Tech stocks soared last year as excitement about emerging industries such as artificial intelligence (AI) and cloud computing roused investors.of Nasdaq 100 Technology Sector The index rose 67% throughout 2023, a significant improvement from the previous year, when it fell 40%. The market also shows no signs of slowing down, making 2024 the perfect time to expand your position in the technology sector.

Nvidia was the biggest winner last year, capturing more than half of the market share for AI chips. The company’s stock is up 224% year over year, making it an attractive option for investing in AI and technology in general. But there are other stocks with similar long-term tailwinds in the tech industry that could offer better value than the chipmaker.

So in 2024, forget about Nvidia. Here are two tech stocks to buy instead.

1.Microsoft

microsoft (NASDAQ: MSFT) became a hot topic last week. apple With a market capitalization of nearly $2.9 trillion, it ranks as the world’s most valuable company. The company has become a giant in the technology industry, driving growth across the industry.

The technology giant is home to some of the most widely known brands, including Windows, Office, Xbox, LinkedIn, and Azure, and attracts billions of users. These services give Microsoft favorable positions in markets such as operating systems, productivity software, digital advertising, cloud computing, AI, and video games.

The growth of these products has caused Microsoft’s stock price to soar 280% over the past five years and annual revenue to increase by 68%. Meanwhile, free cash flow reached more than $63 billion in 2023, providing funds for significant investments in research and development.

So it’s no surprise that Microsoft spent billions of dollars on AI last year. A significant investment in ChatGPT developer OpenAI has resulted in Microsoft acquiring his 49% stake in the startup. OpenAI’s technology and the popular services of Office and Azure make for a powerful combination that could provide nearly limitless ways for Microsoft to monetize its own AI products.

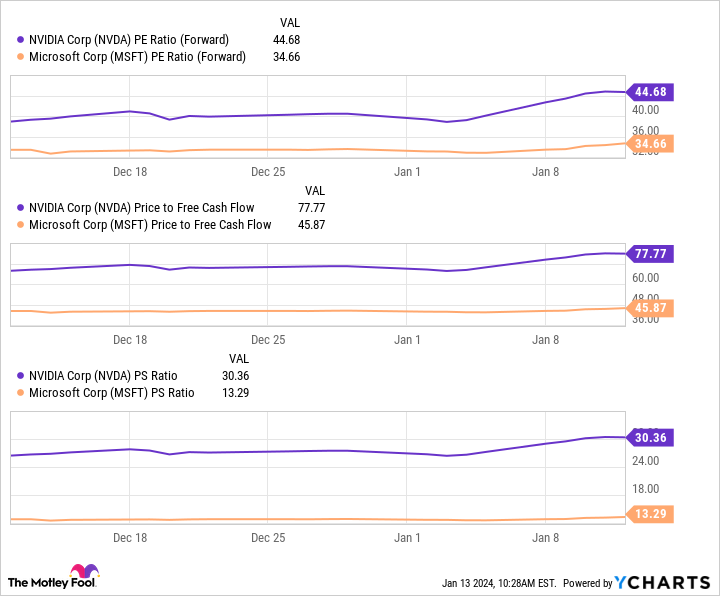

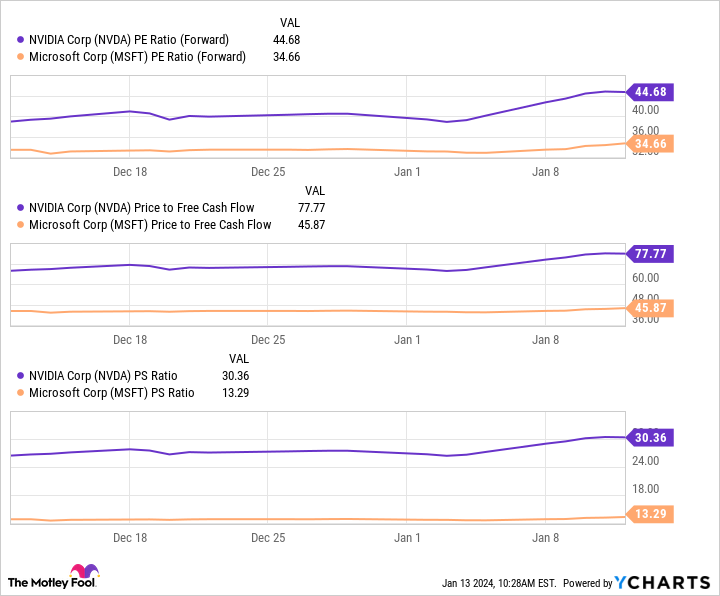

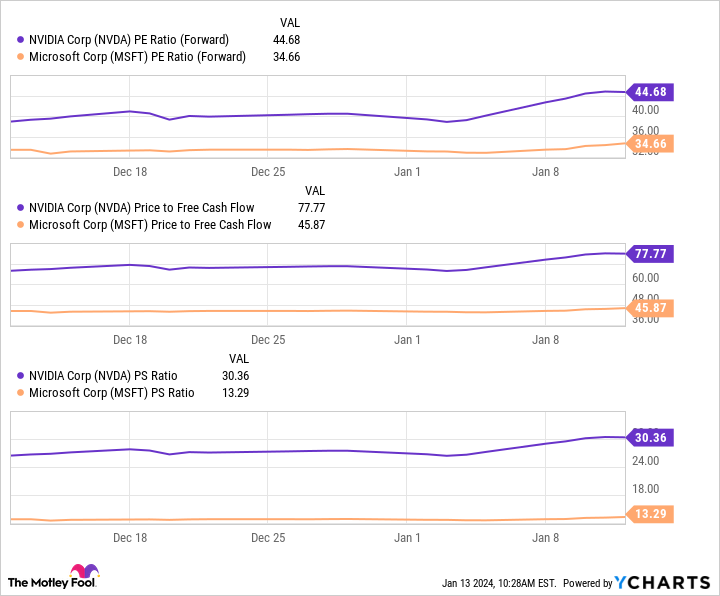

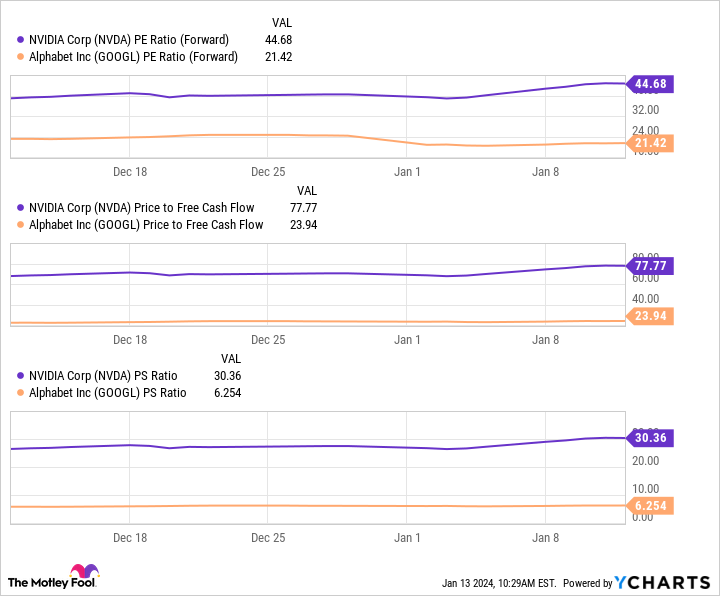

These charts show that Microsoft’s stock price is also significantly cheaper than Nvidia’s stock price. The company has low numbers in three major evaluation indicators: future price/earnings ratio (P/E), price-to-free cash flow (P/FCF), and price-to-sales (P/S) ratio.

The forward P/E ratio is calculated by dividing a company’s current stock price by its expected future earnings per share. On the other hand, P/FCF divides market capitalization by free cash flow. Forward P/S uses a similar calculation, dividing market capitalization by estimated earnings. For all three metrics, the lower the number, the better the value.

These are a great way to determine the value of a company’s stock by considering its financial health relative to its stock price. On each metric, Microsoft is a much better bargain than his Nvidia.

2. Alphabet

alphabet (NASDAQ:GOOG) (NASDAQ:Google) Last year, Microsoft and Amazon. However, the company has spent the last year developing a highly anticipated AI model called Gemini that could give it an edge in the market.

Alphabet is one of the most reliable investment options in the tech space, with its stock rising steadily by 113% since 2019. Meanwhile, sales and operating profits soared 75% and 108%.

Much of its success is due to its dominance in the digital advertising market. The company holds his 25% market share in the industry thanks to the large user base it has built through YouTube, Google, Android, and Chrome. These platforms attract billions of users and offer countless advertising opportunities.

The popularity of these services will be a major asset in expanding in the AI field. With help from Gemini, Alphabet will be able to create a search experience similar to ChatGPT, add new AI tools to Google Cloud, serve more efficient ads, and better track viewing trends on YouTube .

In addition to over $77 billion in free cash flow, the growth potential of Alphabet’s business and stock cannot be ignored.

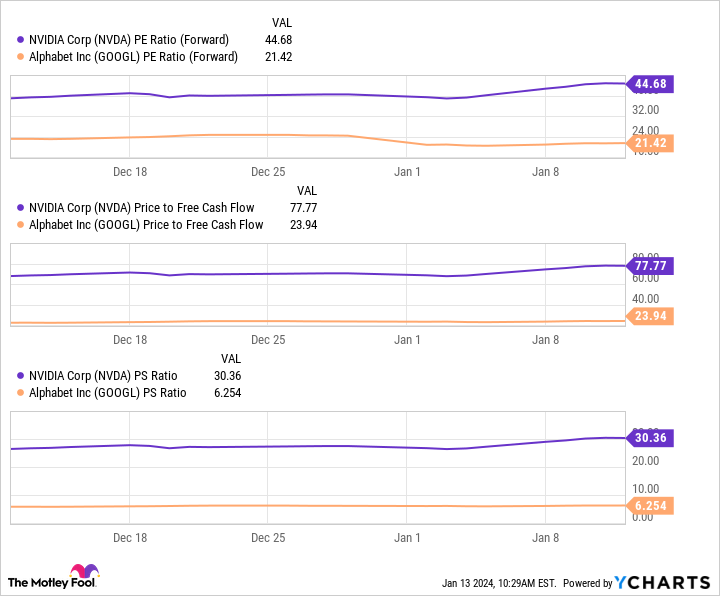

Like Microsoft, Alphabet stock offers much higher value than Nvidia. The table above shows that Alphabet’s forward P/E, P/FCF, and P/S ratios are significantly lower than chipmakers, making the stock less risky.

Nvidia’s rapid growth over the last year has made it an expensive option. But Alphabet remains a good value company with huge potential in tech.

Where you can invest $1,000 now

When our analyst team has a stock tip, it’s worth listening. After all, the newsletter they’ve been running for 20 years is Motley Fool Stock Advisorhas more than tripled its market. *

they just made it clear what they believe Best 10 stocks Microsoft made the list of stocks that investors should buy right now, but there are nine others you may have overlooked.

See 10 stocks

*Stock Advisor will return as of January 8, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Dani Cook has no position in any stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

Forget Nvidia in 2024: 2 Tech Stocks to Buy Instead was originally published by The Motley Fool.

[ad_2]

Source link