[ad_1]

On February 9th, S&P500 For the first time in history, the closing price exceeded 5,000. Optimism about artificial intelligence (AI) There are stocks like , which are important catalysts. Nvidia Lead the market even higher. But Nvidia isn’t your only option. Here are three other AI stocks worth considering right now.

1.Microsoft

My first choice is the largest company in the world by market capitalization. microsoft (NASDAQ: MSFT).

What sets Microsoft apart from the AI crowd right now is how quickly the company brings AI advances to market. Thanks to a long-standing partnership with OpenAI, the company integrated ChatGPT functionality into its Bing search engine and Edge internet browser over a year ago.

And while some may discount the company’s search and related advertising businesses, they would be wrong. By normal business measures, Microsoft’s search business is huge.

For example, in its most recent quarter (three months ending Dec. 31), Microsoft generated $3.2 billion from its search and News Feed advertising business. This is about the same as quarterly revenue. domino pizza, pinterest, cloud strike Holdings (NASDAQ: CRWD)and draft kings Combined.

And search is just one area where Microsoft is incorporating new AI capabilities. The company also debuted Copilot, a new AI-powered “everyday AI companion.” With a subscription, users can access generative AI features to improve and streamline tasks like summarizing and replying to emails, creating charts and graphs, and more.

So Microsoft, perhaps more than any other company, is bringing AI to the public, creating an additional competitive advantage for the world’s most valuable companies.

2. Crowdstrike Holdings

next crowdstrike holdingsa company that operates one of the most popular AI-powered cybersecurity platforms.

CrowdStrike’s flagship product is the Falcon platform, a scalable and dynamic endpoint security solution. Organizations can purchase multiple security modules depending on their needs and budget.

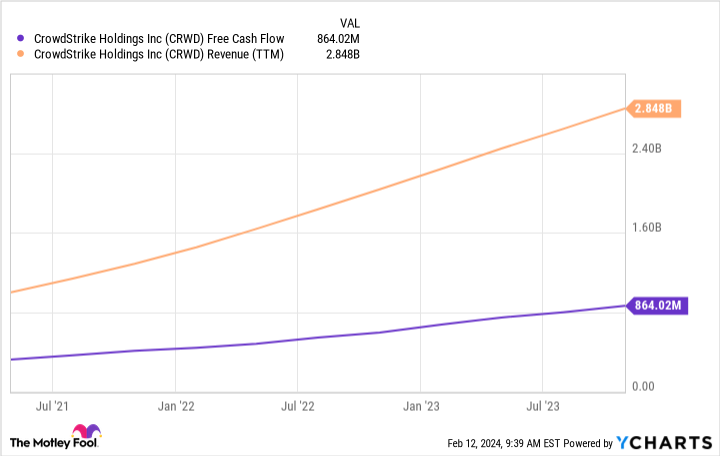

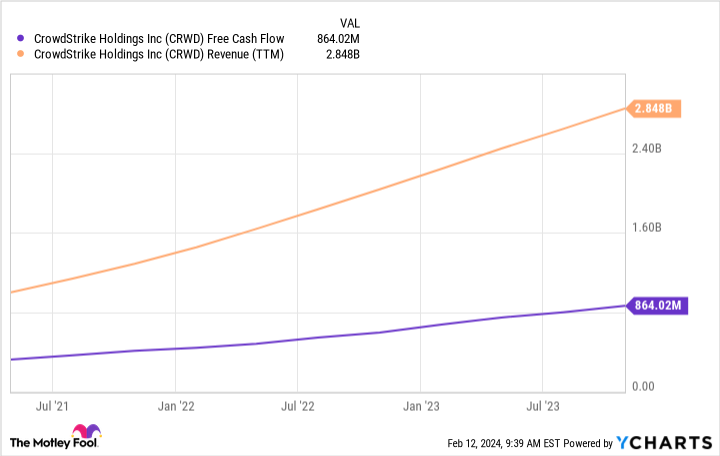

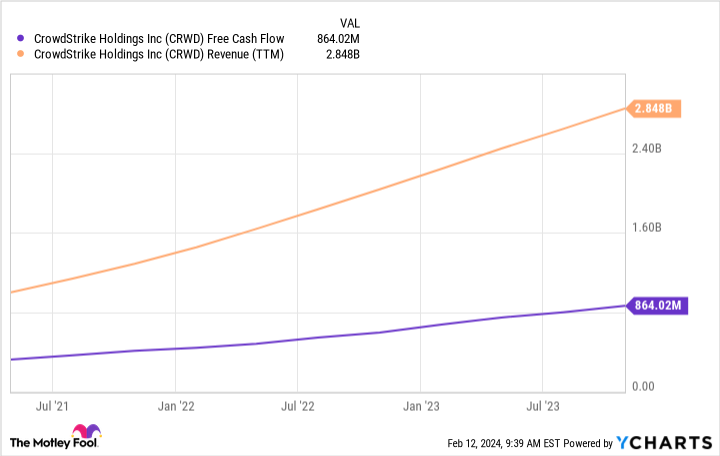

Financially, CrowdStrike is where a young company in the early stages of its lifecycle should be. It is growing rapidly and generating abundant free cash flow.

Revenue for the most recent quarter (ending October 31, 2023) increased 35% to $786 million. Free cash flow for the past 12 months increased to his $864 million. Additionally, the company’s customer count increased 35% year over year.

Indeed, CrowdStrike’s price-to-sales multiple is high at 28x, making it an expensive stock. But for long-term, growth-oriented investors, it’s a name to remember.

3. Super microcomputer

Finally, let’s talk about one of the hottest stocks on Wall Street. wonderful micro computer (NASDAQ:SMCI).

Up 171% year-to-date as of this writing, super micro computers are firing on all cylinders thanks to the AI revolution.

That’s because the company makes server racks, the physical hardware used in data centers to hold, cool, and store cutting-edge AI chips made by Nvidia. AMDothers.

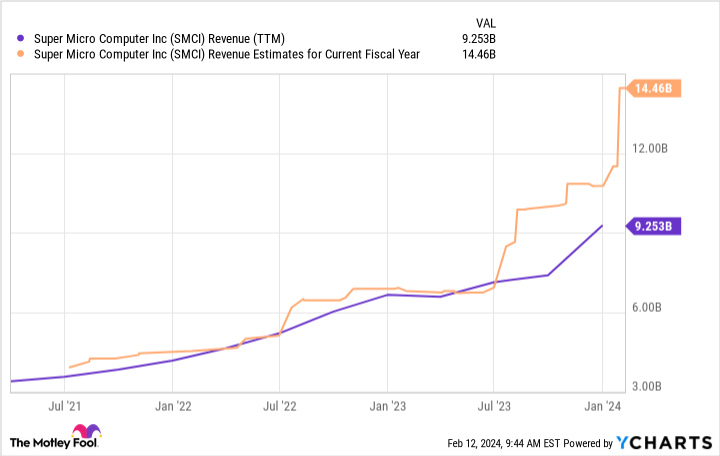

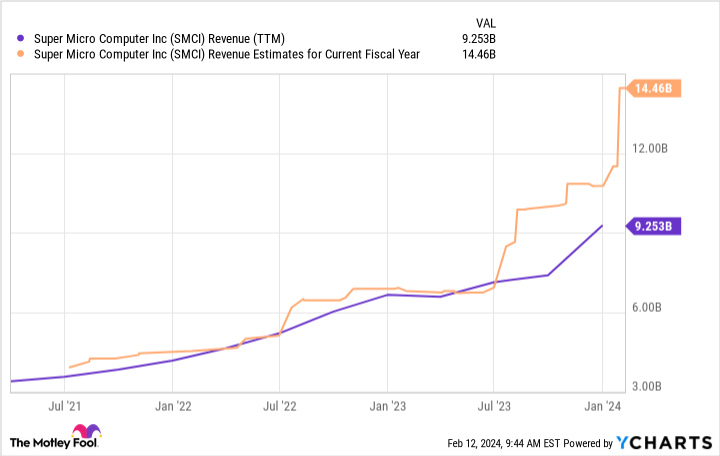

Since cloud giants like Microsoft; alphabetand Amazon As AI chips are being purchased at lightning speed, the demand for server racks is also skyrocketing. In fact, analysts expect the company’s sales to more than double to $14.5 billion in 2024 and grow 34% in 2025.

However, this isn’t a stock that’s for everyone. Given the stock’s meteoric rise, its 58x price-to-earnings valuation is a big no-no for value investors.

But for companies looking for companies to benefit from growth in physical AI infrastructure and data centers, Super Micro Computers is a stock to consider.

Should you invest $1,000 in a super micro computer right now?

Before buying Super Micro Computer stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Things investors could buy right now…and super micro computers weren’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 12, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Jake Lerch has held positions at Alphabet, Amazon, CrowdStrike, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, CrowdStrike, Domino’s Pizza, Microsoft, Nvidia, and Pinterest. The Motley Fool recommends Super Micro Computers and recommends the following options: A long January 2026 $395 call on Microsoft and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.

3 Top Artificial Intelligence Stocks to Buy Now was originally published by The Motley Fool.

[ad_2]

Source link