[ad_1]

of S&P500 The current yield is just 1.4%, as companies that don’t pay dividends or have low yields make up a large share of the overall market. Investors looking for passive income may be looking at stocks with higher yields and a track record of increasing dividends.

walmart (NYSE:WMT), W.M. (NYSE:WM) (formerly known as Waste Management), and sherwin williams (NYSE:SHW) We will continue to buy back our own shares and increase dividends. However, their yields are currently below the S&P 500.

We explain why these three dividend stocks are too successful for themselves, and why great companies can become poor sources of income over time.

Walmart is in growth mode

Walmart is hovering near all-time highs. After a successful 3-for-1 stock split, Walmart raised its dividend by 9%, the largest increase in more than a decade and the 51st consecutive dividend increase. Still, Walmart only pays a quarterly dividend of $0.83 per share, yielding just 1.3%.

Prior to this, Walmart had given annual raises that were close to the minimum. But the main reason for this is reinvestment in stores and fundamental business improvements. The strategy mostly worked.

Walmart’s revenue has increased more than 25% over the past five years, a significant increase for a company of its size. His operating margin is back to over 4%, making a huge difference to his profitability.

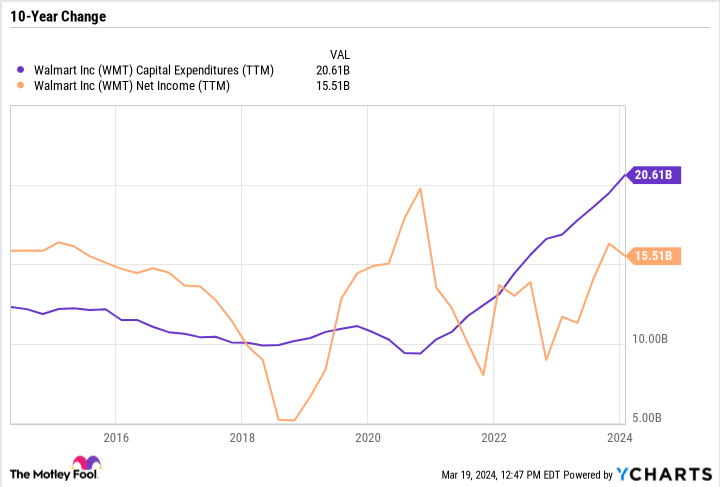

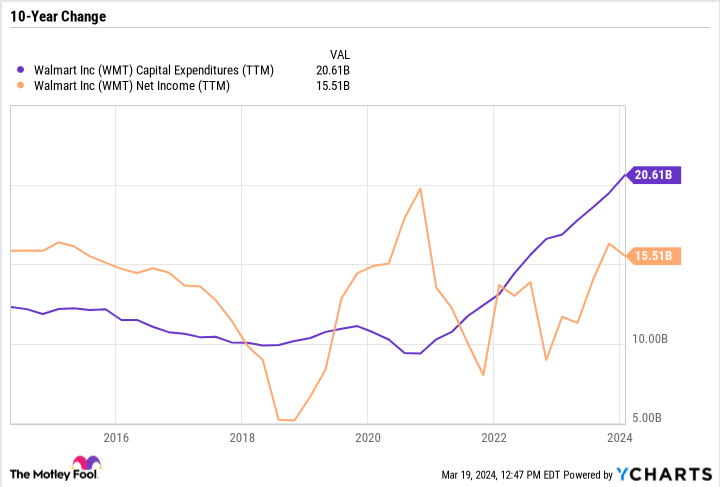

However, as Walmart has increased its capital expenditures (capex), Walmart’s trailing 12-month net income is now shockingly lower than it was a decade ago. In fact, capital expenditures nearly doubled in just his three years.

If Walmart hadn’t spent so much on capital expenditures, it would have generated record profits. However, long-term investors care more about a company’s profits in a few years’ time than what they think they will do now.

Apart from store expansion, Walmart has invested heavily in in-store pickup and delivery through its Walmart+ program. In fiscal year 2024, Walmart’s global e-commerce sales exceeded $100 billion for the first time. This means that e-commerce accounts for more than 15% of total sales.

Walmart will invest in supply chain automation and renovate 928 stores and Sam’s Clubs over the next year. These improvements cost a lot of money and made Walmart look expensive. However, if things go well, it could set the stage for significant growth and dividend increases in the future.

WM is developing new revenue streams

WM covers the entire waste management value chain, from collection to transportation, separation, treatment and reuse. This business is self-explanatory, but until recently, the reuse side of the equation extended far beyond recycling.

Like Walmart, WM’s capital spending has exploded in recent years, doubling in the past three years. The company’s capital investment growth rate has far outpaced its net income growth rate, which makes sense given that WM won’t be able to recoup some of these investments for years.

A major driver of WM’s investments is sustainability through recycling projects and renewable natural gas (RNG).

Landfill gas (LFG) is produced when bacteria break down organic waste. According to the Environmental Protection Agency, LFG contains about 50% methane and 50% carbon dioxide, which is not a good combination when released directly into the atmosphere. WM is working to capture LFG and process it into pipeline-quality gas that can be reused. The sustainable process is why the final product is called “renewable” natural gas.

Producing RNG is much more expensive than fossil-based gas. But there are achievements that make RNG a good investment. In his Q4 2023 earnings call, WM discussed the stability of the credit program and why credits can be stacked to increase the profitability of the program. WM is an industry leader from LFG to his RNG, with decades of potential, especially as the pace of energy transition accelerates.

WM has put up strong numbers despite these long-term investments. Profits are near record highs and margins are recovering from the pandemic-induced slowdown. WM stock has risen fairly quietly over the past five years by over 108%, outperforming the S&P 500. The company has significantly increased its dividend, returning $2.44 billion to shareholders in 2023, but the yield is low due to the stock price. WM invests not only in dividends, but also in long-term growth.

Sherwin-Williams is more than just a paint store

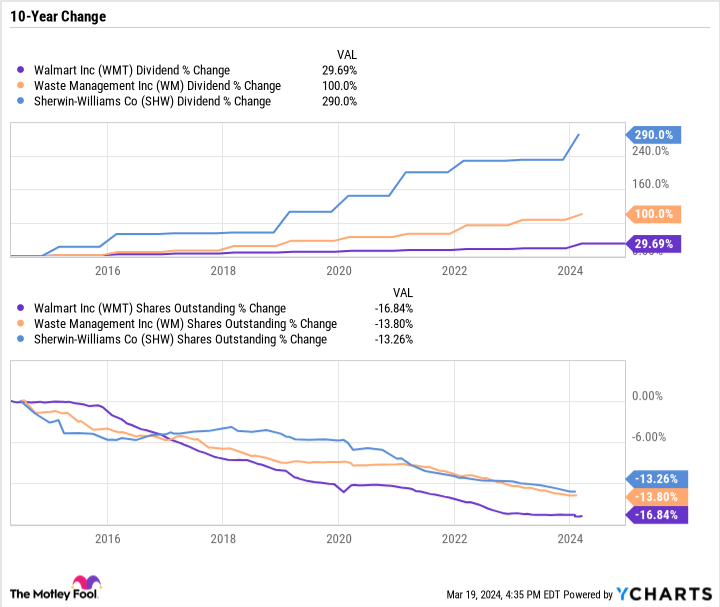

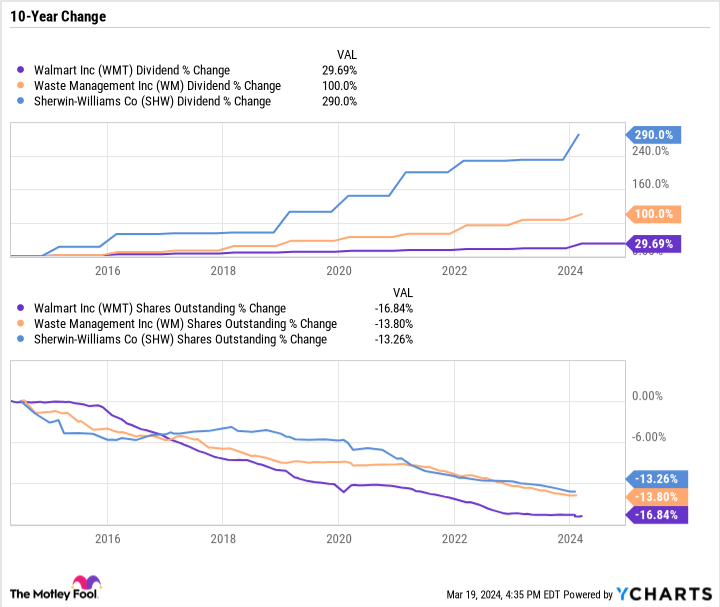

Over the past decade, Sherwin-Williams has increased its dividend nearly fourfold, WM has doubled and Walmart has increased less than 30%. But Walmart shed more shares than WM or Sherwin-Williams.

Sherwin-Williams is also the best performing of the three, dominating the S&P 500 over the past five years. With the market as a whole continuing to rally, supported by growth stocks, things are looking pretty good for paint companies.

Sherwin-Williams has achieved impressive revenue growth while maintaining fairly high profit margins. The key is to increase profit margins across business units, especially its largest segment, Paint Store Group (PSG). PSG, formerly known as America’s Group, focuses on Sherwin-Williams stores serving industrial, commercial and residential customers.

The Consumer Brands group includes products not under the Sherwin-Williams name, such as Cabot and Valspar. The segment boomed as people embarked on their DIY projects during the height of the pandemic. Although the division’s sales and profits fell in the most recent quarter, they are still significantly higher than they were a few years ago, showing how the company was able to grow despite difficult results.

The performance coatings group is a segment you may be less familiar with, as it targets industrial and commercial customers. Sherwin-Williams makes coatings for everything from ships to machinery and equipment.

Sherwin-Williams’ dividend has increased 90% over the past five years, but as the stock price has outpaced this growth, the yield has declined.

Beyond passive income

Walmart, WM, and Sherwin-Williams are great examples of how investment themes can change for good reason.

All three companies have grown steadily, generated solid returns for investors, and still have significant capital return programs with dividends and share buybacks. But with the focus on growth, these stocks are no longer good for passive income.

That doesn’t mean they aren’t good investments, but it does mean investors need to readjust their expectations based on the new direction.

Should I invest $1,000 in Walmart right now?

Before buying Walmart stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Investors can buy now…and Walmart wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 21, 2024

Daniel Felber has no position in any stocks mentioned. The Motley Fool has a position in and recommends Walmart. The Motley Fool recommends Sherwin-Williams and Waste Management. The Motley Fool has a disclosure policy.

“3 Dividend Stocks That Are Too Successful for Their Profit” was originally published by The Motley Fool.

[ad_2]

Source link