[ad_1]

2024 is shaping up to be a landmark year for investors focused on the artificial intelligence (AI) sector. So it’s time to set up your portfolio for the new year. You don’t have to do it alone.

Three Motley Fool contributors pool their wits to share the best AI investments for the new year.

In the resulting discussion, you’ll find three standout AI stocks with prospects to outperform the market in 2024 and beyond. international business machine (NYSE:IBM) Strategically pivoted to AI and cloud computing. Nvidia (NASDAQ:NVDA) is a pioneer in specialized hardware and generative AI systems. ASML Holdings (NASDAQ: ASML) It forms the backbone of AI chip manufacturing.

These companies not only represent the pinnacle of innovation in AI, but also offer unique investment opportunities.

Don’t underestimate this AI pioneer’s ability to shine

Nicholas Rossolillo (Nvidia): It may sound like an “too easy” choice, or even an overhyped choice, but following Nvidia’s last earnings report, the generative AI systems pioneer has plans to invest in the new year. There may be plenty of room for further increases. Why?

Fiscal 2024 third-quarter earnings report (period ending October 2023) shows sales are up year-over-year, driven by the data center division (where the majority of generative AI chip and system sales are made). It jumped 206% to $18.1 billion. Registered). Remarkably, more sequential increases are expected in the fourth quarter, with management forecasting $20 billion in sales.

But here’s where things get interesting and the discussion begins (as Anders, Billy, and I wrote a few months ago): CEO Jensen Huang and the top team are talking about data center revenue (revenue 80% of the time). last quarter’s total revenue) is expected to continue increasing in calendar year 2024 as more AI chips enter the market to meet insatiable demand. The market seems to be scratching its head over this, with Wall Street analysts’ consensus for next year’s sales pegged at nearly $91 billion, implying an increase of more than 50%.

However, semiconductor sales tend to be cyclical. Periods of rapid revenue growth are often followed by downturns. All eyes are now on what will happen in 2025. But for the record, in the last earnings call, Huang said, “I absolutely believe that.”[s] Its data center could grow until 2025. ”

Of course, the jury is still out on this. At some point, I predict the world will take a breather to build new AI computing infrastructure. Perhaps it will finally arrive in 2025, or it could be delayed to 2026 or later.

But if Huang is correct and the roughly $1 trillion global AI data center opportunity continues to grow unabated over the next few years, Nvidia could look like a reasonably valued semiconductor stock. I can see it. The stock trades at 25 times next year’s (calendar year 2024) expected earnings per share. As we begin another busy year, I have no plans to sell his position at Nvidia yet.

It’s time to jump into the big blue AI waters

Anders Byland (IBM): The IBM you see today is very different from the one-stop IT shop of the early 2000s. In a visionary but painful strategic shift that began in 2012 and never ended, Big Blue shifted its vast assets to high-growth industries such as cloud computing, data security, analytics, and AI. Refocused on “strategic imperatives”.

The watsonx.ai platform is a development platform custom-built for enterprise-scale businesses seeking machine learning and generative AI tools. This includes generative AI support in the app creation experience and the option to generate apps with a drag-and-drop graphical interface rather than manual coding, relying on IBM’s decades of AI research.

And the company isn’t resting on its laurels. The company has $11 billion in cash equivalents and generated $10.3 billion in free cash flow over the past four quarters. And those funds are now focused squarely on AI opportunities.

For example, IBM recently committed to working with universities around the world to train 2 million AI professionals over the next three years. It also launched a $500 million investment fund focused on innovative AI startups.

As a result, IBM is poised to generate solid profits over the next few years, offsetting the pain of its strategic shift. IBM stock, trading at just 2.4 times sales and 12.3 times free cash flow, seems like an obvious buy today.

But market makers seem to have forgotten about the huge shadow IBM casts on the AI opportunity. The stock price will rise only 16% in 2023, S&P500 The index rose 25%.

I have no intention of destroying a market-winning company like Nvidia, and I own shares in it myself. But the chip designer’s stock trades at 27 times sales and 70 times free cash flow. If you’re looking for a strong AI investment as 2024 approaches, IBM combines great growth prospects, an unbeatable AI history, and a bargain stock price.

This must-have AI stock has lagged its peers this year, but could soar in 2024

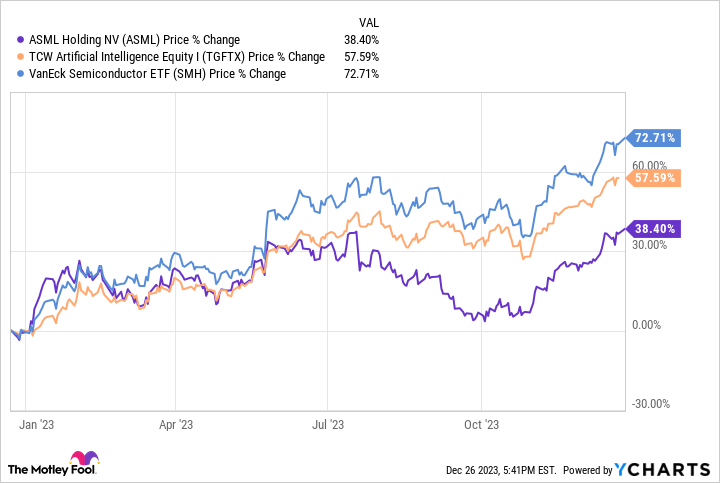

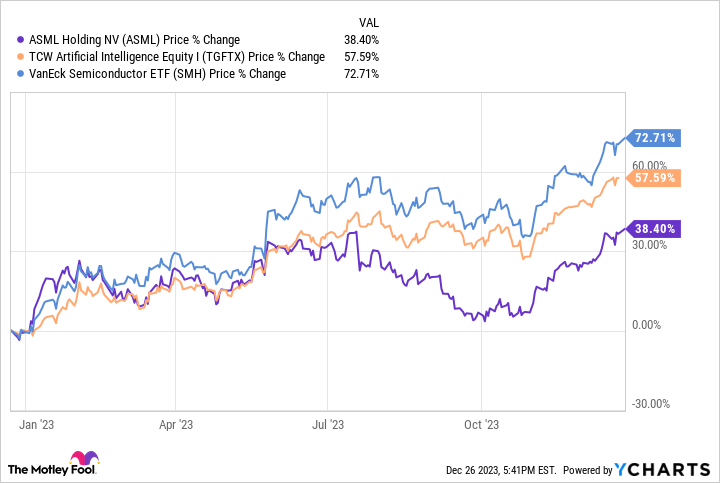

Billy Duberstein (ASML Holdings): There aren’t a lot of bargains to be found, as many artificial intelligence stocks have rallied significantly this year. But ASML Holdings underperformed many AI stocks, at least by comparison, rising only 38% even though its machines are essential to the AI chip manufacturing process. Additionally, while the stock remains about 15% below the all-time high it hit in late 2021, many other semiconductor and AI stocks are now above their previous highs.

ASML data by YCharts.

There are several reasons for this year’s poor performance. First, ASML is a European stock, so the relative performance of each market may have some influence. Second, ASML traded at a relatively higher valuation than other semiconductor equipment companies this year. In other words, there wasn’t much ground to “make up” for after the sector crashed in 2022. ASML’s P/E ratio is still 35x.

Additionally, ASML’s management has already stated that the company does not expect significant growth in 2024. This may come as a surprise since most other semiconductor companies are predicting a downturn in 2023 and a recovery in 2024. However, ASML’s growth is a little different. . Demand for ASML’s extreme ultraviolet (EUV) and deep ultraviolet (DUV) lithography equipment has been extremely high during the pandemic, and production bottlenecks have extended into this year as they are extremely complex and expensive to manufacture. So while many other semiconductor equipment companies will see their 2023 revenues decline, ASML’s 2023 revenues are actually expected to increase by about 30%. Only next year, 2024, will be able to withstand the effects of the post-pandemic economic downturn.

But chip stocks tend to look about a year ahead, so ASML could outperform some of its peers heading into 2025. Management expects this to be a year of significant growth with several new state-of-the-art fabs coming online using ASML’s latest EUV. machine. In fact, ASML has just shipped the first parts of the first high numerical aperture (NA) EUV machine, the newest and most advanced model in EUV. intel. High NA machines are so large that they must be shipped in 250 individual crates. The first batches are shipping now, but their production probably won’t happen until late 2025.

ASML stock isn’t cheap, but it has a monopoly on the EUV technology needed to make sub-7nm chips, which the industry surpassed only a few years ago. Last year’s cutting-edge chips such as the Nvidia H100 were manufactured on his 5nm node, and the first of his 3nm chips were produced in 2023.

However, the first 2nm chips are expected to be manufactured in 2025, and both Samsung and Intel are hoping to catch up with foundry leaders at this node. taiwan semiconductor manufacturing It is mounted on a state-of-the-art logic chip. Intense competition for the 2nm node means all these companies will be buying ASML machines in bulk to make their dreams a reality.

And the story doesn’t end there. All major dynamic random access memory (DRAM) manufacturers will also start using his EUV to manufacture DRAM chips in the future. Samsung started using EUV two years ago, and in 2025 it will also start using EUV. micron is the first to begin using EUV in memory manufacturing as the last memory holdout for complex processes.

Because generative AI relies heavily on cutting-edge processors and high-bandwidth memory, we expect ASML to potentially outperform competitors in 2024 after falling behind in 2023.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Nvidia wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of December 18, 2023

Anders Bylund has held positions at Intel, International Business Machines, Micron Technology, and Nvidia. Billy Duberstein works at ASML, Micron Technology, and Taiwan Semiconductor Manufacturing. Nicholas Rossolillo has held positions at ASML, Micron Technology, and his Nvidia. The Motley Fool has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and International Business Machines and recommends the following options: A long January 2023 $57.50 call on Intel, a long January 2025 $45 call on Intel, and a short February 2024 $47 call on Intel. The Motley Fool has a disclosure policy.

3 Great AI Stocks to Own in 2024 was originally published by The Motley Fool.

[ad_2]

Source link