[ad_1]

It wasn’t easy to become an investor in intel (NASDAQ:INTC) Over the last few years. The company was his major chip supplier for at least a decade, accounting for more than 80% of the central processing unit (CPU) market. apple‘s long-standing MacBook lineup. But Intel has rested on its advantage, leaving it vulnerable to more innovative competitors.

Advanced Micro Devices began to gradually erode Intel’s CPU market share in 2017, and Intel’s share is now down to 69%. Then, in 2020, Apple severed ties with Intel in favor of more powerful in-house hardware designs. Since then, Intel’s stock price has fallen 7% over the past three years. Meanwhile, annual revenue was down 20% and operating profit was down 90%.

However, that downfall seems to have reignited Inter’s management. According to Mercury Research, from the second quarter of 2022 to the second quarter of 2023, Intel took back his 3% of CPU market share from AMD. Meanwhile, the company has shifted its focus to the rapidly growing artificial intelligence (AI) market.

Intel appears to be back on a growth track. Here are three solid reasons to buy the company’s stock in 2024.

1. Intel is poised to make a big impact in AI

According to Grand View Research, the AI market reached nearly $200 billion last year and is expected to grow at a compound annual growth rate of 37% through 2030. If it continues on this trajectory, it will be valued at more than $1 trillion by the end of 2020. . As a result, it’s no surprise that technology companies like Intel are prioritizing AI development.

Chip stocks soared last year as excitement around AI grew. Nvidia took center stage, gaining a head start in the space with an estimated 90% market share in AI graphics processing units (GPUs), the chips needed to train and run AI models. But Intel’s revenue could soar in 2024 as it prepares to challenge Nvidia’s dominance in AI.

In December, Intel announced a series of new AI GPUs called Gaudi3 designed to compete directly with Nvidia’s offerings. The tech giant also announced new Core Ultra processors and his Xeon server chips. These chips contain neural processing units to run AI programs faster.

2. Benefit from a recovering PC market

Macroeconomic headwinds caused the PC market to plummet in 2022 and most of last year. Soaring inflation reduced consumer spending, and PC shipments fell 16% year over year in 2022 and continued to decline in the first three quarters of 2023. However, it seems like the recovery is finally starting, and Intel is in a good position. You can reap big profits from a strong market.

Global PC shipments increased by 0.3% in Q4 2023. Intel’s recent earnings reflect a gradual recovery. In the third quarter of 2023, desktop chip sales increased by 2% year-on-year, while the notebook segment posted a 22% increase in sales.

Total revenue for the quarter was down 14% year over year. However, operating profit rose 23% to $2 billion, indicating the company is on the right track and could see further growth as the PC market grows in 2024.

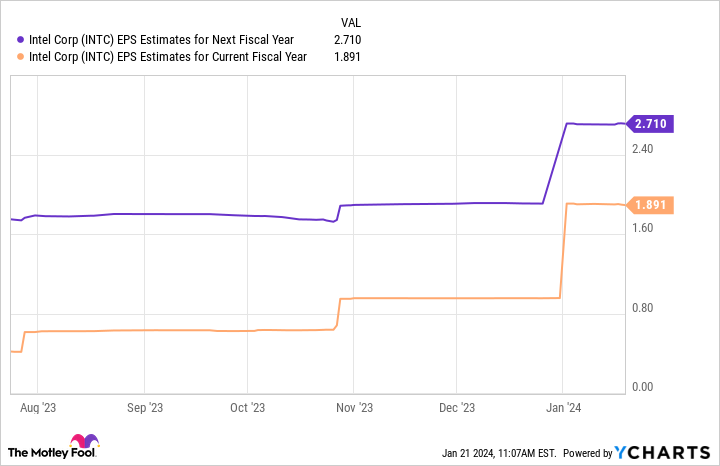

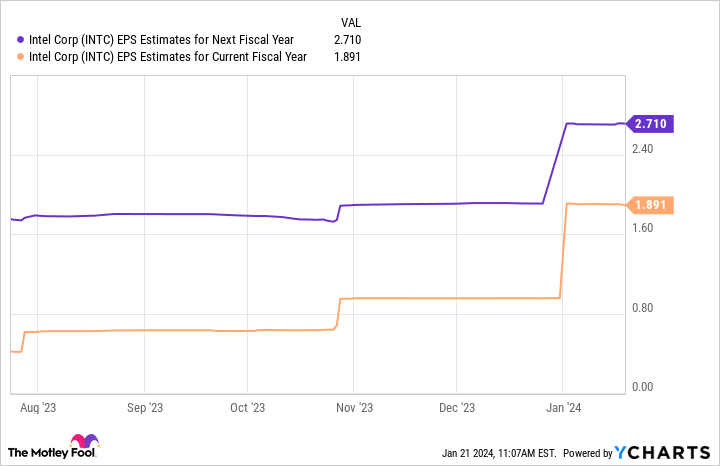

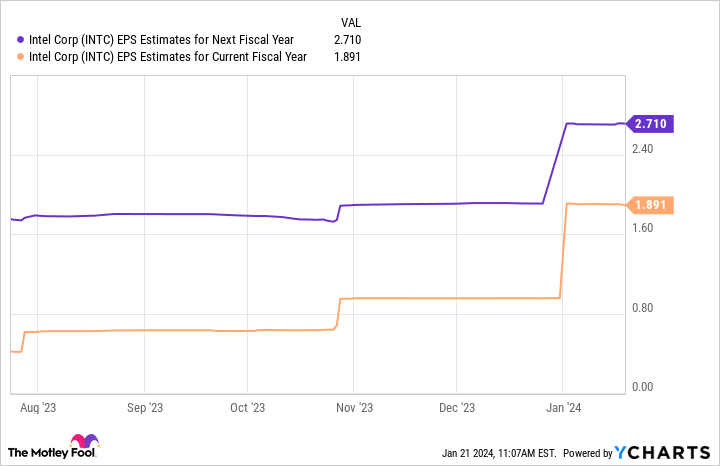

3. EPS estimates show a significant increase over the coming year

Intel has a solid outlook for the year ahead, as easing inflation continues to drive a recovery in the PC market and Intel expands in AI. The EPS estimates are consistent with the tech giant’s growth potential beyond 2024, strengthening the case for the stock.

This chart shows that Intel’s earnings could reach nearly $3 per share by fiscal year 2024. Multiplying this number by the company’s forward P/E ratio of 25 yields a stock price of $68, with the stock expected to grow 42% next year. While this is a lofty goal, this goal is based on reasonable financial projections.

In addition to promising AI expansion and improvements to its PC business, Intel looks like a sure bet to buy in 2024.

Should you invest $1,000 in Intel right now?

Before buying Intel stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Intel wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of January 16, 2024

Dani Cook has no position in any stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, and Nvidia. The Motley Fool recommends Intel and recommends the following options: Long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

3 Reasons to Buy Intel Stock in 2024 was originally published by The Motley Fool.

[ad_2]

Source link