[ad_1]

What are the main drawbacks of the new bull market? Valuations can be frothy.average S&P500 The stock trades at nearly 21.5 times estimated earnings. Valuations for many stocks have skyrocketed even further.

But don’t think for a second that you won’t find a bargain. Here are five great stocks to buy very cheaply (listed alphabetically).

1. Ares Capital

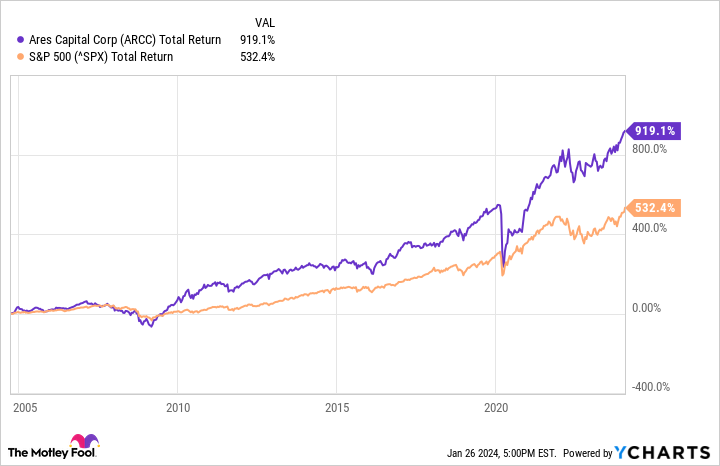

You may not be very familiar with it. ares capital (NASDAQ:ARCC). However, the company is the largest publicly traded business development company (BDC) in the United States, and its stock price is considered very attractive to value investors. Ares Capital’s forward earnings multiple is a low 8.8x.

But its discount valuation isn’t the only thing we like about Ares Capital. BDC’s dividend yield is over 9.4%. This dividend greatly boosts the company’s total return. Since Ares Capital’s 2004 IPO, its total return has outperformed the S&P 500.

2. Energy Transfer LP

energy transfer LP‘s (New York Stock Exchange:ET) The value of the unit has more than doubled in the past three years. Even though this midstream energy provider has posted strong profits, it’s still a bargain at a forward earnings multiple of just 8.3x.

The limited partnership also pays out significant dividends, currently yielding nearly 8.8%. Energy Transfer expects its distribution to grow 3% to 5% annually. The company’s pipeline and processing plants generate steady cash flow, and the company should be able to easily fund these distributions in the future.

3. ExxonMobil

exxon mobil (NYSE:XOM) stands out as another energy stock that’s available at a bargain price. The oil and gas giant’s stock trades at about 10.7 times expected earnings. This is well below the S&P 500 and below the average forward earnings multiple of 11.2 times for the energy sector.

This stock has long been popular among income investors. This is still the case since ExxonMobil’s dividend yield is 3.8%. The company may even have better long-term growth prospects than many think due to its large investments in carbon capture and storage.

4. PayPal Holdings

paypal holdings (NASDAQ:PYPL) It has been a disaster for investors in recent years. Since mid-2021, fintech stocks have plummeted by nearly 80%. However, due to this sharp decline, PayPal’s prices became abnormally low. The expected earnings multiple is lower than 11.4x. PayPal’s price-to-earnings ratio (PEG), which takes into account growth forecasts over the next five years, is extremely low at 0.54. A PEG ratio below 1.0 is considered an attractive valuation.

Although PayPal’s growth has slowed significantly, the company’s underlying business remains very healthy. In the third quarter of 2023, PayPal’s total payments grew 15% year over year. Adjusted earnings per share rose 20%. The digital payments pioneer also generated $1.1 billion in free cash flow.

5. Pfizer

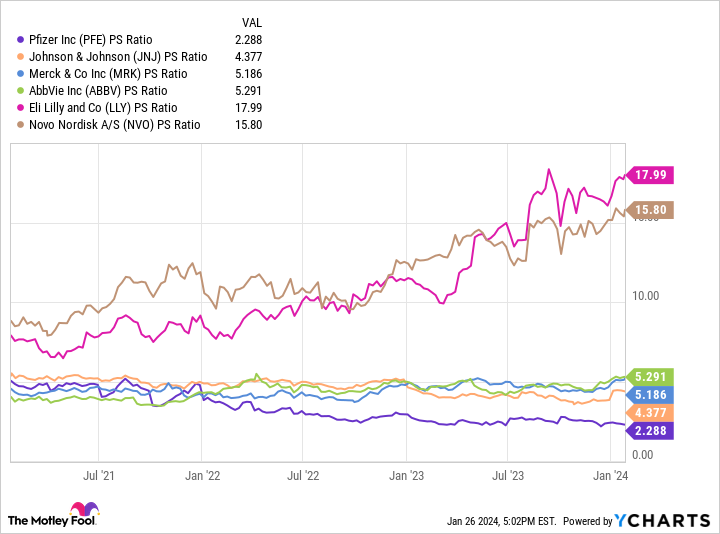

You may question my sanity if I include the following: pfizer (New York Stock Exchange: PFE) As a “great” stock to buy now. The pharmaceutical giant’s stock price has fallen nearly 40% in the past 12 months. The stock is down 55% from its all-time high in late 2021.

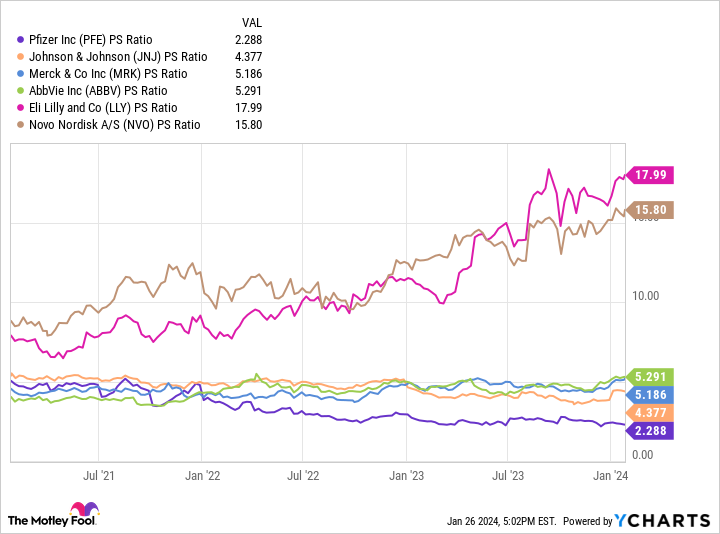

But the way I see it, Pfizer looks like a bargain. The company’s stock trades at 12.6 times forward earnings, well below the S&P 500’s healthcare sector average of 18.4 times. Pfizer’s price-to-sales multiple is only a fraction of that of its large pharmaceutical peers.

Indeed, Pfizer deserves a lower rating due to declining sales of its COVID-19 products and the approaching patent expiry of its best-selling drug. But I think the outlook for this drug company is much better than it appears at first glance. As a bonus, Pfizer pays a nice dividend with a yield of 6.1%.

Should you invest $1,000 in Pfizer right now?

Before purchasing Pfizer stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors should be buying now…and Pfizer wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of January 22, 2024

Keith Speights has held positions at Ares Capital, PayPal, and Pfizer. The Motley Fool has a position in PayPal and Pfizer and recommends PayPal and Pfizer. The Motley Fool recommends this option: His March 2024 $67.50 Short Calls on PayPal. The Motley Fool has a disclosure policy.

“5 Great Stocks to Buy Very Cheaply” was originally published by The Motley Fool.

[ad_2]

Source link