[ad_1]

Warren Buffett is one of the most famous figures in the financial world. His talent for picking stocks made him a millionaire and created incredible wealth for other investors.shares of berkshire hathaway doubled the annual revenue of S&P500 Since Buffett took control in 1965.

Understandably, investors often look to Buffett for stock market advice, but as Buffett reminded attendees at the 2021 Berkshire Annual Meeting, he consistently gives the same advice: Readers may be surprised to learn that they were provided with A long, long time for people. ”

Here’s how Buffett’s suggestions can turn $400 a month into $847,800 for patient investors.

Vanguard S&P 500 ETF

of Vanguard S&P 500 ETF (NYSEMKT: VOO) Measures the performance of 500 U.S. companies, including value and growth stocks in all 11 market sectors. Its constituent stocks cover 80% of the domestic stock market and more than 50% of the global stock market.

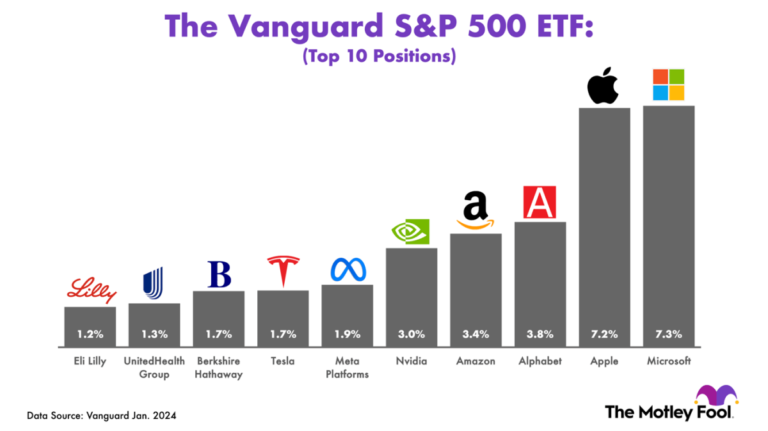

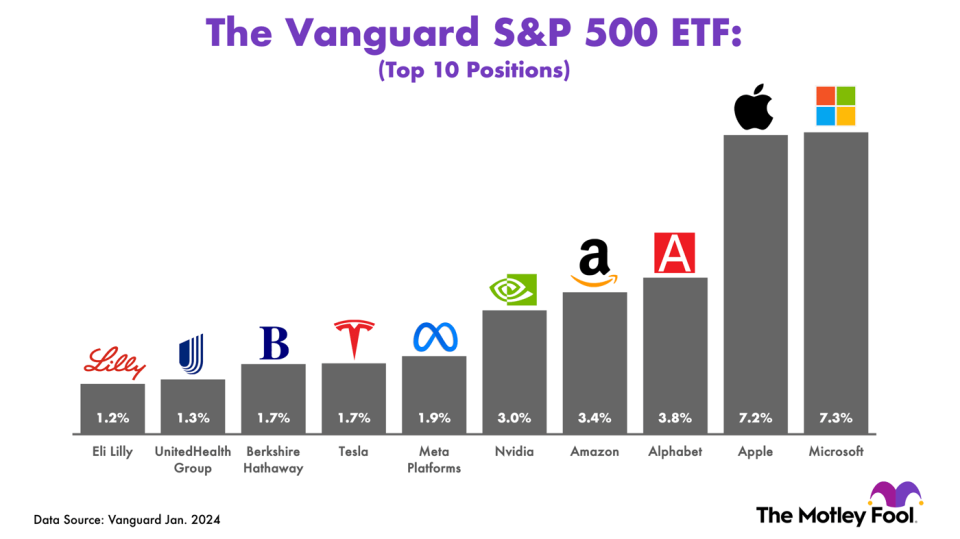

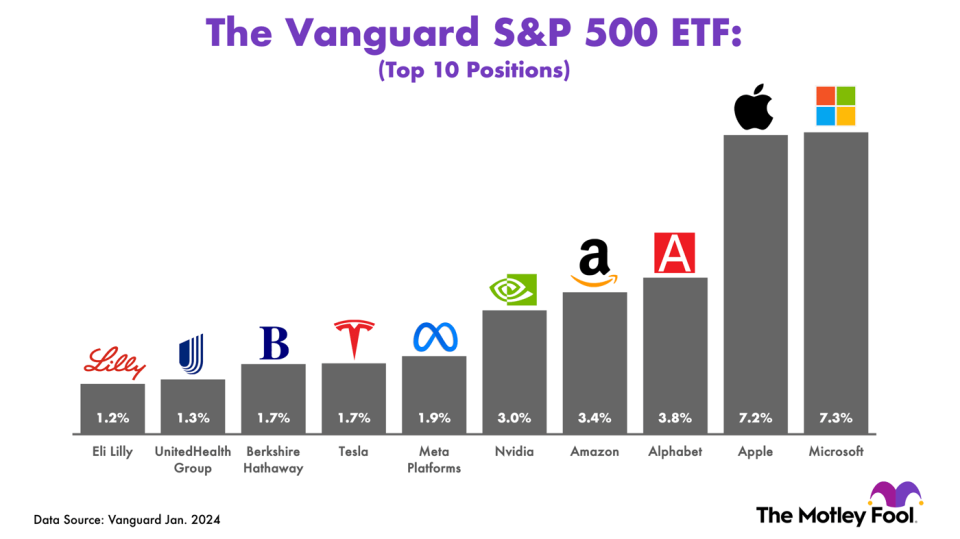

In other words, index funds allow investors to spread their money across many of the world’s most influential companies.This includes enterprise software leaders microsofta major consumer electronics company applea leader in digital advertising alphabeta leader in cloud computing Amazonartificial intelligence chip manufacturer Nvidia.

The following graph shows the top 10 Vanguard S&P 500 ETFs as of January 1, 2024.

Buffett believes that the average person cannot pick stocks. This is not because people lack mental capacity, but rather because identifying good stocks requires a level of patience and dedication that many people are unwilling to engage in.

Buffett believes the S&P 500 index fund is the best option for the average person because it provides exposure to “a broad range of businesses that should do well as a whole” instead of individual stocks. In fact, the S&P 500 has been a steady source of income for patient investors.

The S&P 500 has been a solid long-term investment.

The S&P 500 has been a profitable investment for every 20-year period since its creation in 1957, and its predecessor, the S&P 500, has been a profitable investment for every 20-year period since its creation in 1926. did.

Additionally, the S&P 500 has increased 1,720% over the past 30 years, compounding at an annual rate of 10.14%. If you invest at this pace, your $400 monthly investment will be worth $80,500 in 10 years, $292,000 in 20 years, and $847,800 in 30 years.

Some investors may not be able to invest $400 every month, and others may want to save more. Assuming an annual return of 10.14%, the following graph shows how various monthly contributions grow over time.

|

Retention period |

$200/month |

$600 per month |

$800 per month |

|---|---|---|---|

|

10 years |

$40,300 |

$120,800 |

$161,100 |

|

20 years |

$146,000 |

$438,100 |

$584,200 |

|

30 years |

$423,900 |

$1.2 million |

$1.6 million |

Data source: Author. Dollar totals are rounded to the nearest $100.

Investors can diversify their portfolio with S&P 500 index funds

We’ve already mentioned that Buffett doesn’t think ordinary people can pick stocks, but investors shouldn’t be discouraged. Anyone willing to do the necessary research should feel comfortable buying individual stocks, especially when combined with his S&P 500 index fund.

Identifying good investments requires understanding individual companies and the industries in which they operate. Building that knowledge takes time, and few people have enough time to research every sector of the stock market on a regular basis. Therefore, investors can use S&P 500 index funds to fill knowledge gaps and diversify their portfolios.

To be clear, diversification is not necessary to make money in the stock market, but it does reduce the risk inherent in a concentrated portfolio. I think that’s very convincing. I have a large portion of my portfolio in individual stocks, many from the technology sector, and the rest in Vanguard S&P 500 ETFs.

I like that strategy for two reasons. First, if my individual stocks outperform the S&P 500, my entire portfolio will outperform the market. Second, even though my individual stocks are underperforming the S&P 500, my portfolio still performs reasonably well since the S&P 500 has returned 10.14% annually over the past 30 years.

Should I invest $1,000 in the Vanguard S&P 500 ETF right now?

Before purchasing Vanguard S&P 500 ETF shares, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and the Vanguard S&P 500 ETF wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Randi Zuckerberg is a former Facebook head of market development and spokesperson, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon, Nvidia, Tesla, and Vanguard S&P 500 ETFs. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Tesla, and Vanguard S&P 500 ETFs. The Motley Fool recommends his UnitedHealth Group. The Motley Fool has a disclosure policy.

Warren Buffett also recommends the Surefire Index Fund. “You Can Turn $400 a Month into $847,800” was originally published by The Motley Fool

[ad_2]

Source link