[ad_1]

key insights

-

Insiders appear to have a vested interest in Queen’s Road Capital Investment’s growth, as evidenced by their large ownership stake.

-

62% of the business is owned by the top 3 shareholders

-

A company’s past performance data, combined with ownership research, allows you to better assess a company’s future performance.

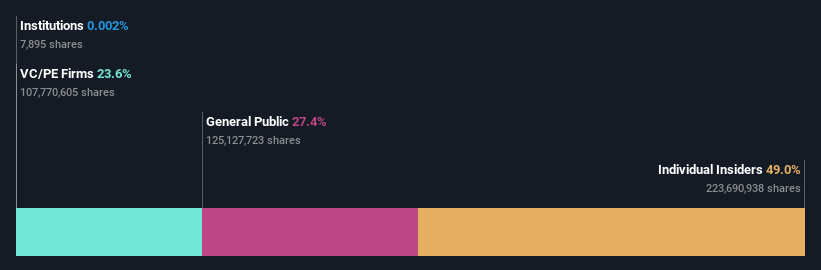

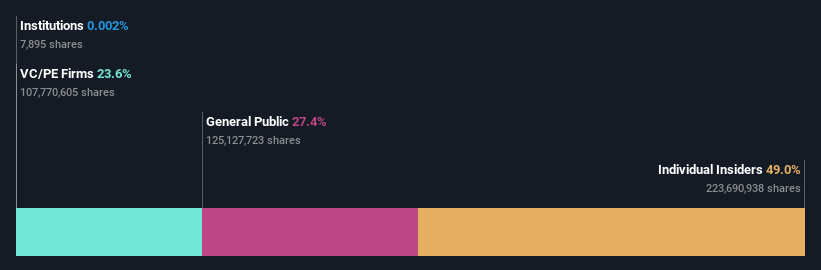

To find out who really controls Queen’s Road Capital Investment Ltd. (TSE:QRC), it’s important to understand the business’s ownership structure. We can see that individual insiders control a majority of the company, with his 49% ownership. In other words, this group faces the greatest upside potential (or downside risk).

With such a noteworthy stake in the company, insiders are highly motivated to make value-enhancing decisions.

Let’s delve deeper into each type of owner for Queen’s Road Capital Investment, starting from the chart below.

Check out our latest analysis for Queen’s Road Capital Investments.

What does the lack of institutional ownership tell us about Queen’s Road capital investment?

Institutional investors often avoid companies that are too small, too illiquid, or too risky for their tastes. However, it is unusual for large companies to have no institutional investors.

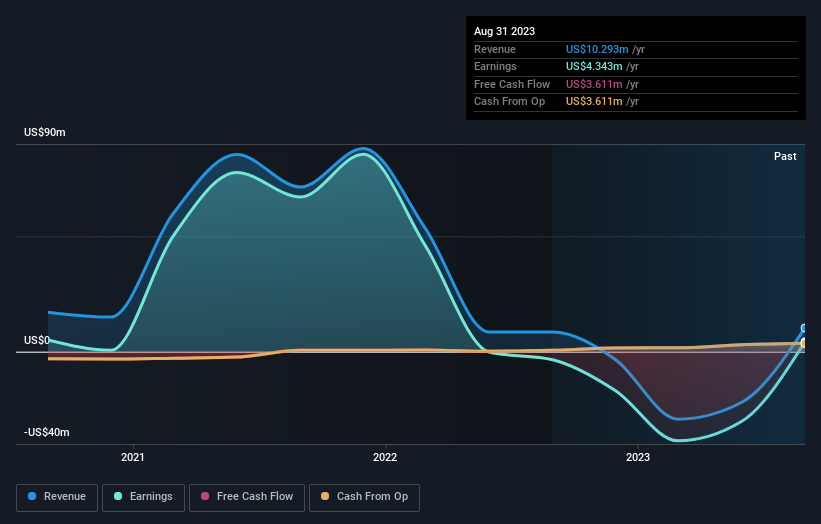

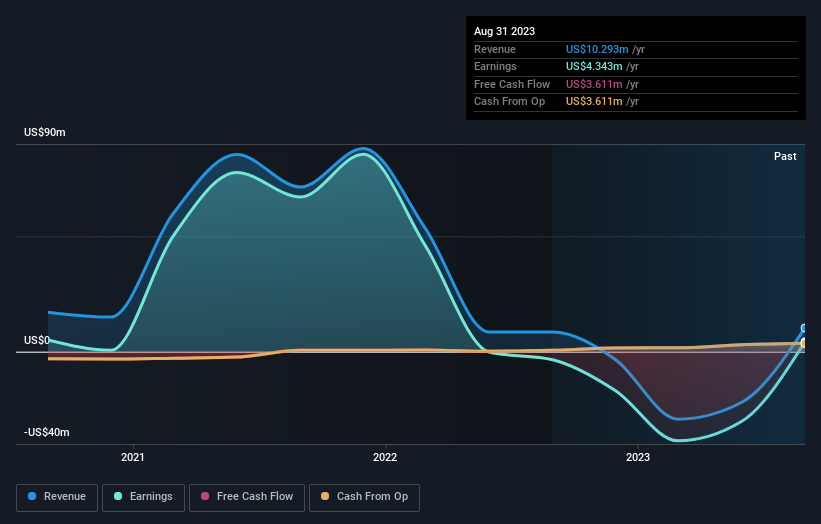

There are multiple explanations as to why institutions don’t own shares. Most commonly, financial institutions are unwilling to take a closer look at the company because it is too small compared to the funds under management. It is also possible that the fund manager does not own the stock because he is not convinced that it will perform well. Queen’s Road Capital Investment’s earnings and revenue history (below) may not be attractive to institutional investors. Or maybe you just didn’t look closely at this business.

Note that hedge funds don’t have a meaningful investment in Queen’s Road Capital Investment. The company’s largest shareholder is Jack Cowin, with 25% ownership. Wyloo Metals Pty Ltd is the second largest shareholder owning 24% of the common stock and Brett Blundy holds approximately 14% of the company’s stock. Furthermore, the company’s CEO Warren Philip Gilman directly holds 8.2% of the total outstanding shares.

To make our study more interesting, we found that the top 3 shareholders have majority ownership in the company. This means they have enough power to influence company decisions.

Researching institutional ownership is a good way to assess and filter a stock’s expected performance. The same can be done by studying analyst sentiment. As far as we know, there isn’t any analyst coverage of the company, so it’s probably flying under the radar.

Insider ownership of Queens Road Capital Investments

The definition of an insider may vary slightly from country to country, but members of the board of directors are always considered. The answers of company management to the board of directors and the latter must represent the interests of shareholders. In particular, top-level managers may serve on the board themselves.

I generally consider insider ownership to be a good thing. However, in some cases, it may be more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders own a significant stake in Queen’s Road Capital Investment Company. The company’s market capitalization is just CA$342m, but insiders have CA$168m worth of shares in his own name. While this shows alignment with shareholders, it’s worth noting that the company is still very small. Some insiders may have founded this business. You can click here to see if insiders have been buying or selling.

Open to the public

The general public, usually retail investors, owns 27% of Queen’s Road Capital Investment’s shares. While this group doesn’t necessarily call the shots, it can certainly have a big influence on how the company is run.

private equity ownership

With a 24% stake, private equity firms are in a position to play a role in shaping the company’s strategy with a focus on value creation. Some may like this because private equity can be activists who hold management accountable. However, private equity can also be sold by taking a company public.

Next steps:

I think it would be very interesting to see who exactly owns the company. But to really gain insight, you need to consider other information as well. For example, we discovered that 1 warning sign for Queen’s Road Capital Investment What you need to know before investing here.

If you want to check out another company with potentially better financials, don’t miss this free A list of interesting companies backed by strong financial data.

Note: The numbers in this article are calculated using data from the previous 12 months and refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the full year annual report figures.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and the articles are not intended as financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link