[ad_1]

The version of this article is TKer.co.

Stocks fell as 2024 began, with the S&P 500 index down 1.5% to end the week at 4,697.24. The index is currently up 31.3% from its October 12, 2022 closing low of 3,577.03 and down 2% from its January 3, 2022 closing high of 4,796.56.

Nothing causes more investor anxiety than a weak week in stock prices.

“The ups on roller coasters are scary, but the downs are thrilling,” veteran Wall Street strategist Ed Yardeni wrote Thursday. “The stock market is thrilling when it’s up, but unsettling when it’s down.”

After an impressive streak of gains, the negative weeks were followed by nine consecutive weeks of positive returns to end 2023, while stocks were falling. The usual Go up, they’re not everytime Go up.

Let’s look back at the history of the market.

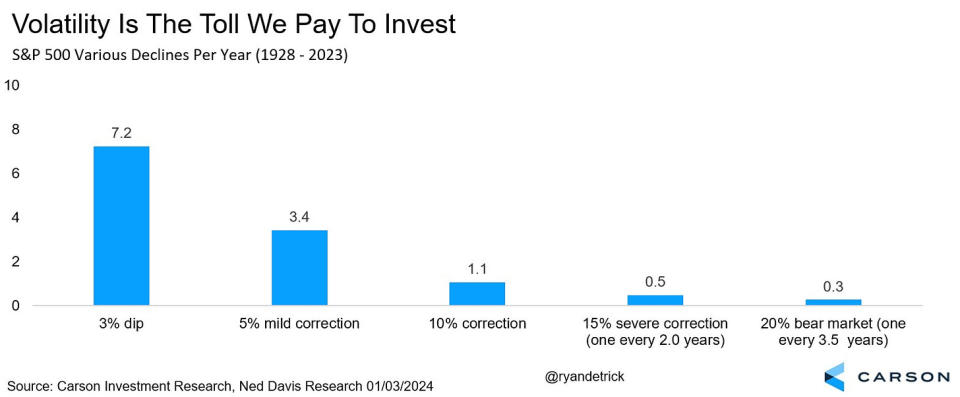

The chart below from Carson Group’s Ryan Detrick shows that in a typical year, the S&P sees at least seven declines of at least 3%, three declines of at least 5%, and one correction of at least 10%. It shows.

“Volatility is the price you pay for investing,” Detrick said. Said. surely.

At this point, we might be understandably worried about a significant drop later this year. But they happen all the time.

Check out JP Morgan’s “Guide To The Markets” chart. This is my favorite visualization of short-term stock market performance.

Going back to 1980, the graph shows the S&P 500’s annual return for each year in gray and the annual maximum drawdown (i.e., the largest decline from this year’s high) in red. During this period, the S&P recorded an average annual maximum drawdown of 14%, with 33 of his 44 years measured ending in the positive. This means that in most years the market has more than fully recovered the losses experienced at the maximum drawdown.

Bottom line: A stomach-churning drop is normal.

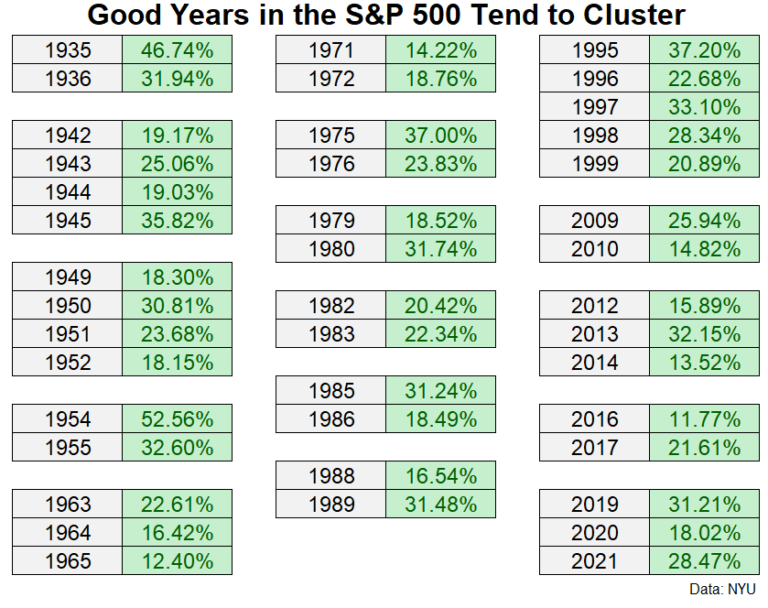

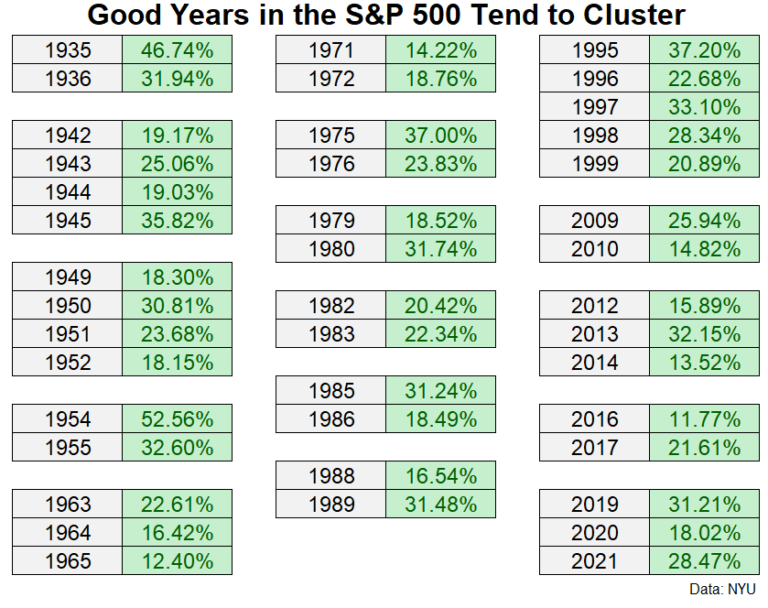

“Good years tend to be followed by good years.”

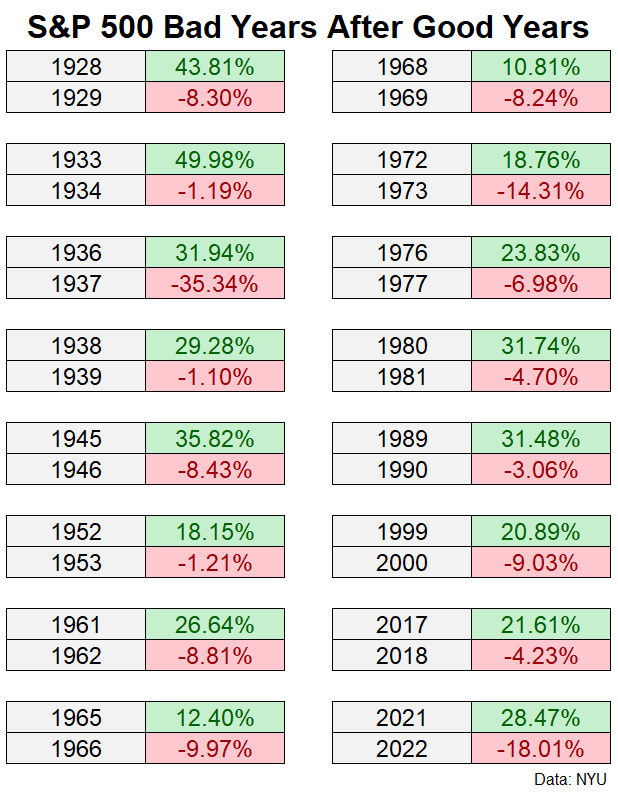

Given the S&P 500’s above-average 24% gain in 2023, you might be tempted to think it’s a sure bet it’s going to be a bad year.

To be sure, there are many examples of unusually good years followed by bad years. Ben Carlson of Ritholtz Wealth Management looked back and found 16 instances where double-digit profit years were followed by negative years.

At the same time, Carlson found that it was much more common for double-digit gains to be followed by further gains.

So it wouldn’t be too surprising if this year was a weak one, but history suggests a positive return is likely.

“Since 1946, the S&P 500 has posted positive annual returns 71% of the time,” says CFRA’s Sam Stovall. observed on Tuesday. “Each of these strong performances was then followed by an average gain of 6.9% and a 69% increase frequency. However, the S&P 500 rose by an average of 10.0% the following year after a 20%+ annual surge. 80% of the time, you’ll find that after a good year, you tend to have above-average returns and profits. ”

Every once in a while, news emerges that significantly changes a major topic that moves the fundamental outlook for the stock market. But often the news that causes volatility is noise, not a major inflection point.

zoom out

The stock market continues to The usual Go up.But what is not will also remain true everytime Go up.

So I think it’s helpful to keep statistics like the ones above in mind.

While it’s good to enjoy the many bullish markets, it’s also important to stay grounded and not get carried away by too much enthusiasm and develop unreasonable expectations for the market. The last thing you want to do is panic at the first sign of volatility, even though history tells us that volatility is normal.

Confirmation of macro cross current

There were some notable data points and macroeconomic trends to consider last week.

The labor market continues to add jobs. U.S. employers added 216,000 jobs in December, according to the BLS Employment Situation Report released Friday. Although the pace of job growth has slowed overall, the 36th consecutive month of increases reaffirms the economy’s strong demand for labor.

Employers added a whopping 2.7 million jobs in 2023. Total payroll employment hit an all-time high at 157.2 million.

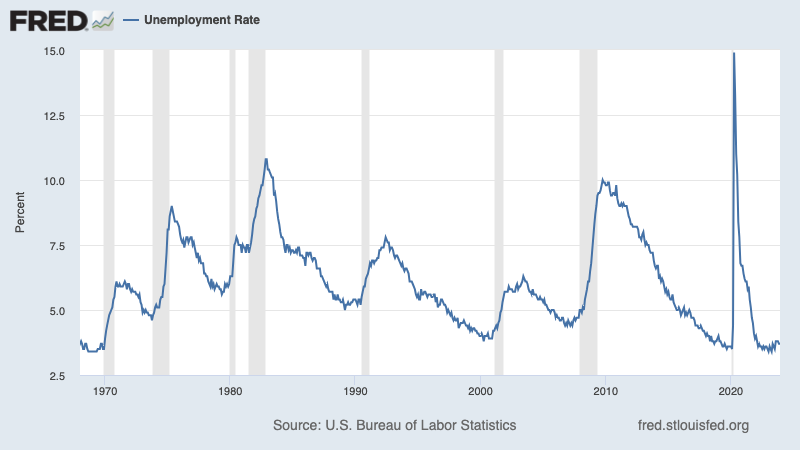

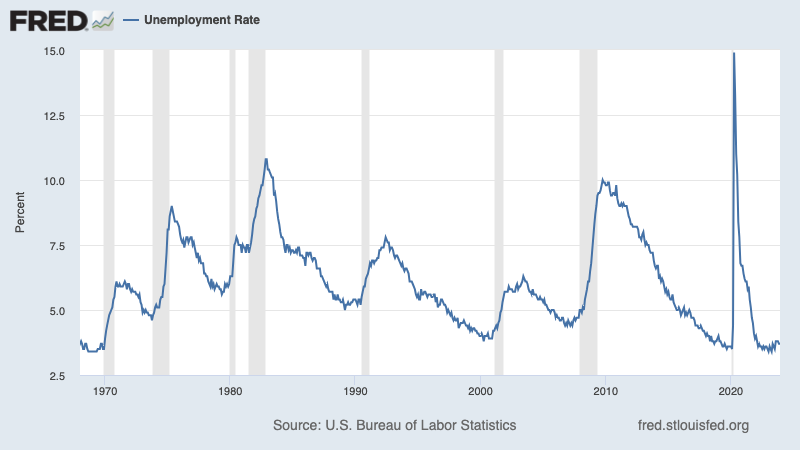

The unemployment rate, or the number of workers recognized as unemployed as a percentage of the civilian labor force, was 3.7% during the month. Although above its cycle low of 3.4%, it remains near a 50-year low.

Wage growth is slowing. The average hourly wage in December increased by 0.44% from the previous month, slightly up from the 0.35% pace in November. Year-on-year, this indicator has increased by 4.1%, and although this rate is slowing down, it is still rising.

Salaries for job-changers remain high. According to ADP, which tracks private sector salaries and uses a different methodology than the BLS, annual salary growth for job changers in December was 8% higher than a year earlier. For those who kept their jobs, the wage increase was 5.4%.

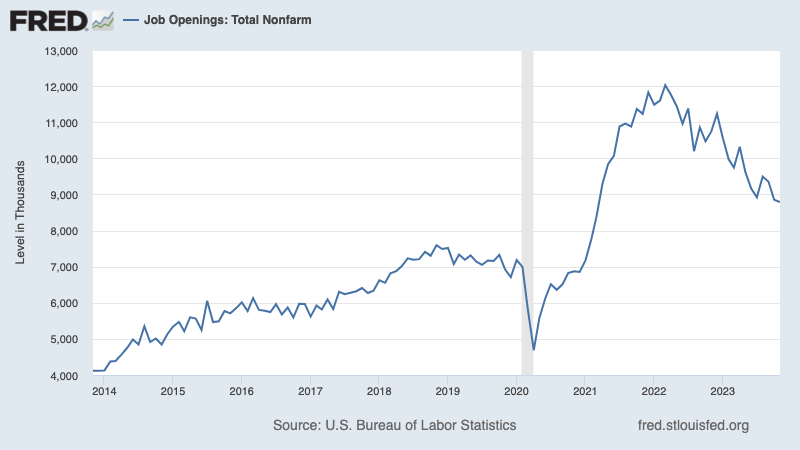

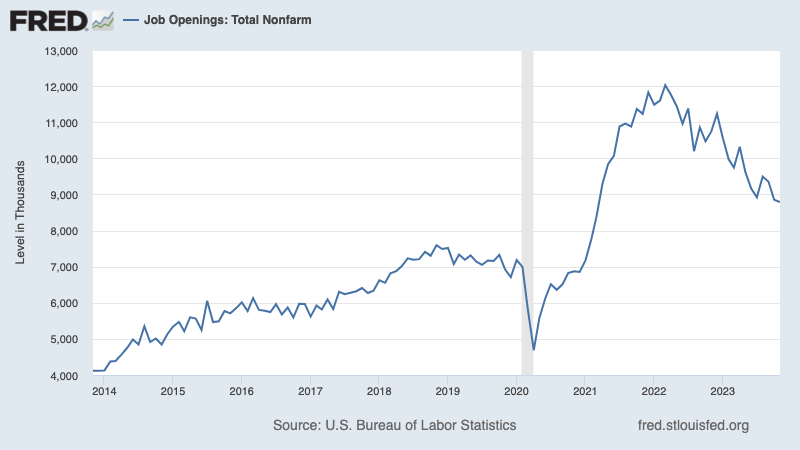

Number of job openings is decreasing. Employers had 8.79 million job openings in November, according to the BLS Jobs and Turnover Survey. While this is still above pre-pandemic levels, it is down from the March 2022 high of 12.03 million.

During this period, there were 6.29 million unemployed people. That means there were 1.4 job openings for every unemployed person. This continues to be one of the most obvious signs of excessive demand for labor.

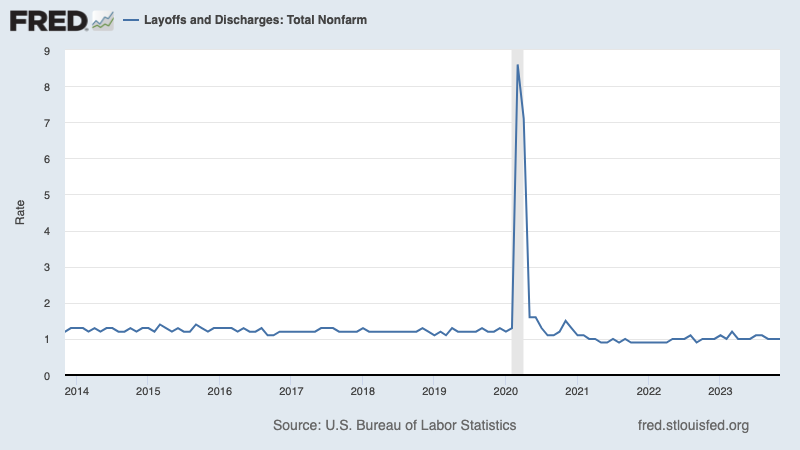

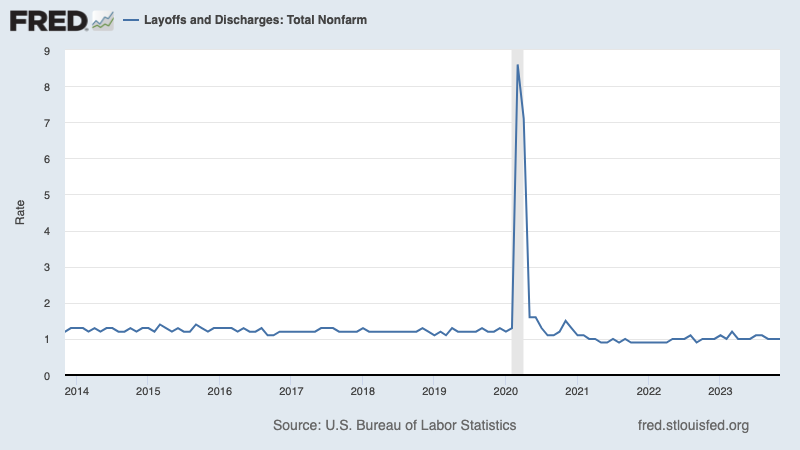

Headcount reductions remain sluggish, employment remains strong. Employers laid off 1.53 million people in November. Although difficult for all those affected, this figure represents only 1.0% of total employment. This indicator continues to trend below pre-pandemic levels.

Hiring activity continues to far outpace layoff activity. In the same month, employers hired 5.47 million people.

The number of unemployment insurance applications has decreased. The number of new applications for unemployment benefits for the week ending December 30 was 202,000, down from 220,000 the previous week. Although this is an increase from the lowest figure of 182,000 in September 2022, it continues to be at a level consistent with economic growth.

Companies are talking less about labor shortages. From Bloomberg’s Michael McDonough: “The labor shortage appears to be receding into the rearview mirror, as evidenced by related mentions in the S&P 500’s earnings call. Meanwhile, the debate over layoffs remains prominent, but since last spring did not reach the heights observed in

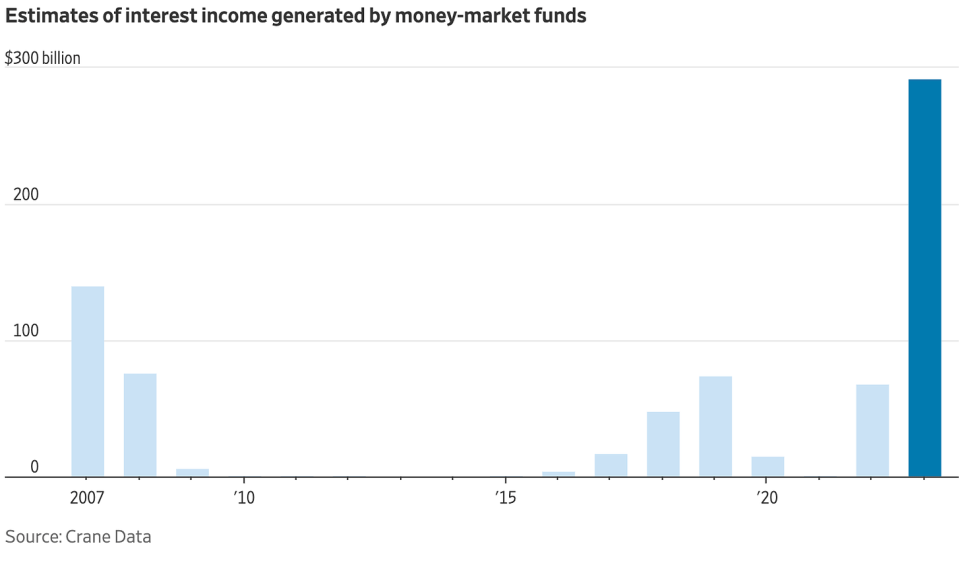

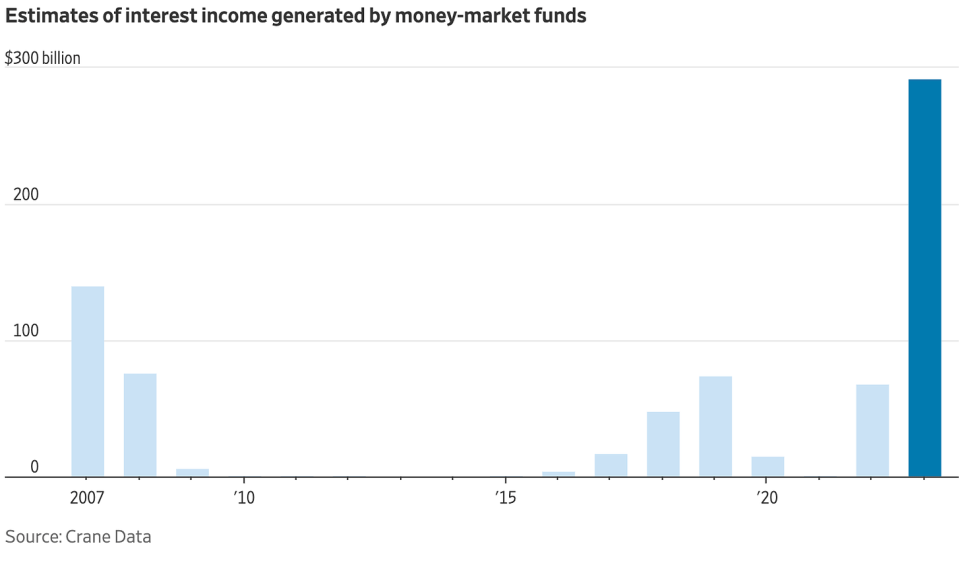

Consumers are earning interest.from WSJ reporter Gunjan Banerji: Crane Data estimates that Americans generated up to $300 billion in interest income from money market funds in 2023. ”

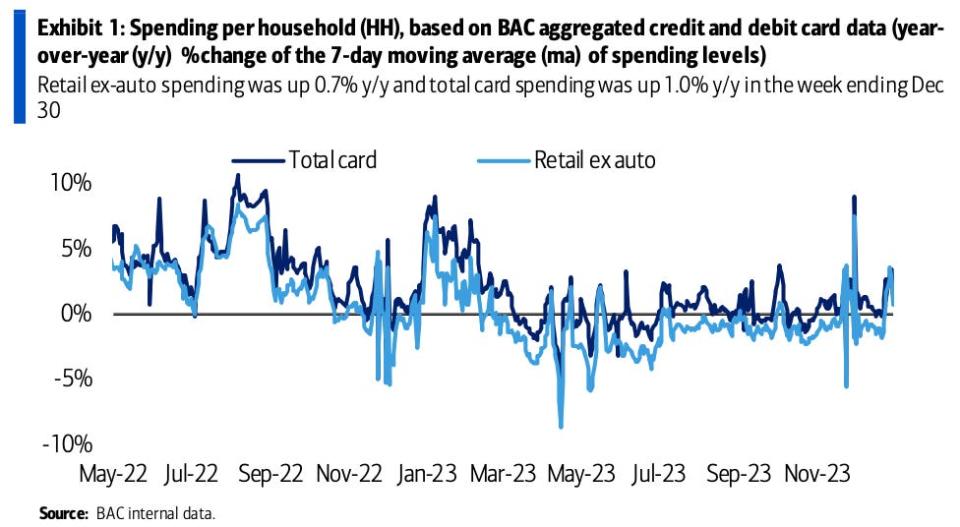

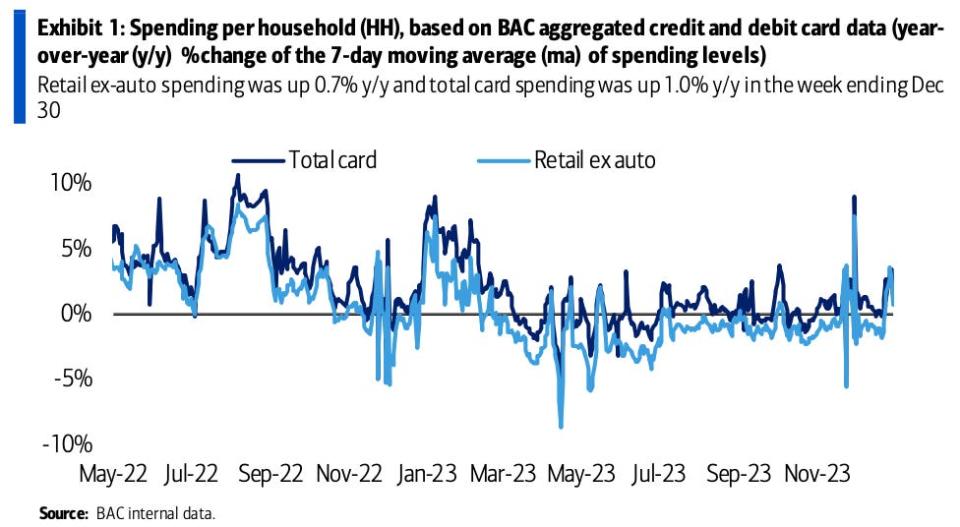

Card data suggests consumer spending is holding up. From BofA: “According to credit and debit card data compiled by BAC, total card spending per HH person increased 1.0% year-over-year in the week ending December 30. Spending on holiday items increased in December. It was down 1.3% year-over-year in the week ending the 30th.” …However, in the five weeks after Thanksgiving, spending on holiday supplies increased 0.3% compared to the same period last year. ”

car sales increase. From Wards Auto, via Accumulated Risk: “December US light vehicle sales hit 5-month high. Total for 2023 is 15.5 million units, the highest in four years… Labor-related factory closures in the United States during the same month negatively impacted deliveries in November. Total sales of vehicles affected by the shutdown in November were down 15% compared to the same month last year. If we had been in line with last year’s performance, sales would have totaled 15.9 million units SAAR.”

Gasoline prices continue to fall. From AAA: “The national average for a gallon of gas fell slightly from last week by 3 cents to $3.09, in part because fewer people are filling up after the peak holiday road trip. , demand may have dropped… According to new data from AAA, gas demand plunged last week from 9.17 million barrels per day to 7.95 million barrels per day, while domestic gasoline demand fell sharply last week, according to the Energy Information Administration (EIA). Total inventories increased significantly by 10.9 million barrels to 237 million barrels. Weak gas demand and increased supply are pushing pump prices higher. However, higher oil prices are pushing prices lower. It’s limited.”

Mortgage interest rates soar. The average interest rate on a 30-year fixed-rate mortgage rose to 6.62% from 6.61% last week, according to Freddie Mac. From Freddie Mac: “From late October to mid-December, 30-year fixed-rate mortgages plummeted by more than a percentage point. However, since then, rates have leveled off as the market digests incoming economic data. Mortgage rates are likely to continue to decline as the year progresses, given expectations for Federal Reserve interest rate cuts this year and abatement of inflationary pressures. Lower mortgage rates are welcome. “This is great news, but potential homebuyers still face the dual challenge of low inventory and continued rising home prices.”

Supply chain pressure eases. The New York Fed’s Global Supply Chain Pressure Index, which combines a variety of supply chain metrics, fell in December and remains below levels seen before the pandemic. This is well below the supply chain crisis peak in December 2021.

Services surveys suggest slowing growth. ISM’s December services PMI reflects growth in the sector, although at a slower pace.

The survey’s employment sub-index reflected the sharpest contraction in employment since May 2020.

Production investigation signal reduction. S&P Global’s December manufacturing PMI suggested a deterioration in the sector. From the report: “Output fell at the fastest pace in six months as recent order declines intensified. Manufacturing therefore likely was a drag on the economy in the fourth quarter.”

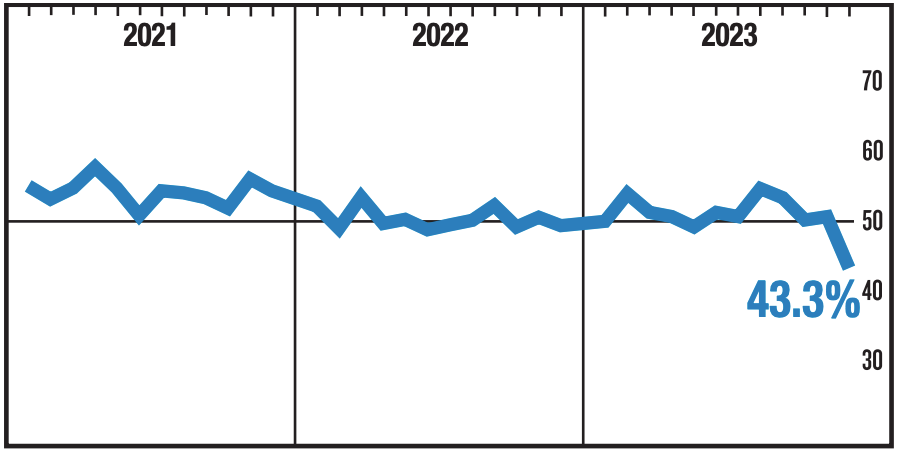

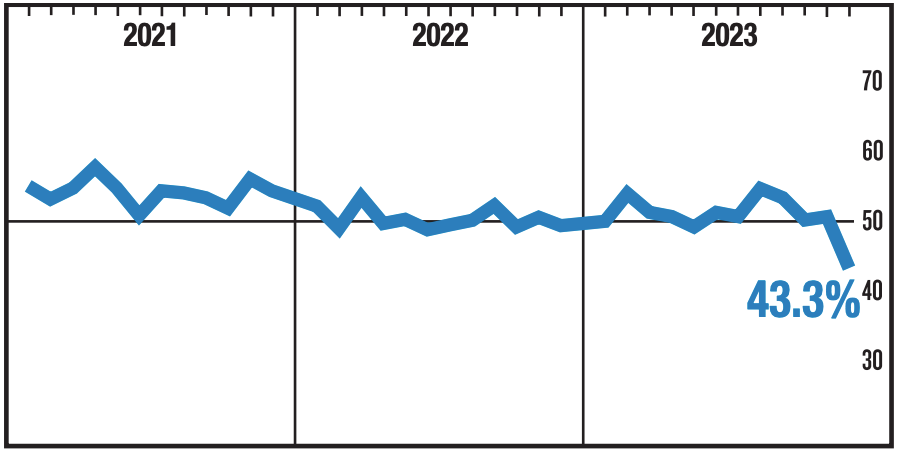

ISM’s December manufacturing PMI improved slightly for the month, but still signaled the 14th consecutive month of contraction.

It’s worth remembering that soft data like PMI surveys don’t necessarily reflect what’s actually happening in the economy.

Construction spending increases. Construction spending rose 0.4% in November to an annual rate of $2.05 trillion.

Business investment recovers. Orders for non-defense capital goods, excluding aircraft (also known as core capital investment or business investment), rose 0.8% in November to a record $73.97 billion.

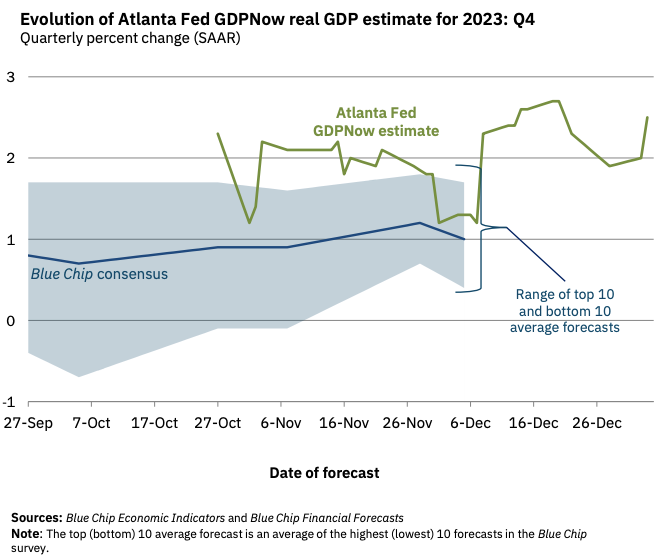

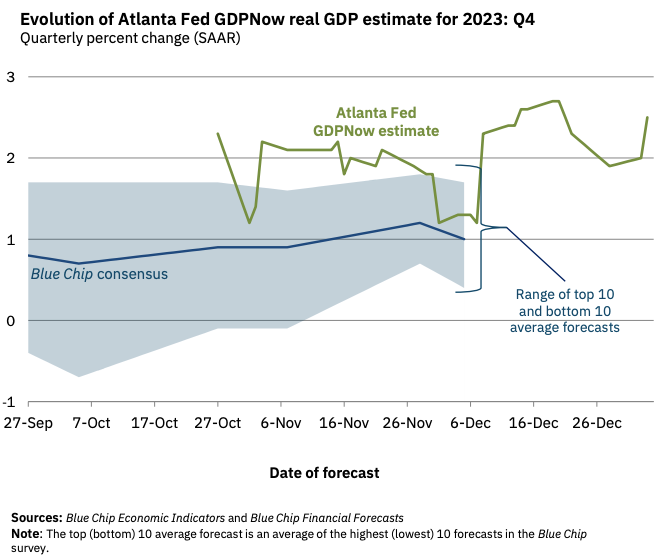

Short-term GDP growth forecasts improve. The Atlanta Fed’s GDPNow model projects real GDP growth of 2.5% in the fourth quarter.

put everything together

We continue to receive evidence that we are experiencing a bullish “Goldilocks” soft landing scenario in which inflation cools to a manageable level without the economy going into recession.

This comes as the Federal Reserve continues to adopt highly austere monetary policy in its ongoing efforts to control inflation. It’s true that the Fed took a less hawkish tone in 2023 than it did in 2022, and most economists believe the last rate hike of the cycle has either already happened or is close. agree, but inflation still needs to subside further and central banks need to remain calm for some time to come before they are satisfied with price stability.

Therefore, we should expect central banks to continue tightening monetary policy. This means you need to prepare for a prolonged period of tight financial conditions (e.g., rising interest rates, stricter lending standards, and lower stock valuations). All of this means that monetary policy will be unfriendly to markets for some time to come, increasing the relative risk that the economy will fall into recession.

At the same time, we know that stock prices have a discount mechanism. That means prices will bottom out before the Fed signals a major dovish shift in monetary policy.

It’s also important to remember that while the risk of a recession may be increasing, consumers are coming from a very strong financial position. Unemployed people can get jobs, and people with jobs can get raises.

Similarly, many companies have fixed their debt at low interest rates in recent years, so their corporate finances are healthy. Despite the looming threat of higher debt servicing costs, rising profit margins are giving companies room to absorb higher costs.

At this point, any recession is unlikely to turn into an economic disaster, given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the trade when entering the stock market with the aim of generating long-term profits. The market has been pretty tough over the past few years, but the long-term outlook for stocks remains positive.

The version of this article is TKer.co.

[ad_2]

Source link