[ad_1]

opinion

Editor

According to Unusual Whales, Rep. Nancy Pelosi’s stock portfolio had a 65% return on investment in 2023.

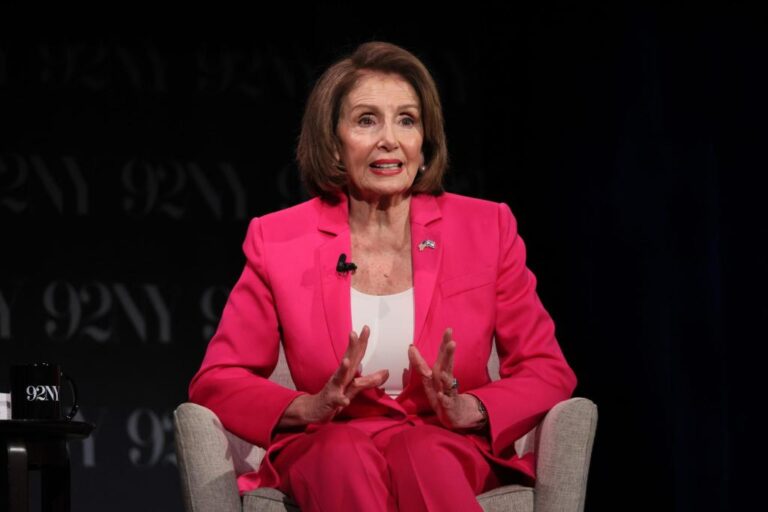

Photo credit: Dia Dipasupil/Getty Images

Feed them stock options!

Congresswoman Nancy Pelosi’s stock portfolio posted big gains in 2023 as Americans sweated out high food and gas prices.

According to industry news service Unusual Whales, the former speaker has been a consistent high performer in the market (despite a slump in 2022 due to increased scrutiny on his trading), enjoying a 65% return on investment.

This is better than most large hedge funds.

The key to her success was a very “lucky” use of stock options, often a sign of trading with inside information, which members of Congress often had.

To help average Americans empathize with the rise of Congressional Democrats (and their spouses), Unusual Whales last year launched the NANC trading fund, named after Nancy.

In theory, various guardrails prevent blatant insider trading by members of Congress, but ethics watchdogs regularly raise red flags.

Pelosi and her husband, Paul Pelosi, make millions of dollars from the technology companies she regulates. (Don’t try this at her home or you could face 20 years in prison.)

Several bills were introduced last year that would halt or restrict Congressional trading, including the bipartisan “Government Official Stock Trading Ban Act” introduced by Sens. Kirsten Gillibrand and Josh Hawley in late July. However, no results were obtained.

No surprise: Politicians agree. both Both sides of the aisle benefit from the deal.

It’s not just insider trading, it’s insiders blocking rules that might prevent it.

Load more…

{{#isDisplay}}

{{/isDisplay}}{{#isAniviewVideo}}

{{/isAniviewVideo}}{{#isSRVideo}}

{{/isSR video}}

[ad_2]

Source link