[ad_1]

In economically challenging times, access to credit is critical for many individuals, especially those living paycheck to paycheck.

One form of credit that consumers often rely on is an overdraft, which serves as a safety net for individuals facing unexpected financial problems or temporary cash shortages. Unlike traditional loans and credit cards, an overdraft is a convenient way to cover immediate expenses without the need for a formal application process or a set borrowing limit.

Additionally, the flexibility of overdrafts, which allows transactions beyond available account balances, is a major attraction for individuals seeking short-term financial relief.

However, as noted in , there are costs to using an overdraft.Credit Accessibility Series: How consumers use overdrafts” is a PYMNTS Intelligence report that uses insights from more than 2,800 U.S. consumers to examine consumer behavior and sentiment related to overdraft usage.

The study found that consumers living paycheck to paycheck were six times more likely to have attempted a transaction without sufficient funds in the past year, and more than two-thirds of those transactions Overdraft fees are being paid.

Millennials and credit-alienated consumers (individuals who have experienced at least one credit rejection in the past year) were also more likely to attempt a transaction with insufficient funds.

While some financial institutions offer to cover overdrafts without fees, research shows that 71% of attempts without sufficient funds result in an account being overdrafted, and the average consumer You will be overdrafted for 9 days.

Most consumers who experienced overdrafts had accounts with financial institutions that covered them for a certain period of time or up to a certain amount without fees or declined transactions. However, many consumers were still unable to cover their overdrafts during the grace period.

The study also found that overdrafts often result in additional charges for consumers. High-income consumers and Gen X consumers paid higher rates in overdraft fees than other consumer groups. On average, a high-income consumer paid a fee of $30.90, and a low-income consumer paid a fee of $25.50. These fees can increase the financial burden on low-income consumers who are already economically vulnerable.

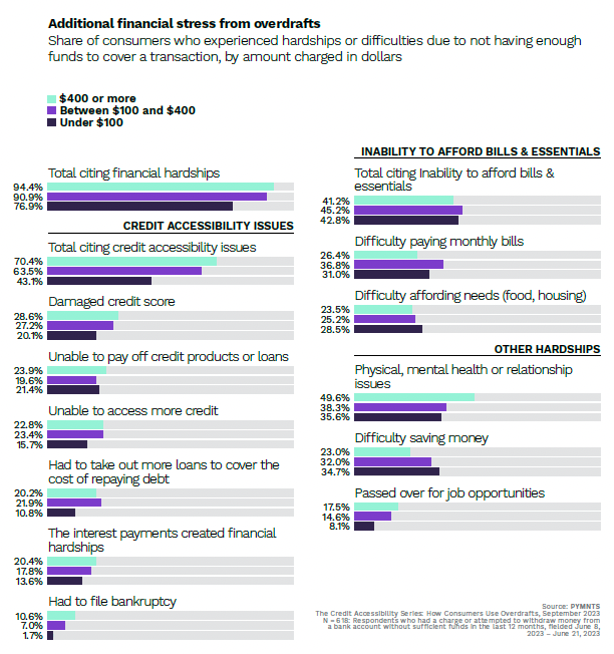

The survey found that consumers who struggled to cover charges on their accounts were experiencing additional financial hardship. His two-thirds of overdrafts led to widespread credit availability issues, including lower credit scores and an inability to pay accumulated bills.

Survey data shows that consumers who frequently overdraft or have high bills are more likely to experience financial hardship. For example, 98% of consumers who overdraft at least once a month report some difficulty, compared to 79% of consumers who overdraft only once or twice a year.

Additionally, among individuals who used an overdraft for transactions over $400, 94% faced challenges such as difficulty obtaining credit or meeting bill payments. In contrast, only 77% of people who made transactions under $100 experienced similar difficulties.

Similarly, a lack of funds to cover transactions of less than $100 can have a noticeable impact on access to credit. Specifically, 43% and 20% of consumers, respectively, reported that they faced problems obtaining credit and that this deficiency was hurting their credit scores.

Overdrafts provide a lifeline of financial flexibility during a crisis, but their convenience can be overshadowed by additional financial burdens. As this study reveals, fees and interest associated with overdrafts can lead to increased financial stress and, in some cases, exacerbate the hardships consumers already face.

This is an important part of comprehensive financial education so that consumers can gain the knowledge they need to make informed decisions about their finances, including understanding the implications of using overdraft facilities. It highlights the need.

[ad_2]

Source link