[ad_1]

atlanta, January 9, 2024 /PRNewswire/ — Noble Investment Group (“Noble”) announced today that it has completed the final closing of Noble Hospitality Fund V, LP (“Noble Fund V”). This is his fifth in Noble’s flagship real estate fund series, which focuses on value-added investments in select service and extended stay hotels around the world. US.

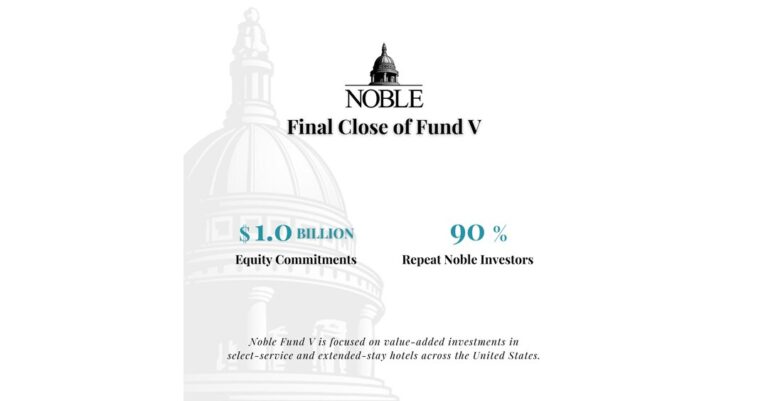

Noble is pleased to announce the final closing of Noble Fund V. Noble Fund V is his fifth in Noble’s flagship real estate fund series focused on value-added investments in select service and extended stay hotels across the United States. Noble Fund V was oversubscribed with his $1 billion equity commitment.

Noble Fund V has been oversubscribed 1 billion dollars Total equity commitments from a global institutional base including public public pension plans, corporate pensions, endowments, foundations, insurance companies and asset management companies. His 90% of Noble’s existing limited partners reiterated their commitment to Noble Fund V, along with commitments from several new institutional investors.

Noble achieved a net IRR of 15%. 3 billion dollars Total realized capital over multiple market cycles over 30 years.1

“Our team, procurement relationships, research DNA, data and insights continue to deliver outstanding returns for our investors and provide Noble with significant and scalable competitive advantage,” said Mitt Shah, CEO of Noble. It gives us an advantage.” “Noble Fund V’s overwhelming support reflects the enduring confidence of our limited partners, and we remain deeply grateful for their continued confidence in us as a fiduciary.”

Long-term demand growth in travel and hospitality, combined with significant restraint in new supply, continues to give the sector long-term pricing power. Noble believes it is well-positioned to build on the success of its predecessor funds and aims to deliver superior risk-adjusted returns to its investors.

Noble Managing Principal said: “We are proud to have reached our hard capital cap in a highly competitive funding environment where investor selection is highly selective.” Adi Boopathy. “Repeated commitments from our existing limited partners and new commitments from prominent institutional investors reflect the clear benefits of our Noble platform.”

“The combination of large loan maturities and record amounts of past-due renovations makes it difficult for Noble to acquire revenue-generating hotels, re-capitalize owners, and improve operational management,” said Noble’s managing principal. “We have created a generational investment opportunity that adds value on both the physical and physical levels.” Ben Brandt. “Over multiple cycles, we have demonstrated that with experience, patience and discipline, we can deploy capital opportunistically.”

“Since the second quarter of 2021, Noble 2 billion dollars We have increased new investments, improved operational performance, increased asset values, and subsequently averaged double-digit equity distributions each year,” said Noble Managing Principal. george dabney.

“We continue to leverage Noble’s vertically integrated capabilities to source opportunities not readily available in the public markets, making our investments more efficient, profitable and value-packed,” said Noble’s managing principal. I will make it what it is.” stephen nicholas.

“Noble continues to be a leader in design, innovation, technology and energy-efficient solutions that drive performance and a stronger future for our investors, community and industry,” said Noble Managing Principal. says. kevin glass.

About Noble Investment Group

Noble is an award-winning real estate investment manager specializing in the travel and hospitality sector. With a 30-year track record, Noble has made nearly every investment to date. 6 billion dollars We work in communities across the country, adding value throughout the cycle and supporting significant job creation. PERE named Noble one of the world’s top 200 investment managers, and the firm has been recognized as one of the Best Companies to Work For by Pensions and Investments and the Atlanta Business Chronicle.

As a fiduciary to leading pension plans, endowments, foundations, asset managers, insurance companies and other institutional investors, Noble’s work helps preserve and grow the capital of our limited partners, helping our nation’s teachers and law enforcement… Contributes to providing retirement benefits to institutions. , firefighters, other pensioners, and students to attend college. For more information, please visit www.nobleinvestment.com.

1 Value-added strategy September 30, 2023

Source Noble Investment Group

[ad_2]

Source link