[ad_1]

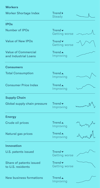

The indicators in the State of American Business Data Center help measure the health of business and the economy. At the start of 2024, many indicators are trending in a positive direction, while others lag.

The pandemic disrupted our economy and basic way of life, but because of the resilience and resourcefulness of the private sector, we have surpassed many pre-pandemic economic benchmarks. American businesses continue to drive innovation and make meaningful investments in their employees, in their communities, and for the betterment of the planet.

The U.S. Chamber’s 2024 State of American Business event on January 11, will celebrate and highlight how American businesses serve customers, solve problems and strengthen society.

State of American Business 2024

It’s almost time for our premier annual event! This year, President and CEO Suzanne P. Clark will celebrate the free enterprise system and the power of American businesses and their ability to serve customers, solve problems, and strengthen society.

Join us on Jan. 11 from 11 a.m. to 12:30 p.m. ET

HOW WAS 2023? See last year’s State of American Business Data Center

American Business by the Numbers

Jump to each section of the Data Center below for detailed analysis and data visualizations for 12 economic indicators.

Worker Shortage: 8.8 Million Unfilled Jobs

For decades, fewer and fewer people have been participating in the U.S. labor force. The shifting population demographics paired with dwindling legal immigration and other barriers keeping workers out of the labor force, like access to childcare, is resulting in a smaller workforce that is expected to continue shrinking for years to come.

8.8M

Unfilled jobs in the U.S.

6.3M

Unemployed workers in the U.S.

The Chamber’s Worker Shortage Index number indicates the number of available workers for every job opening. The current Worker Shortage Index reading is 0.71, above the all-time low of 0.63 in April 2022 but still very low. This means that for every 100 job openings there are only 71 available workers.

While job growth has been strong this year, the country is still struggling with labor force participation. If the percentage of people participating in the labor force were the same as in February 2020, we would have over 2 million more people in the workforce today.

Bottom line: Solutions exist to ease the worker shortage. Government and business leaders need to work together to:

- Increase legal immigration while securing the border.

- Expand access to quality, affordable childcare for working parents.

- Create pathways for veterans and military spouses, formerly incarcerated individuals, individuals with disabilities, and retirees to secure good jobs.

- Invest in building a skilled workforce for the jobs of today and tomorrow.

The Chamber’s America Works Initiative details these solutions, and more.

IPO Market, Loan Markets Sagging

Businesses need capital to start their enterprises, to run them efficiently, and to grow. Business growth is stronger when capital is more accessible. The issuance of initial public offerings is an indicator of the vitality of the economy. More companies go public when growth prospects are strong and they need access to the deep pool of capital going public affords.

The private sector plays a leading role in driving innovation to solve problems, but the number of IPOs coming to market has dropped below average. Higher taxes, government overreach, and overregulation saps the innovation needed in our economy.

The surge in IPOs in 2021 was in large part due to the growth in Special-Purpose Acquisition Companies. Before the SPAC surge, there was little growth in the number of IPOs. SPACs have declined due to rising interest rates which have suppressed mergers and acquisitions.

The 94.2% drop in dollar value of IPOs in 2022, the most recent year for which data is available, is mostly the result of SPACs falling off. Fewer IPOs, aside from the drop in SPACs, also played a role, albeit smaller.

Before that, the dollar value of IPOs had strong growth, a result of bigger companies going public after spending more years private. More traditional IPOs (not through SPACs), where younger companies acquire the capital they need to grow from the offering, would make the economy more vibrant and dynamic.

Bottom line: Smart government policy will help the economy by encouraging, not disincentivizing, companies to go and stay public. The more vibrant, growing companies, the better for American workers that benefit from stronger wages.

For smaller businesses, Commercial and Industrial (C&I) Loans are their primary source of vital capital to grow and thrive. The value of C&I loans issued has been strong.

Bottom line: As the Federal Reserve continues its tighter monetary policy to fight inflation, access to C&I loans will decrease and their prices will increase making it harder for many companies to access financing.

Consumer Spending Strong

Businesses exist to serve their customers. The more customers they have, and the more those customers spend on an ongoing basis, the better it is for business. Consumers have continued to spend despite inflation and turbulent economic conditions over the past few years.

Even though inflation remains high, spending is still surpassing it. For example, retail sales—spending at retail stores, bars and restaurants—rose by 0.3% in November 2023, outpacing the rate of inflation for the month. Prices rose 0.1% in November 2023, so even adjusted for inflation retail sales still rose by 0.2%.

Inflation is down from the peak of 8.8% in June 2022, but still well above the Federal Reserve’s 2% target rate. Core prices, which strips out volatile elements like food and energy, is a metric the Fed looks at closely, and it is 3.2%, so still above the 2% target.

Bottom line: Padded savings and more availability of credit card debt from the pandemic shutdown have been helping customers keep up with inflation, but this cannot last indefinitely and is a trend to watch in 2024. The economy will slow if consumer spending drops due to lingering inflation and higher interest rates.

Supply Chain Strains Easing

U.S. businesses are linked through a global web of interconnected supply chains and rely on them to access consumers and compete in the global marketplace.

An efficient supply chain is crucial to business growth. The New York Federal Reserve tracks pressure on the global supply chain. Higher levels indicate higher stress on the system.

Pressure on the global supply chain was stable for years leading up to the pandemic. It spiked during the pandemic but has come down since. It is now near pre-pandemic levels.

Bottom line: A well-functioning supply chain is a key component of reducing inflation.

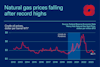

Energy Prices Coming Down

Energy is an enormous cost for businesses. When energy prices rise, businesses have to absorb those costs and their earnings decline, and sometimes they have to pass them on to customers in higher prices.

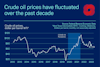

This year, crude oil prices have begun to trend downward after spiking in the past two years as the economy reopened following pandemic shutdowns, providing relief to businesses and consumers.

Record U.S. oil and gas production in the wake of sanctions on Russia has helped bring stability to global energy markets and security to America, and its allies and trading partners.

Bottom line: American energy production delivers economic advantages to U.S. families and businesses and diminishes the economic strength of aggressors like Russia. The most important thing Washington can do this year to help is to make progress on permitting reform, dial back harmful regulations, and send long-term signals to energy producers to give them the confidence and certainty they need to invest.

An Uneven Innovation Ecosystem

For the economy to continue growing, it must foster innovation. Existing businesses need to create new products and improve existing ones. New businesses are needed to bring fresh ideas to market.

134K

U.S. granted patents in 2012

168K

U.S. granted patents in 2022

The number of patents issued is a measure of how much innovation is occurring in the economy over time — and the U.S. continues to churn out patents in strong numbers.

The pandemic brought the number of patents issued in the U.S. down, but only slightly. However, while the number of patents issued is strong, less than half go to U.S. residents.

Overall, the U.S. is still the prime place for innovation globally. But we need more innovation from U.S. residents, and we need to make it easier and more inviting for innovators from other countries to bring their ideas here.

The U.S. Chamber’s International IP Index evaluates intellectual property (IP) rights in 55 global economies across 50 unique indicators — from patent and copyright policies to ratification of international treaties.

The U.S. had the highest score of 95.48 out of 100, signaling a strong IP framework; but the global average remains below 60, illustrating there is room to strengthen the ecosystem for innovation through more effective IP standards.

New business formations drive innovation

Like patents, new businesses are a big generator of economic growth. The more new businesses, the better, because having strong numbers of new businesses increases the potential amount of future high-performing enterprises and well-paying jobs.

The years 2020 and 2021 saw the largest increase in new business applications in recorded history. Nearly 5.4 million applications were filed to form new businesses in 2021 — the highest recorded since the U.S. Census Bureau started tracking this data in 2004.

3.5M

Total new business applications in 2019

4.6M

Total new business applications in 2023

The surge in entrepreneurship has continued through 2022 and 2023, with both years seeing elevated numbers of new businesses.

Bottom line: A year ago it was hard to predict whether the entrepreneurship surge was an aberration of the pandemic or the start of a renewed entrepreneurial spirit. The fact that new business formations have remained strong through 2023 gives evidence to the latter.

The Chamber supports and fights for policies that keep small businesses thriving, including advocating for a tax and regulatory environment that helps—not hurts—entrepreneurs to create jobs and to serve our communities and the economy.

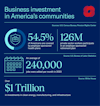

Businesses make big investments.

Despite headwinds from the economic and regulatory environment, American businesses continue to make significant investments that improve the lives of individuals and build healthy communities.

For example, businesses create good jobs, provide health benefits to more than half of the U.S. population, and help employees access childcare.

When disasters strike a community, businesses mobilize their expertise, capabilities, and community resources to assist with the relief and recovery efforts. The U.S. Chamber of Commerce Foundation’s Disaster Corporate Aid Tracker keeps record of the business community’s response to disasters.

America’s free enterprise system allows businesses to make improvements, invest in research and development, merge with other companies, and trade with other countries to grow their business.

New innovations that benefit individuals and communities across the globe such as lifesaving vaccines, clean energy solutions, and widespread internet usage are improving society every day because of the free enterprise system and the American ingenuity of the businesses that operate in it.

Conclusion

The U.S. Chamber advocates for policies that are pro-growth. A faster growing economy generates more tax revenues to pay for education, defense, transit and infrastructure, and the social safety net. It puts more money in people’s pockets so they can care for their families and pursue their goals.

Bottom line: There are economic and regulatory headwinds, but the state of American Business is optimistic. The diversity of the U.S. business ecosystem is why our economy is the most innovative, dynamic, and resilient in the world.

About the authors

Curtis Dubay

Curtis Dubay is Chief Economist, Economic Policy Division at the U.S. Chamber of Commerce. He heads the Chamber’s research on the U.S. and global economies.

Read more

Stephanie Ferguson

Stephanie Ferguson is the Director of Global Employment Policy & Special Initiatives. Her work on the labor shortage has been cited in the Wall Street Journal, Washington Post, and Associated Press.

Read more

Isabella Lucy

Isabella has created stunning visualizations tackling pressing issues like the worker shortage, the benefits of hiring veterans, the lifespan of small businesses, and the future of work.

Read more

[ad_2]

Source link