[ad_1]

Howard Marks said that instead of worrying about stock price fluctuations, “the possibility of permanent loss is the risk I worry about…and every practicing investor I know worries about that.” He expressed it well. In other words, financially smart people seem to know that debt (usually associated with bankruptcy) is a very important factor when assessing a company’s risk. Points to keep in mind are: walt disney company (NYSE:DIS) has debt on its balance sheet. But the more important question is how much risk that debt creates.

Why does debt pose a risk?

Debt supports a company until the company has difficulty paying it back with new capital or free cash flow. Part of capitalism is the process of “creative destruction” in which failing companies are ruthlessly liquidated by bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, resulting in permanent shareholder dilution. However, as an alternative to dilution, debt can be a very good tool for companies that need capital to invest in growth at high rates of return. When investigating debt levels, we first consider both cash and debt levels together.

Check out our latest analysis for Walt Disney.

How much debt does Walt Disney have?

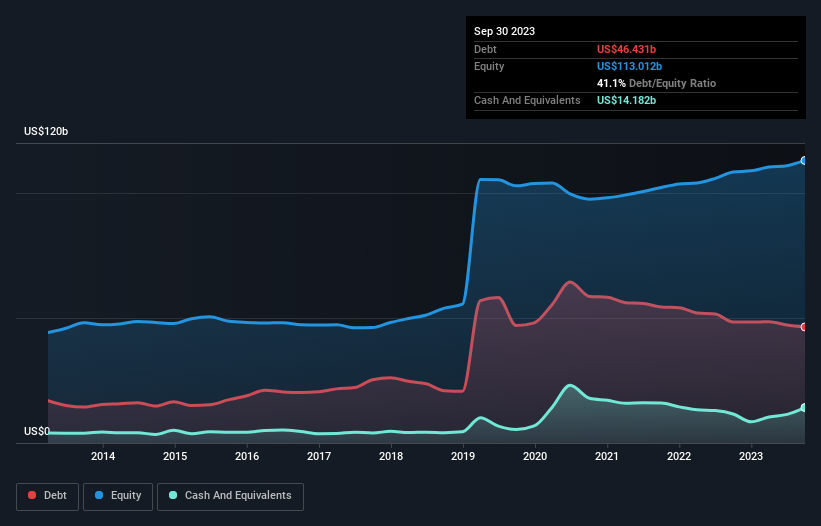

As you can see below, Walt Disney’s debt was US$46.4 billion as of September 2023, down from US$48.4 billion in the same period a year ago. However, since the company has his US$14.2b in cash, its net debt is less, at around US$32.2b.

How healthy is Walt Disney’s balance sheet?

According to its last reported balance sheet, Walt Disney had liabilities of US$31.1 billion due within 12 months, and liabilities of US$61.4 billion due beyond 12 months. Offsetting this, it had US$14.2b in cash and his US$12.3b receivables due within 12 months. So its liabilities outweigh the sum of its cash and (short-term) receivables by US$66.1b.

Walt Disney has a huge market capitalization of US$166.4 billion, so it’s very likely that it will raise cash to shore up its balance sheet if the need arises. But we always want to be on the lookout for signs that the debt poses too much risk.

To determine how much debt a company has relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA), and its earnings before interest, tax, and amortization (EBIT) divided by its interest expense. (its interest cover). Therefore, we consider debt relative to earnings, with or without depreciation.

Walt Disney’s net debt is a very reasonable 2.2x EBITDA, but last year its EBIT was only 6.0x its interest expense. It’s not much to worry about, but it does suggest that interest payments are a bit of a burden. Importantly, Walt Disney grew his EBIT by 37% in the last twelve months, and that increase should make it easier to deal with debt. The balance sheet is clearly the area to focus on when analyzing debt. But more than anything else, future earnings will determine whether Walt Disney can maintain a healthy balance sheet going forward.If you’re focused on the future, check this out free A report showing analyst profit forecasts.

Finally, while tax preparers may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is converted into free cash flow. Looking at the most recent three years, Walt’s Disney recorded free cash flow of 40% of his EBIT, which is lower than expected. This weak cash conversion makes dealing with debt even more difficult.

our view

According to our analysis, Walt Disney’s EBIT growth rate should indicate that the company doesn’t have much trouble with debt. However, other observations were less encouraging. For example, it looks like you’ll have to work a little harder to deal with your total debt. Considering all the factors mentioned above, Walt Disney appears to be managing its debt quite well. Having said that, the burden is significant enough that we recommend shareholders keep an eye on it. The balance sheet is clearly the area to focus on when analyzing debt. Ultimately, however, any company can contain risks that exist outside the balance sheet. These risks can be difficult to identify.Every company has them and we discovered that 2 warning signs for Walt Disney you should know about.

If you’re interested in investing in a business that allows you to grow profits without taking on debt, check this out free A list of growing companies that have net cash on their balance sheet.

Valuation is complex, but we help make it simple.

Please check it out Walt Disney Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link