[ad_1]

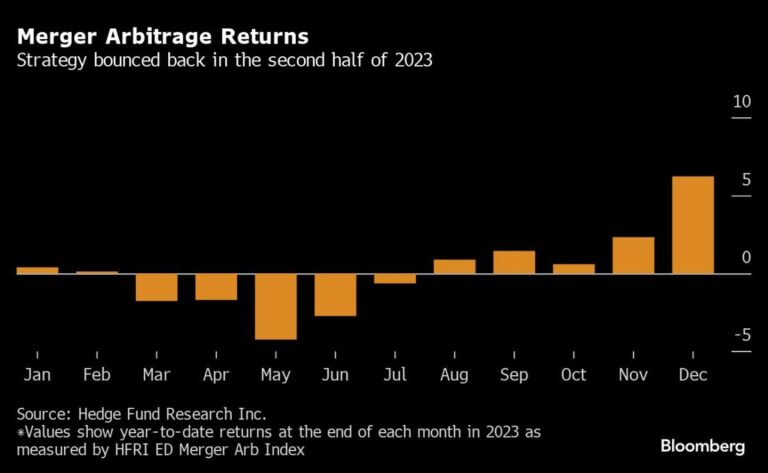

(Bloomberg) — The tide finally appears to be turning for hedge funds that have struggled to make money from M&A arbitrage after 2023 was the worst trading year in a decade.

Most Read Articles on Bloomberg

Mergers and acquisitions are showing signs of making a comeback. Goldman Sachs Group Inc. said the surge in trading volumes towards the end of last year reflected the highest level of activity since the start of the current rate hike cycle. Industry tracker Hedge Fund Research said 2023 will be off to a bad start.

Michel Massoud’s Mercato ended 2023 with a 16% gain, reversing a 4.4% decline in the first half. The Kite Lake Special Opportunity Fund ultimately rebounded to 10.7% after falling 5.5% through May, according to people familiar with the matter. Castleknight, the event-driven equity and credit firm founded by Appaloosa Management alumnus Aaron Wightman, posted a 16.5% return, rebounding from a 6.5% decline through May, the people said, as the details were not made public. He said he requested anonymity. Representatives for both companies declined to comment.

Event-driven hedge funds tracked by Bloomberg rose 7.2% last year.

The 18-month slump in M&A activity has hurt hedge funds, which trade on the spread between a target company’s stock and its offering price, making a profit if a deal goes through but risking a steep drop if it falls through. Lower trading volumes have reduced trading opportunities, and spreads have remained tight, especially in the first half of the year. Rising interest rates and uncertainty from the Federal Trade Commission’s crackdown on some mergers added to the squeeze.

Read more: Lina Khan upends Wall Street’s merger and arbitrage strategies

Last year’s trading volume was $2.9 trillion, the lowest since 2013, but the final three months were the only year-over-year increase at about $869 billion, according to data compiled by Bloomberg. It became a quarter. Broadcom’s completion of its acquisition of VMware in November and Pfizer’s closing of its $43 billion acquisition of Seagen last month, both of which cleared a series of regulatory hurdles, helped boost profits. It’s one of the trades.

“It seems like a shift in M&A started late last year,” said Simon Davis, founder of Sand Grove Capital Management. “Disparity in target valuations, ambitious acquirers with strong balance sheets, and record levels of dry powder from private equity and private credit create the perfect cocktail for a surge in M&A activity in the coming years. produce.”

In a research note outlining the outlook for M&A in 2024, Goldman said it expects a “long-term high interest rate regime” to normalize and the institutional leveraged loan market to increasingly support M&A financing. As the market progresses, deals should gain momentum.

But Stefan Feldgoys, Goldman’s global co-head of M&A, said in an interview last week that the resurgence also hinges on a resurgence in private equity activity, which has accounted for less than all deal activity over the past five years. He said that it has been driving about 35 to 38% of the total sales. Even if they offered high premiums, buyout firms spent less on acquisitions last year than in 2022 amid securing debt financing for big deals and disagreements over price with sellers. decreased by 36%.

Read more: Goldman’s Feldgois says M&A revival depends on private equity

One hedge fund pointed out that there is $2.7 trillion in dry powder PE funds sitting idle, $1 trillion of which is earmarked for acquisitions.

Another hedge fund firm noted that the merger arbitrage landscape is now less crowded, with several players closing down last year. Companies that returned capital include Oceanwood Capital Management, Berry Street Capital Management and Aslan House Capital. Several event-driven managers at Millennium Management have also left the investment giant.

Many bankers and lawyers remain cautious, so it may be too early to cheer for an M&A rebound. Key risks include uncertainty over the trajectory of interest rates, the potential for further escalation of geopolitical tensions and conflicts, and a series of upcoming national elections.

Man Group downgraded its outlook on merger arbitrage to neutral in a research note this week, saying the strategy’s best days may have been behind them after strong performance.

However, there is some optimism.

“Merger arbitrage is set to take center stage in 2024, with October seeing the most active M&A activity in years and November with several large deals,” said Oliver Sharping, Portfolio Manager at Vantreon. I’m ready to stand on the stage.” “A true renaissance is at hand.”

–With assistance from Fareed Sahloul.

(Updated performance in fourth paragraph. Previous version corrected fund name in subheading.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link