[ad_1]

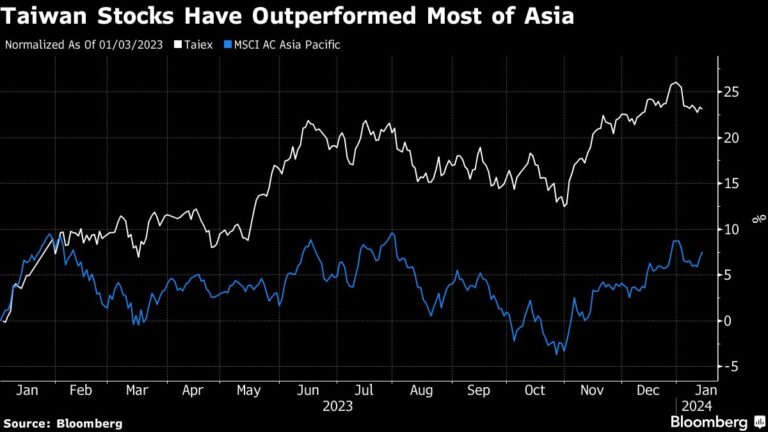

(Bloomberg) – Taiwanese stocks rose modestly, while the Taiwanese currency weakened as investors digested the results of the weekend election, weakening on a legislative stalemate and the possibility of continued cross-Strait tensions.

Most Read Articles on Bloomberg

Although the ruling Democratic Progressive Party won the presidential election, it lost its legislative majority, suggesting that it needs to coordinate with other major parties, including the pro-China Kuomintang, on policy. The Tyex stock benchmark rose as much as 0.7% before paring its gains. The local dollar fell by 0.3%.

Victory had been expected for Lai Qingde, who has been criticized by the Chinese government for his pro-independence stance, but his narrow lead shows hurdles to achieving his domestic agenda. After securing his lowest winning percentage since 2000, Mr. Lai promised to study his rivals’ policies and include talent from other parties in official appointments.

Redmond Wong, chief China strategist at Saxo Markets, said the loss of the Democratic Progressive Party’s majority in the Legislative Yuan will likely weaken Lai’s presidency and give rival parties more influence in shaping legislative policy. said.

“They will also have greater powers to scrutinize the Rai government’s budget proposals,” Wong said. “The potential outcome is a series of intense negotiations and confrontations that could lead to Taiwanese policy becoming more centrist over the next four years, with a positive impact on financial markets. ”

Lai’s party also lost seats to the Taiwan People’s Party amid growing voter dissatisfaction with domestic issues such as soaring real estate prices and lower-than-expected wage increases.

Lai pledged to “strongly” support the further development of the island’s chip industry, which is dominated by Taiwan Semiconductor Manufacturing Company. Equipment from Western providers rose as much as 1%, with shares rising by as much as 1% on hopes of improved relations with the United States, which is key in securing access to chip manufacturing.

The market is paying close attention to what actions China will take in the future. Beijing declined to name the winner in its initial response, and a spokesperson for the Taiwan secretariat said the election results showed the Democratic Progressive Party “does not represent mainstream public opinion on the island.”

“The election results broadly suggest the status quo,” said Gary Tan, portfolio manager at AllSpring Intrinsic Emerging Markets Equity, with markets watching to see who is appointed to run Congress. he added. He does not expect a “significant impact on Taiwanese stocks.”

The island’s benchmark ThaiX stock index and the Taiwanese dollar saw some volatility in the two weeks before the vote, with the ThaiX down about 2%.

“While the uncertainty about who will govern Taiwan has passed, uncertainty in cross-strait relations remains a risk,” said Christopher Wong, foreign exchange strategist at OCBC Bank. He said that apart from geopolitics, the currency will be driven by factors such as export trends, the high-tech outlook and US Federal Reserve policy.

With the Democratic Progressive Party likely to focus more on industry to strengthen the island’s military capabilities, defense companies such as Taiwan’s leading fighter jet maker Aerospace Industry Development Corporation and shipbuilder CSBC Corporation have come forward. Raised.

Wind power companies rose as Mr. Lai’s party backs renewable energy and aims to phase out nuclear power by 2025. Companies that produce materials for wind turbines, such as Century Steel Industries, rose.

Thailand Trade’s tourism sub-gauge was the sector’s worst performer, falling more than 1.5% on concerns that the result would hurt cross-strait travel.

Here’s what else analysts are saying:

Redmond Wong, Saxo Market:

-

Geopolitics and developments in the triangular relationship between the United States, China, and Taiwan in the global semiconductor supply chain are risk factors that investors should keep an eye on over the medium term.

Stephen Chiu, Bloomberg Intelligence

-

The fall in the Taiwan dollar after the polls is a technical move and also reflects concerns that depending on the election results, it may be difficult for the new cabinet to implement its policies.

-

“In fact, market consensus and positioning were quite bullish on the Taiwan dollar even before the election, so a decline may be inevitable regardless of the election outcome.”

Gary Tan, Allspring Intrinsic Emerging Markets Equities:

Gary Ng, senior economist at Natixis, said:

-

The election results do not change the global trend of risk aversion. Taiwanese companies have no choice but to pursue more overseas investment than ever before due to friend-shoring integration in markets outside China.

-

The fact that the US is its largest customer for export orders means Taiwan will continue to decouple from China, but the pace could be influenced by a hung parliament.

-

The company’s key role in chip manufacturing will continue to be a magnet for FDI in terms of efficiency and innovation. Sentiment toward foreign investors is likely to remain positive.

–With assistance from Iris Ouyang and Jiyeun Lee.

(Update by sector movement)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link