[ad_1]

Charlie Munger once said: “More investors are not copying our model because it is too simple. Most people believe that too simple does not make them experts.” It’s really the best.

Munger was best at simplifying investment ideas. Together with his partner Warren Buffett, they invested hundreds of billions of dollars in companies. And each time they were interviewed, they kept their answers simple.

They emphasized that execution is more important than ideas. Mr. Munger and Mr. Buffett never did anything in secret, and dozens of books have been written about their investment strategies. They just executed on another level.

In the vein of Munger, here are five simple ideas that, if followed strictly, can make you rich.

1. Where there is freedom, there is also wealth.

Why invest in the first place? This is an important thing for everyone to think about.

Most people start investing in search of financial security. Others see it as a profession. And some find it an intellectually fulfilling pursuit.

No matter what your intentions were when you started, it’s tempting to forget about them and focus on winning more money.

Many people fall into the trap of endlessly chasing more money. They try to feel fulfilled until they have a certain amount of money in stocks or banks. But wealth is about feelings, not numbers.

Wealth is not just about accumulating money. It’s about financial security and freedom. It’s the ability to weather financial emergencies, the freedom to make choices that aren’t dictated by financial constraints, and the peace of mind that comes from knowing you’re financially secure.

Even high-income earners can struggle financially if they spend recklessly and save little. On the other hand, people with modest incomes can accumulate large amounts of wealth through frugal living and diligent savings. This is where a simple investment idea comes into play.

You can call yourself wealthy if you focus on setting your life free. Even if you’re not a millionaire, you can still feel free.

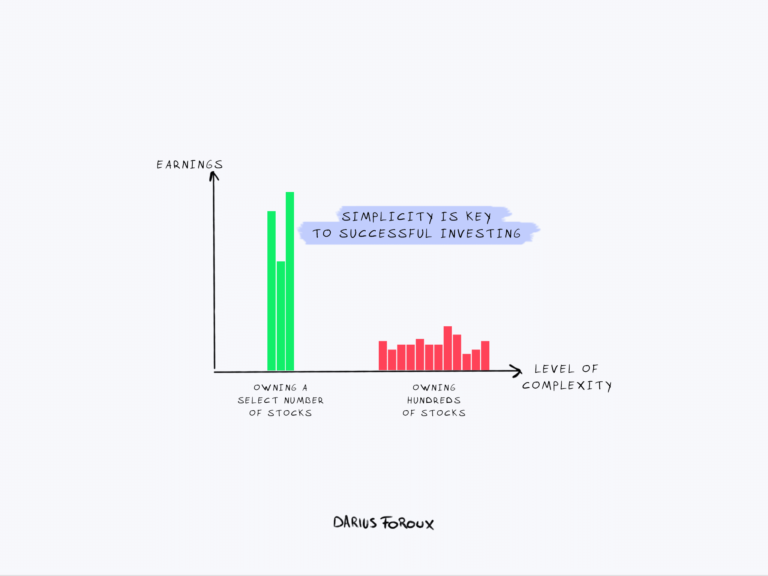

2. Complexity does not mean better returns

Innovation and complexity are often praised as drivers of value in modern economies. But in reality, value is not necessarily tied to the novelty or complexity of a product or service.

If that were true, everyone with genius-level intelligence would be rich. Good math skills don’t necessarily translate to good investing skills either.

Many believe that investors who rely on mathematical models and use automated trading systems will always perform better. Some people do, some don’t.

As an individual investor, your best bet is to avoid complexity. The simpler the investment, the better.

3. The best antidote to high interest rates is to save more money.

High interest rates are often perceived as negative for financial growth, making loans and credit more expensive.

Yes, renting can be expensive. But there is a very easy way to solve it.

Save more, borrow less. Want to lease a car? stop it. Buy used items with the cash you have.

By increasing the amount of money you save, you can build a financial buffer that you can use at any time. Especially during periods of high interest.

Additionally, the habit of saving promotes financial discipline, reduces reliance on borrowing, and further increases financial security.

4. Dollar-cost averaging is the best passive investment strategy

Dollar-cost averaging (DCA) is an investment strategy that involves regularly investing a set amount of money in a specific investment, regardless of price.

This not only ensures a consistent investment over a long period of time, but also reduces the impact of volatility on the overall purchase. The idea is that by investing a certain amount of money, you can buy more shares when prices are low and more shares when prices are high.

This strategy has two main advantages. First, you no longer need to time the market. Your investments are spread out over a long period of time, so you don’t have to worry about whether you can buy at the “right time.” Second, it reduces the risk that a large investment at one point will decline in value shortly after.

DCA is a disciplined strategy that focuses on investment habits rather than reacting to market conditions, and is a practical approach for long-term investors. The simplicity of this strategy shows that investing doesn’t have to be complicated to be successful.

5. Avoid what you don’t understand.

One of the most valuable pieces of investment advice is to avoid participating in financial arrangements or investment ideas that you do not fully understand.

The lure of high returns can mask the inherent risks associated with certain investments. A lack of understanding about investing not only often results in losses, but also prevents you from sleeping.

For me, that’s the biggest reason I stick to what I know. For example, I avoid cryptocurrencies and complex financial products.

I own real estate and stocks. That’s what I stick to and it helps me focus.

This doesn’t mean you need to be an expert on every detail, but you should have a clear understanding of how the investment works and what the potential risks are.

Financial education never ends

Keeping your investment strategy simple doesn’t always mean it will work out financially.

In order to continue to build wealth, you need to continue to acquire more financial knowledge. Financial literacy is a continuous journey, not a destination.

The more you learn about personal finance and investing, the better equipped you will be to navigate the complexities of the financial world.

So when faced with an investment opportunity or financial decision, take your time and do your research. Ask questions, seek advice from trusted advisors, and make sure you know what you’re getting into before investing your hard-earned money.

I’m sure none of the ideas seemed like new information to you. This was Mr. Munger’s argument.

Investing is easy. I’m leaving it as is.

[ad_2]

Source link