[ad_1]

(Bloomberg) — Oil prices edged lower as renewed volatility in the Red Sea was offset by a softer tone across markets as traders assessed the outlook for monetary policy.

Most Read Articles on Bloomberg

Brent crude traded below $77 per barrel before paring some of its losses. Stocks fall, the dollar rises and products priced in that currency as markets focus on cues on interest rates ahead of a slew of policymakers speaking at the World Economic Forum in Davos this week. became less attractive.

On Monday, a major trade group said it had been informed by the U.S. Navy that navigation in the Red Sea remained too dangerous and advised commercial ships to avoid Red Sea routes. The issue came into focus after the Royal Navy reported that a merchant ship had come under missile attack in the area.

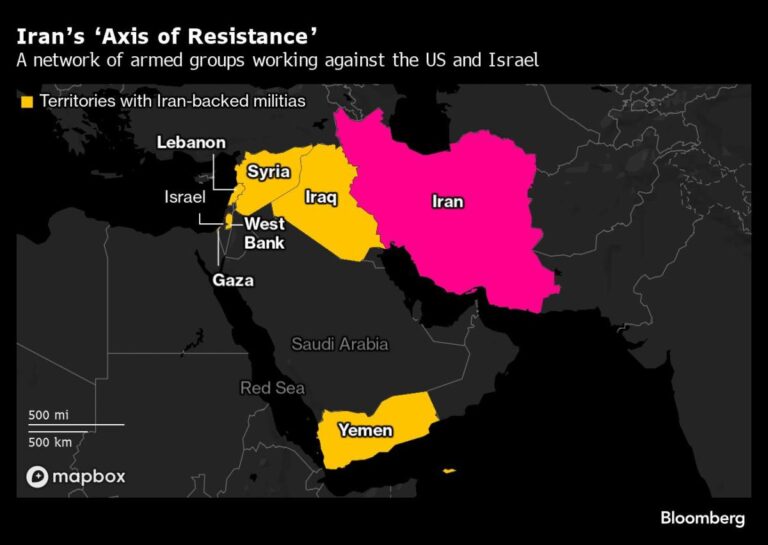

Global oil markets have been riveted on the situation in the Middle East since Hamas attacked Israel on October 7th. The attack on the Houthis was in retaliation for Hamas rushing ships in the Red Sea in recent months. Iranian-backed militants have vowed not to let up until Israel finishes its assault on the Gaza Strip.

The price reaction is that the market currently believes the evolving conflict is not likely to escalate and jeopardize oil production and oil spills from the Middle East region, which accounts for about a third of the world’s oil. It suggests that. Rather, the prospect of increased supply from non-OPEC countries and slower demand growth are helping to keep prices within range. Monday is a public holiday in the United States, so trading volume may be lower.

“It is not our base case that U.S. and U.K. attacks on Houthi targets in Yemen or the Red Sea issue will lead to a significant increase in oil prices in the coming weeks,” Citigroup analyst Francesco Martoccia wrote in a note. mentioned in. “On the other hand, the potential for escalation of tensions between Israel and Hezbollah and/or Iran is likely to cause markets to believe that it could, or does, cause supply disruptions and could lead to short-term is of greater concern, but may not be the case within our base case. ”

Still, rising tensions in the Middle East have disrupted oil flows to some extent. At least three oil tanker owners, who control more than 350 vessels, announced on Friday that they would suspend sailings through the southern Red Sea. All ships have been advised by Western militaries to stay away from the area, and more ships are likely to follow suit.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link