[ad_1]

Last year, overall semiconductor company revenue trended down by 10%, making 2023 a period of adjustment for the group. But as Oppenheimer analyst Rick Schaefer acknowledges, the segment’s overall performance doesn’t really tell you that.

“In classic fashion, investors discounted the fundamental bottom early, driving SOX up 67% in 2023. The best growth stories outperformed,” the 5-star analyst wrote. To tell.

These growth stories were based on this year’s key theme: AI initiatives. Companies with greater exposure to this space benefited greatly, with NVIDIA (NASDAQ:NVDA) leading the pack and rival Advanced Micro Devices (NASDAQ:AMD) also reaping the spoils of this year’s market. received. Both stocks generated significant returns for investors.

AI remains Schaefer’s top theme this year as companies look to monetize their AI strategies as we head into 2024, so can we expect more performance from these big chip companies? Since we are evaluating the prospects and think one of the pair is in a better position than the other, let’s dig deeper and find out which one has the advantage.

Nvidia

For those who follow the stock market, it’s been hard to avoid Nvidia’s meteoric rise and rise over the past year. It’s not like the semiconductor company was a relative unknown a year ago, but the success of its stock (up 239% over the year) has propelled it into the exclusive environment of the $1 trillion-plus market cap club.

There is a very simple explanation for this success. Nvidia was once a graphics company that primarily made chips used in games, but now its main cash cow is ancillary data center business. The company has virtually cornered the market with its industry-leading AI chips. And thankfully for Nvidia, demand is through the roof.

The result was a series of earnings reports that stunned all of Wall Street. Reading the third quarter earnings reports of major semiconductor companies reveals their strength. Data center revenue increased 279% year-over-year to a record $14.51 billion, with total revenue of $18.12 billion, an increase of 205.6% year-over-year. This number exceeded consensus estimates by $2.01 billion. The same was true at the other end of the spectrum, with adjusted net income increasing nearly 600% year-over-year to $1.46 billion, and adjusted EPS of $4.02, beating street estimates by $0.63. As for guidance, for the fourth quarter, Nvidia expects revenue to reach his $20 billion plus or minus 2%, suggesting an increase of almost 231% year over year. Analysts had expected just $17.82 billion.

Meanwhile, the stock has transitioned seamlessly into the new year, still racking up profits despite underperforming relative to other segments so far.

This isn’t all that surprising given that Schaefer sees Nvidia as a continued winner on the back of AI adoption. “Year-to-date, his NVDA stock price is up 10% (SOX -3%), and our CY25E EPS is his 23x, whereas the three-year average is his 38x ,” said the analyst. “NVDA remains the purest large-scale effort for AI adoption. As accelerator connections increase, we expect continued structural growth led by DC AI (5 years in the cloud versus 20% today). NVDA’s established DC/AI ecosystem is core to GenAI adoption. We continue to be a long-term buyer…NVIDIA continues to grow in 2024 One of the top candidates of the year.”

To this end, Schaefer rates NVDA an Outperform (i.e. Buy), and his $650 price target has room for further upside of up to 19% from current levels. . (Click here to see Schaefer’s track record)

Most analysts think along the same lines. The stock claims a “Strong Buy” consensus rating, based on a combination of 31 buys to just 4 holds. At the average target of $662, the stock would trade at a 21% premium after one year. (look Nvidia stock price prediction)

Advanced Micro Devices

It makes sense to look at Nvidia and then evaluate AMD’s prospects. In AI games, the company cannibalize Nvidia’s advantage by bringing to market products that are equal in quality and have unique advantages in the form of open source software and his Nvidia proprietary solutions, but boast lower prices. It is considered a company with potential. price point.

History also shows that AMD has been able to maintain segment leader status before. Once completely eclipsed in the CPU space by chip giant Intel, AMD has steadily chipped away at its lead over the years, and under the leadership of CEO Lisa Su, about a decade ago, It has transformed from a company on the verge of bankruptcy to a semi-giant company. The market capitalization is approximately $236.7 billion.

Similar to Nvidia, AMD significantly outperformed last year, delivering a 127% return. While not as surprising as Nvidia’s financial statements, the company generally reported strong quarterly results and finished with the best results in print for the third quarter.

Revenue for the quarter reached $5.8 billion, up 4.1% from a year earlier, beating analysts’ expectations by $110 million. In the end, his adjusted EPS came out to be $0.70, beating the Street’s expectations by $0.02. However, the third quarter printing was not a complete success, mainly due to the disappointing outlook. The company expects fourth-quarter sales to reach approximately $6.1 billion, with a consensus estimate of $6.39 billion plus or minus $300 million.

AMD deserves credit for its success in keeping its rivals on the lookout, but for Schaefer, the combination of intense competition and high ratings was too much for him to handle.

“We remain cautious about whether AMD can offer a profitable long-term business model as a second-tier player in the long-term decline of the PC market. We believe that market-leading INTC is strengthening its position in both CPUs and GPUs, challenging AMD’s revenue and GM’s trajectory. The company believes that pursuing a significantly reduced GM gaming business is “We believe this will further hinder the company’s ability to improve its profitability. We believe there are structural issues with the business model and that the company’s above-peer valuation provides a good balance between risk and reward,” Schaefer said. Ta.

To this end, Schafer continues to monitor AMD’s progress from the sidelines with a Perform (i.e. Neutral) rating without setting a fixed price target.

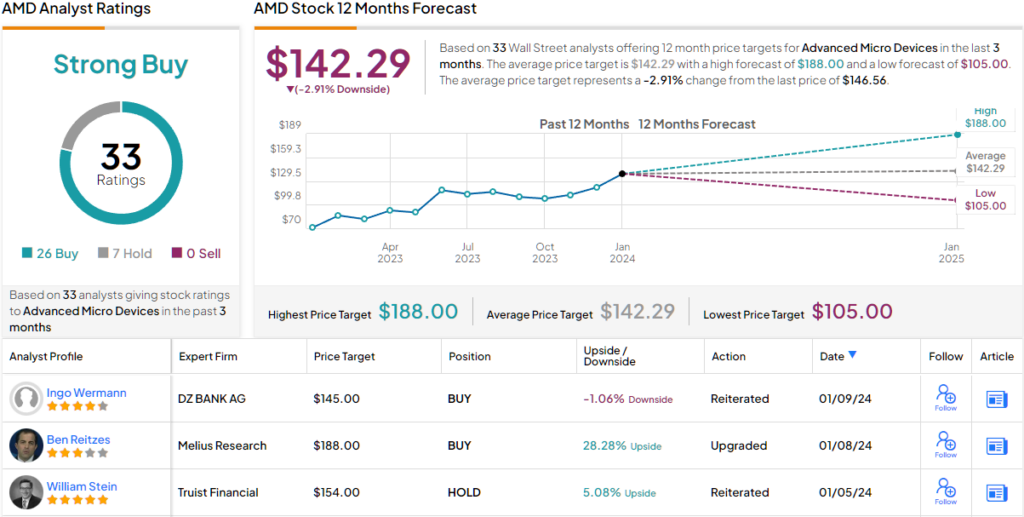

Still, Schaefer is in the minority on Wall Street. Elsewhere, the stock has an additional 26 buys and 6 holds, all of which add up to a Strong Buy consensus rating. However, we think this valuation is a bit deceptive, as the average price target of $142.29 suggests the stock will remain range-bound for the time being. (look AMD stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.

[ad_2]

Source link