[ad_1]

(Bloomberg) — Stocks fell across Asia as new data heightened concerns about China’s economy and investors tempered bets on the Federal Reserve cutting interest rates.

Most Read Articles on Bloomberg

Hong Kong’s Hang Seng Index fell 3%, and mainland China’s index CSI300 also fell more than 1%. The losses came as official figures showed that while China achieved its 2023 economic targets, the housing recession worsened and domestic demand remained weak.

Stocks from South Korea to Australia also fell, weighing on regional indexes. Japan was an exception, helped by the weaker yen. US stock futures also fell, but US Treasuries were firm and the dollar rose slightly.

“Due to deflationary pressures, China’s nominal GDP growth rate in 2023 will be lower than its real GDP growth rate.The labor market is weak,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management. “This suggests that the growth rate is likely to be below the potential growth rate.”

The underlying tone in Asian markets weakened on Tuesday after the S&P 500 fell 0.4%, U.S. Treasuries fell and the 10-year Treasury yield rose about 12 basis points.

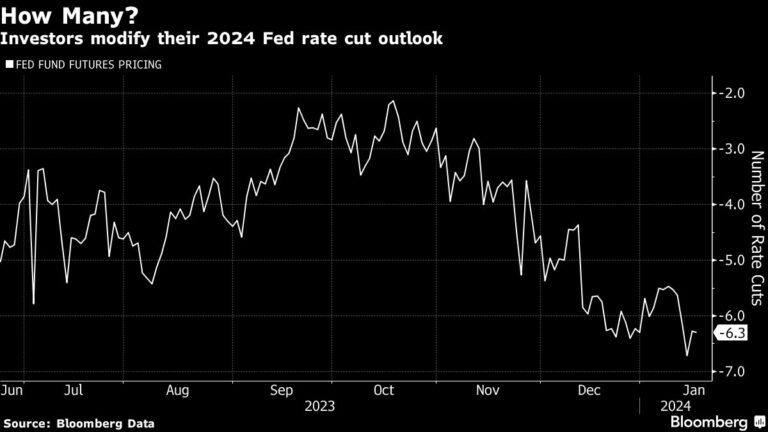

The move followed comments from Fed President Christopher Waller, who urged caution but said interest rates could be cut by the end of the year if inflation moderately falls toward the central bank’s target. Waller said at a virtual event on Tuesday that interest rates should be lowered “systematically and prudently” when the time is right.

Reflecting the readjustment of expectations for the Fed’s rate cut, the swap market’s expectations for a March rate cut have gradually declined to around 65% from 80% on Friday.

mixed china data

Data released early Wednesday showed China’s gross domestic product (GDP) grew by 5.2% last year, in line with economists’ expectations and exceeding Beijing’s official target of about 5%. The latest figures for December continue to heighten concerns about the growth outlook. The decline in new home prices accelerated last month, while retail sales growth slowed more than expected.

Meanwhile, prices across China’s economy have fallen for the longest time since 1999.

“This is the deepest and longest deflation in China since the 1998 Asian financial crisis,” said Robin Xin, chief China economist at Morgan Stanley. “The longer deflation lasts, the more policy stimulus will be needed.”

In commodity markets, oil prices fell as a strong US dollar and broad risk-off sentiment offset concerns about escalating tensions in the Middle East, including continued attacks on ships in the Red Sea by Iranian-backed Houthi rebels. .

Earlier, the dollar rose for the first time in 10 months as yields rose as expectations for a rapid Fed rate cut this year faded.

In U.S. profits, Morgan Stanley fell after warning of falling returns on assets, while Goldman Sachs Group Inc. rose after profits beat expectations. Boeing Co. fell due to analyst downgrade. Apple Inc. lost ground after the U.S. Supreme Court refused to consider an appeal in an antitrust case against the App Store.

Elsewhere, gold held steady after falling more than 1% on Tuesday to trade around $2,028 an ounce, while Bitcoin held steady above $43,000.

This week’s main events:

-

Eurozone CPI, Wednesday

-

US retail sales, industrial production, business inventories, Wednesday

-

Fed releases Beige Book survey of regional economic conditions Wednesday

-

New York Fed President John Williams speaks on Wednesday

-

ECB President Christine Lagarde and ECB Executive Board members Klaas Nott and Boris Vučić speak at Davos on Wednesday

-

U.S. housing starts, new unemployment insurance claims, Thursday

-

Republican presidential primary debate Thursday in New Hampshire

-

ECB President Christine Lagarde participates in panel discussion in Davos on Thursday

-

ECB releases report of December policy meeting on Thursday

-

Atlanta Fed President Rafael Bostic speaks Thursday

-

Canadian retail sales Friday

-

Japanese CPI, tertiary index, Friday

-

U.S. existing home sales, University of Michigan consumer sentiment, Friday

-

ECB President Christine Lagarde and IMF Managing Director Kristalina Georgieva will speak in Davos on Friday.

-

San Francisco Fed President Mary Daley speaks on Friday

The main movements in the market are:

stock

-

S&P 500 futures were down 0.2% as of 1:56 p.m. Tokyo time.

-

Nikkei 225 futures (OSE) rose 0.1%

-

Japan’s TOPIX rose 0.4%

-

Australia’s S&P/ASX 200 falls 0.4%

-

Hong Kong’s Hang Seng fell 2.8%.

-

The Shanghai Composite fell 0.6%.

currency

-

Bloomberg Dollar Spot Index rose 0.1%

-

The euro was almost unchanged at $1.0869.

-

The Japanese yen fell 0.1% to 147.36 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2159 yuan to the dollar.

cryptocurrency

-

Bitcoin fell 1.4% to $42,842.41.

-

Ether fell 1.5% to $2,567.37.

bond

-

The 10-year government bond yield was almost unchanged at 4.05%.

-

Japan’s 10-year bond yield rose 1.5 basis points to 0.605%.

-

The Australian 10-year bond yield rose 6 basis points to 4.21%.

merchandise

-

West Texas Intermediate crude oil fell 0.8% to $71.82 a barrel.

-

Spot gold fell 0.1% to $2,025.50 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Iris Ouyang and James Mayger.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link