[ad_1]

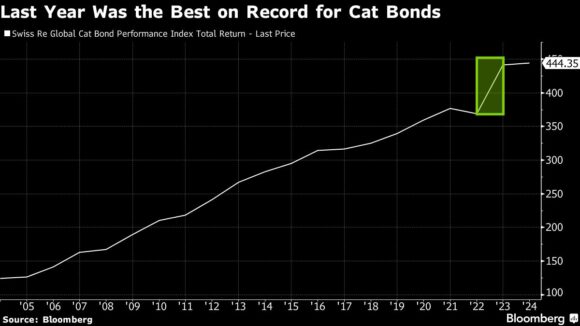

Fermat Capital Management just had its best year in more than 20 years, as a huge bet on catastrophe bonds delivered record results.

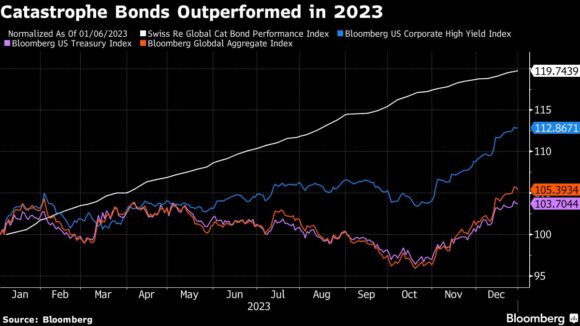

Brett Houghton, managing director at Fermat, which manages about $10.8 billion in assets, said the hedge fund’s returns were “in line” with the 20% rise in the Swiss Re Global Cat Bond Performance Index.

For cat bond investors, 2023 was “a unicorn year with great returns and market equilibrium,” Horton said in an interview. “There was strong investor interest and a need for the insurance market to issue more and more cat bonds,” he said.

Fermat is the world’s largest investor in so-called cat bonds, owning 80% of the approximately 280 stocks on the market. These bonds, which typically have maturities of three to five years, are becoming popular among issuers looking for ways to cover non-insurable risks. Investors stand to earn above-market returns in exchange for the risk of losing some or all of their capital in the event of a catastrophe.

“The market has grown in size, but not enough to meet potential event needs,” Horton said.

Climate change is driving growth in the cat bond market, with insurers beginning to retreat from intolerable loss probabilities in the face of increasingly extreme weather patterns. And Horton points out that inflation has increased post-disaster rebuilding costs by about 25%, leading to increased issuance of cat bonds to fill the gap.

According to Munich Re, global losses from natural disasters reached $250 billion last year alone, but only $95 billion of that was insured.

Industry pressure on cat bonds to calculate risks and rewards for so-called secondary disasters (hailstorms, tornadoes, floods) that generate ever-higher levels of losses, apart from major hurricanes and other remote disasters. Interest is growing. For insurance companies. However, many investors remain wary because the data and models supporting these risks are not yet robust enough.

“We think some secondary risks are attractive and others are not,” Horton said. “It helps diversify your portfolio, but it also comes with uncertainty. Less research and development goes into these models.”

Other high-risk scenarios that cat bonds are being used to address include cyber-attacks. Fermat has already started investing in these securities and expects to increase its exposure, he said.

Beazley launches first cyber catastrophe bond in global reinsurance market

“The impact of cyber losses could be as large as a Category 4 or 5 hurricane that hit Miami,” he said. “We have identified that part of the market as a key growth area over the next five to 10 years.”

Investor interest in this security is growing, and cat bond asset managers now include Schroders, Leadenhall Capital Partners, Neuberger Berman, and Blackstone. , investing in high-yield products to protect real estate assets from losses due to natural disasters.

Fermat was founded in 2001 by Jong Seo, a physicist by training, and his brother Nelson. From the beginning, the firm focused entirely on catastrophe bonds, a then-niche and poorly understood form of alternative debt investment. Mr. Seo’s key observation was that as more people move to Florida, California and other natural disaster-prone places, the insurance industry will want to shift some of the increased risk to Wall Street.

Seo then used his background in physics to develop more accurate models than previously existed to efficiently estimate the risks associated with extremely rare events such as devastating hurricanes. Developed. Mr Horton, who has known Mr Seo for about 25 years, said he had the “enthusiasm” needed to “understand everything” about risk.

Last year’s rally in the cat bond market was boosted by the fact that the hurricane season was milder than in 2022, and bondholders had fewer losses to cover.

New cat bond issuance, including private deals, reached $5.6 billion in the final quarter of 2023, bringing full-year trading volume to a record $16.4 billion, according to Artemis, a firm that tracks cat bonds and insurance-related securities. It is said that it has been reached. market. With these transactions, the company estimates that outstanding market balance has reached an all-time high of $45 billion.

“And 2024 will be another interesting year for investors in terms of attractive returns,” Horton said.

Related:

Photo: Buildings in Manhattan, New York, New York, Thursday, June 17, 2021. Photo credit: Victor J. Blue/Bloomberg

Copyright 2024 Bloomberg.

topic

catastrophe

interested in catastrophe?

Get automatic alerts on this topic.

[ad_2]

Source link