[ad_1]

spencer lowell

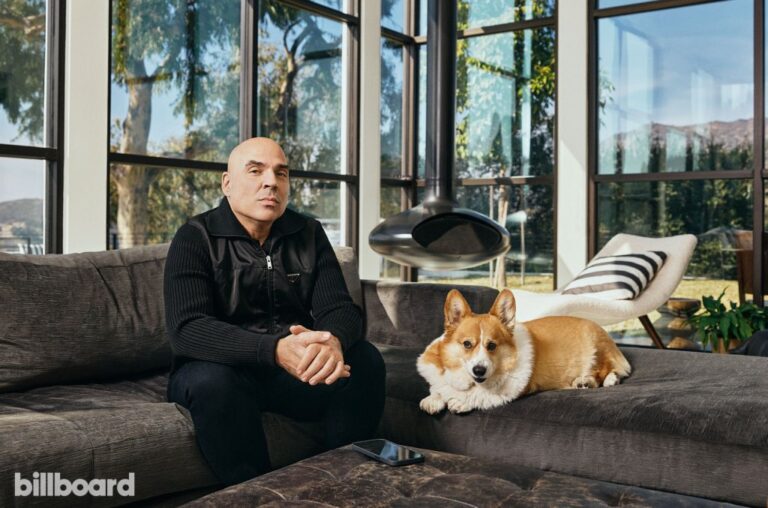

Hipgnosis Song Fund’s Board of Directors provides that: Merck Mercuriadis-Hipgnosis Song Management led the ability to purchase the company’s music catalog in the event of contract termination.

Hypnosis Songs Fund’s board of directors, after consulting with shareholders owning more than 60% of its outstanding shares, said in a regulatory filing on Thursday (January 18) that Mercuriadis’ call options were of concern. He explained that it is “one of the important themes” that will be discussed. Shareholders believe the call option would prevent third parties from bidding on the company’s music assets, “depressing the potential value” of the Hypnosis Songs Fund and limiting its ability to create value for shareholders.

The call for feedback from shareholders is part of Hipgnosis Songs Fund’s strategic review following the vote against continuation at its October general meeting. At the meeting, shareholders also voted against the proposed $440 million sale of 29 music catalogs to Hypnosis Songs Capital, a joint venture of investment advisory and investment giant Blackstone.

To address shareholder concerns regarding the call option, the board proposed a special resolution to amend the articles of association to provide for the payment of fees of up to £20 million ($25.4 million) to potential buyers at the board’s discretion. . This fee is intended to reduce the risk of making offers on Hipgnosis Songs Fund’s music catalog. According to the filing, the board believes the proposed fee “provides prospective offerors with significant protection against due diligence and acquisition costs” and “provides a potential opportunity to maximize shareholder value.” “We hope to provide even more of this.” The board said it received support for the proposed fee from shareholders representing more than 35% of the company’s outstanding shares.

“Investors in the Hypnosis Songs Fund voted overwhelmingly in favor of the changes, rejecting the proposed continuation of the company and the sale of certain music assets,” chairman Robert Naylor said in a statement. . “Based on consultation with our shareholders, the core of the change requirements is to address call options held by our investment advisor, Hypnosis Songs Management. “Not only does it act as a structural conflict, but it also serves as a significant disincentive to potential bidders for our assets, thereby reducing our value.”

Shareholders are expected to vote on the amendments at an extraordinary general meeting to be held on a date yet to be announced.

[ad_2]

Source link