[ad_1]

A new federal law requires nearly all businesses in Colorado to register with the Treasury Department’s Federal Crime Enforcement Network, or face stiff penalties.

Although the Corporate Transparency Act is intended to catch money launderers, it also applies to LLCs, DBAs, and corporations, regardless of size.

Under the law, anyone who owns at least 25% of a company or who operates a company must file a Beneficiary Information Report with the U.S. Department of the Treasury Financial Crimes Enforcement Network or otherwise The fine is $500 per day up to $10,000. and up to two years in prison.

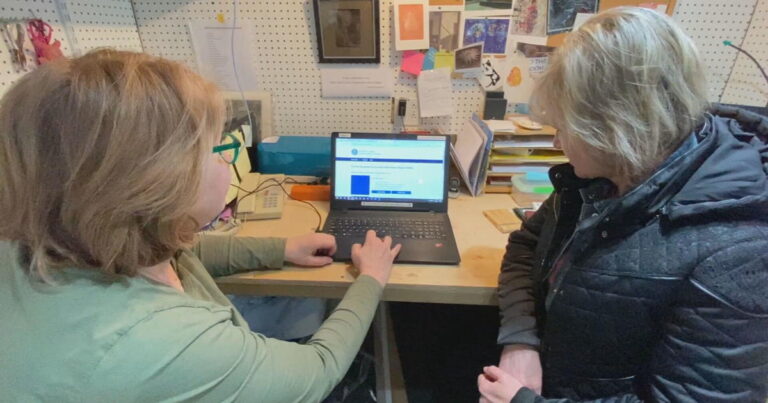

Artist-turned-entrepreneur Jacqueline Webster is among those affected by the law. She runs an analog photography business in Golden and stumbled upon an article about the law online.

“They never contacted us in any way. It was completely by chance that I found out about it,” she said.

CBS

Her reaction is what you would expect from someone who sells prints at art festivals and has no idea about setting up shell companies.

“Wow, this is so annoying…I mean, why are you doing this?” she asked.

Dave Ratner of the Creative Law Network worries that independent artists will be among the many small businesses caught by surprise.

“Treasury may not be known for marketing, but it’s true…I mean, this is…I’m really glad you’re asking about this,” he said.

Penalties for non-compliance are steep, but companies established before January 1 have until the end of the year to comply.

New businesses have a 90-day deadline. If you disband your business or make changes such as new ownership or address, you only have 30 days to update your filing. The database is private and can only be accessed by law enforcement.

CBS

Ratner said small business owners may think federal law doesn’t apply to them because they register with the state and file most claims with the state. He says he shouldn’t ignore it, but he also shouldn’t worry about jail time.

“However, penalties are imposed for…particularly willful…deliberate failure to file. In other words, ‘you knew you had to file and you didn’t file,’ or ‘you knew you had to file, but you failed to file.’ I knowingly submitted it fraudulently,”’ he said.

Webster says she’s trying to spread the word.

“I told some friends about it and they were like, ‘What? What?’ And it’s no big deal. It’s just one more thing to keep track of.” she said.

She said the application required uploading a driver’s license or passport, but it only takes about 20 minutes and is free.

[ad_2]

Source link