[ad_1]

The macroeconomic challenges that characterized much of the past two years are beginning to fade. After plummeting 35% in 2022; Nasdaq Composite It rebounded in 2023, rising 43%. The market is currently realigning, but history suggests it could go higher.

Looking at data from 51 years ago, each year after a market recovery, tech-heavy indexes rose an average of 19% in the second year. This gives us good reason to believe that the current bull market still has momentum. The economy is still fragile and things could get worse, but the stock market could be in for another strong year.

Last year’s market rally was driven by a group of investor-favorite stocks collectively known as the Magnificent Seven, which significantly outperformed the broader market in 2023.

Among these well-known companies, Amazon represents a particularly attractive opportunity for investors today. Following last year’s strong performance, the stage is set and the company is likely to deliver another outstanding performance.

lingering issues

The macroeconomic headwinds of the past few years have been a perfect storm for Amazon. High inflation slowed consumer discretionary spending, and online purchases were the first casualty. This led to a similar decline in corporate spending.

Advertising is one area of the budget that companies can easily and quickly cut or scale up, and the deep cuts in this area weighed on Amazon’s digital advertising business. Additionally, many companies have put off digital transformation, such as moving workloads to the cloud, which is contributing to slower growth in the company’s cloud infrastructure business, Amazon Web Services (AWS). .

Although the effects of these problems are still felt, Amazon’s situation is improving.

The undisputed leader in e-commerce

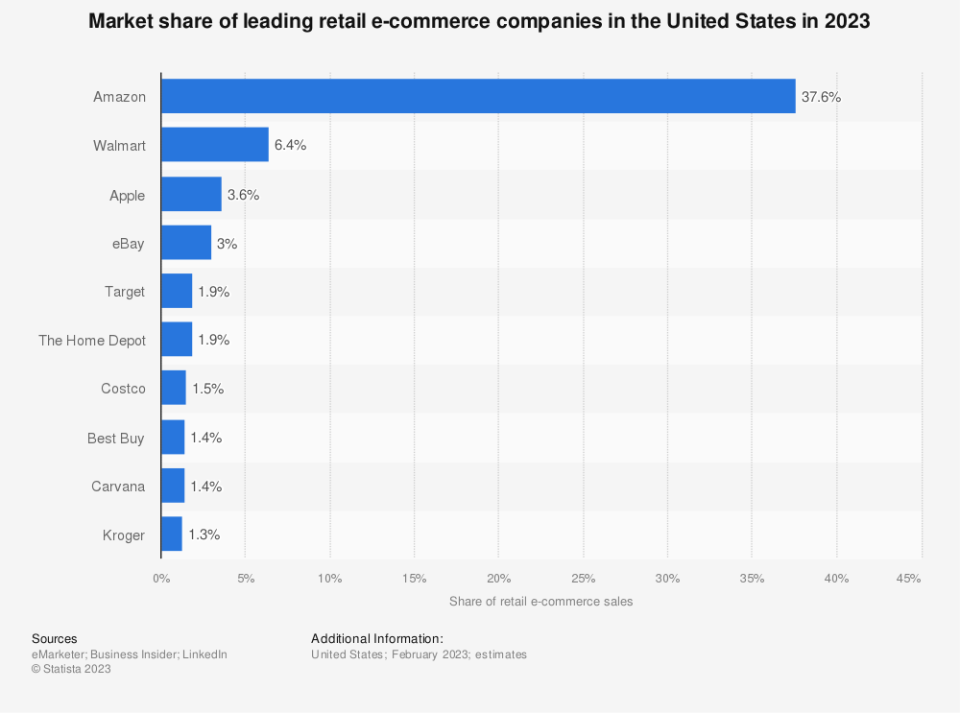

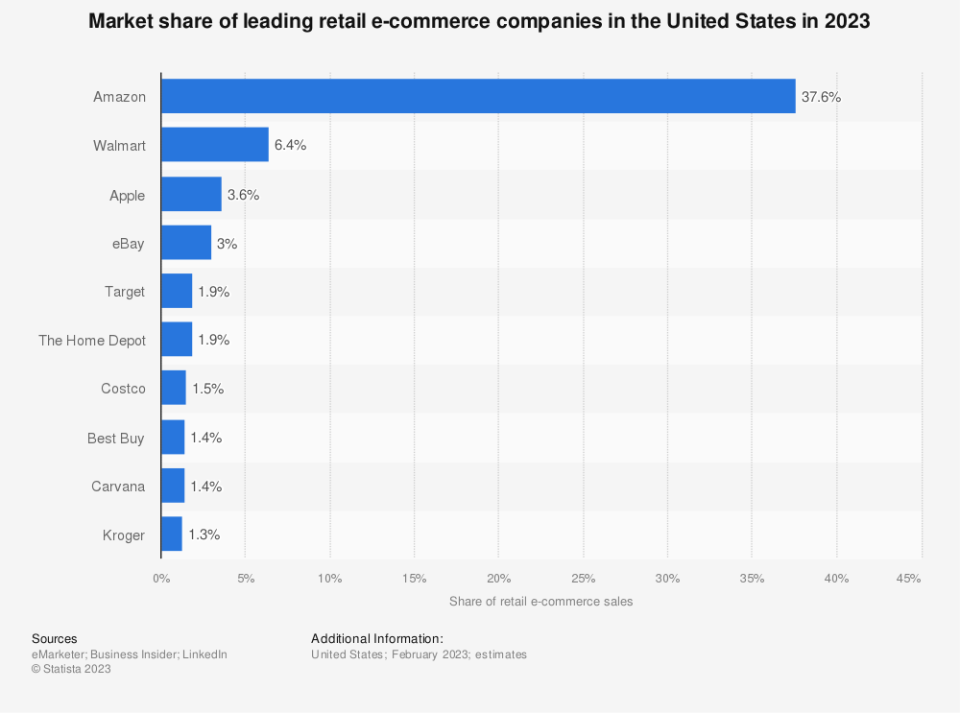

Despite persistent concerns about the economy, there are reasons to remain optimistic. Amazon is synonymous with e-commerce, an industry it continues to dominate. Although 2023 numbers have not yet been compiled, Amazon accounted for about 38% of all U.S. online sales in 2022, more than its 14 closest competitors combined, according to online data provider Statista. Although competitors may have made some inroads, the company is unlikely to relinquish its industry leadership position.

Additionally, Insider Intelligence estimates that e-commerce sales are expected to increase by more than 9% to reach $6.3 trillion in 2024, representing more than 20% of all retail sales. To do. As the leader in online sales, Amazon will benefit from this long-term tailwind.

It all becomes “advertising”

One of Amazon’s biggest growth drivers in recent years has been the digital advertising that captivates the company’s audience. Amazon’s digital ad revenue rose 26% year over year in the third quarter, outpacing its biggest rivals Alphabet and Metaplatform, which increased ad revenue by 9% and 24%, respectively.

Starting this month, Amazon aims to strengthen its advertising business by displaying “limited ads” on its Prime Video streaming service. Subscribers have the option to pay an additional $3 per month to maintain an ad-free viewing experience, but Amazon wins either way.

Additionally, according to Insider Intelligence, digital advertising is expected to grow by 13.2% in 2024 after increasing by more than 10% last year. Amazon, the third-largest digital advertising platform in the U.S., is sure to benefit from an acceleration in ad spending.

clouds are rising

Even in the face of economic challenges, AWS maintained its position as the world’s leading provider of cloud infrastructure services, controlling 31% of the market in the third quarter, according to market analyst Canalys.

After slowing growth for most of the past two years, cloud adoption is expected to accelerate again in 2024.research and consulting firm gartner predicts that public cloud spending will jump 20% to $679 billion. Accelerating cloud adoption could further enhance AWS’s fortunes.

You can’t make money without AI

Last but not least, Amazon has a long and storied history of leveraging artificial intelligence (AI) to improve its operations, and has jumped into the generative AI ring with both feet. AWS Bedrock gives users access to all the most popular AI models and allows them to build their own customized AI apps. It also provides access to Nvidia’s latest and greatest AI chip, the H200 Tensor Core graphics processing unit (GPU), as well as Amazon’s own Inferentia and Trainium AI chips. This allows customers to balance speed and economy.

The company recently announced Amazon Q for Enterprise, an AI-powered generative digital assistant designed to help automate and streamline time-consuming, routine tasks and improve user productivity. .

Amazon also offers AI tools to help sellers selling on its platform succeed. The company introduced AI-powered image generation for digital advertisers and used AI to improve search and product recommendations. Just this week, Amazon began testing a feature that allows customers to ask questions about products and receive AI-generated answers.

These recent forays into AI offer a glimpse into Amazon’s strategy.

attractive opportunity

Despite Amazon’s rich opportunities, the company’s stock is still reasonably valued at twice next year’s expected sales.

Given the recovery in online retail, the recovery in the advertising market, the ongoing digital transformation, and the AI-driven gold rush, now is the time to buy Amazon before the stock climbs even higher.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Amazon wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of January 16, 2024

Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Danny Vena has held positions at Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends his Gartner. The Motley Fool has a disclosure policy.

History suggests Nasdaq will soar in 2024: 1 ‘Magnificent Seven’ stocks to buy before it happens The original article was published by The Motley Fool.

[ad_2]

Source link