[ad_1]

To justify the effort of picking individual stocks, it’s worth striving to beat returns from market index funds. However, results among individual stocks in any portfolio are mixed. Some shareholders may have doubts about investing in the company at this point. Casting PLC (LON:CGS), since the share price has fallen 10% over the past five years.

It’s worth assessing whether the company’s economic performance is keeping pace with these overwhelming shareholder returns, or if there are any discrepancies between the two. So let’s just do that.

Check out our latest analysis on foundries.

Although the efficient markets hypothesis continues to be taught by some, it has been proven that markets are dynamic systems that overreact and that investors are not always rational. One imperfect but simple way to consider how the market perception of a company has changed is to compare the change in the earnings per share (EPS) with the share price movement.

Although the stock price fell over five years, Castings actually managed to make a profit. increase EPS averages 9.9% per year. Therefore, we don’t think EPS is a good guide to understanding how the market values a stock. Alternatively, past growth expectations may have been unreasonable.

Generally speaking, we would expect the stock price to rise even more strongly on the back of sustained EPS growth, but other metrics may provide clues as to why the stock’s performance has been relatively modest.

Note that the dividend remains healthy. Therefore, it does not explain the decline in stock prices. It’s not entirely clear why the share price is falling, but a closer look at the company’s history may help explain it.

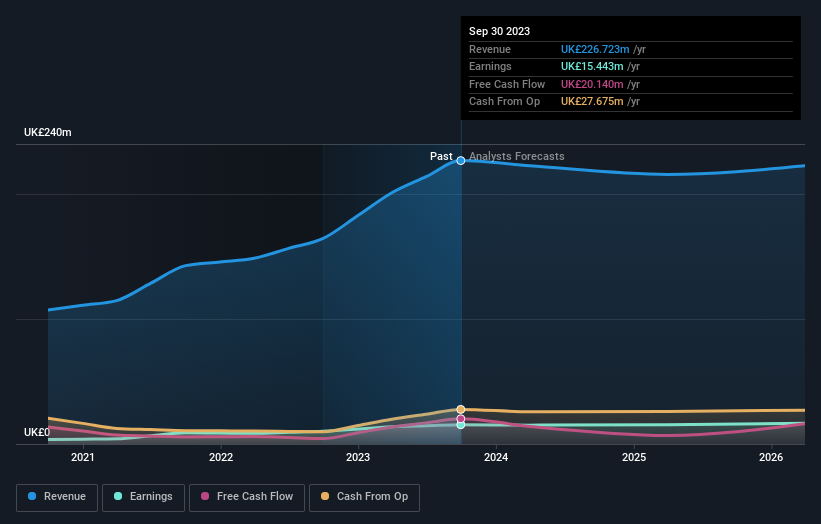

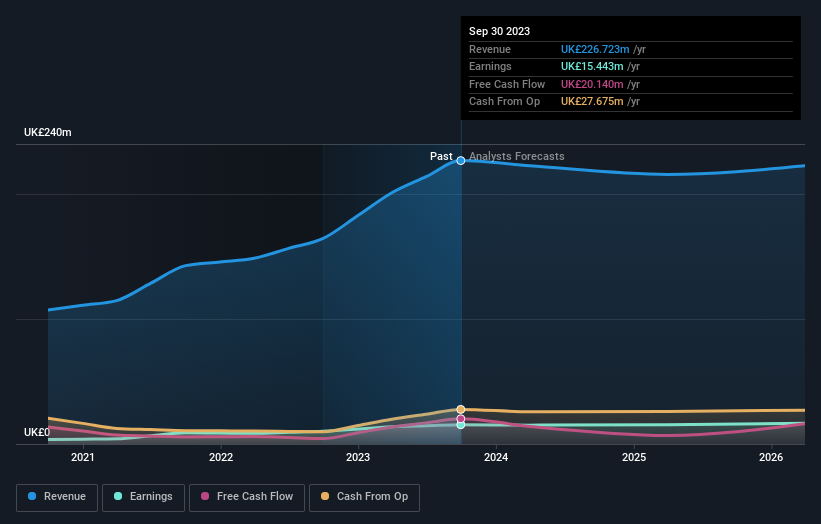

The company’s earnings and revenue (long-term) are depicted in the image below (click to see the exact numbers).

We know that Castings has improved its earnings over the past three years, but what does the future have in store? We can see how this balance sheet has strengthened (or weakened) over time. Masu. free Interactive graphics.

What will happen to the dividend?

As well as measuring share price return, investors should also consider total shareholder return (TSR). Whereas the price/earnings ratio only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return delivered by a stock. For Castings, the TSR for the last five years was 25%. This exceeds the stock return mentioned earlier. Therefore, the dividend paid by the company is total Shareholder returns.

different perspective

We’re pleased to report that Castings shareholders received a total shareholder return of 5.8% over one year. That includes dividends. The 1-year TSR is better than his 5-year TSR (the latter at 4% p.a.), so it looks like the stock has been performing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock to make sure you don’t miss out. Before you spend more time with Castings, it might be wise to click here to see if insiders have been buying or selling shares.

of course, You may find a great investment if you look elsewhere. So take a look at this free A list of companies with expected revenue growth.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on UK exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link