[ad_1]

To justify the effort of picking individual stocks, it’s worth striving to beat returns from market index funds. But every investor almost certainly has stocks that perform both well and poorly. Some shareholders may have doubts about investing in the company at this point. Al Salam Real Estate Investment Trust (KLSE:ALSREIT), since its share price has fallen 45% over the past five years.

It’s worth assessing whether the company’s economic performance is keeping pace with these overwhelming shareholder returns, or if there are any discrepancies between the two. So let’s just do that.

Check out our latest analysis for Al Salam Real Estate Investment Trust.

To paraphrase Benjamin Graham, in the short term the market is a voting machine, but in the long term it is a weighing machine. One imperfect but simple way to consider how the market perception of a company has changed is to compare the change in the earnings per share (EPS) with the share price movement.

Although the share price has fallen over the five years, Al Salam Real Estate Investment Trust actually managed to make a profit. increase EPS will increase by an average of 10% per year. Given the stock price reaction, one might suspect that EPS is not a good indicator of performance during the period (perhaps due to temporary losses or gains). Alternatively, past growth expectations may have been unreasonable.

Because there is a sharp contrast between EPS growth and share price growth, we tend to look at other metrics to understand changes in market sentiment around a stock.

Note that the dividend has declined over the past five years, so that may have contributed to the share price decline. On top of that, revenue has declined by 5.1% annually over this five-year period. That may be a red flag for some investors.

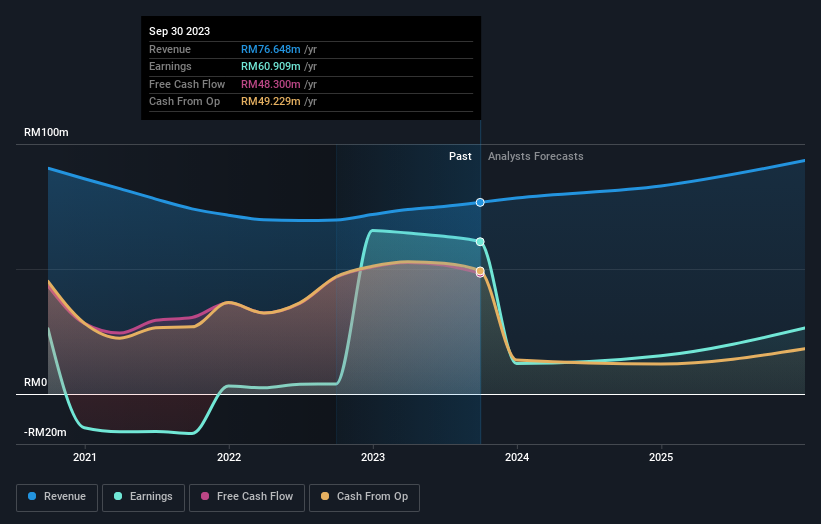

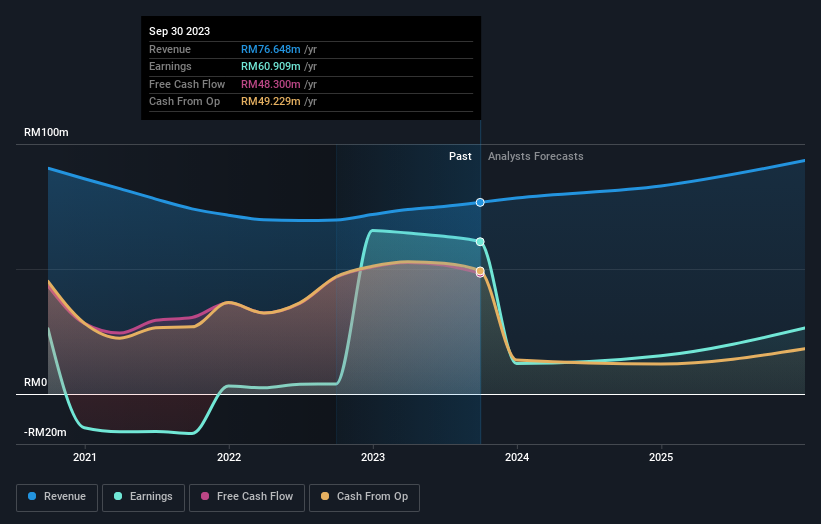

The image below shows how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Of course, it’s great to see that Al Salam Real Estate Investment Trust has grown its profits over the years, but the future is more important to shareholders.Let’s now take a more thorough look at Al Salam Real Estate Investment Trust’s financial health. free Report the balance sheet.

What will happen to the dividend?

When looking at return on investment, it is important to consider the following differences: Total shareholder return (TSR) and stock price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, based on the assumption that the dividends are reinvested. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. Coincidentally, Al Salam Real Estate Investment Trust’s TSR over the past five years was -30%, which is higher than the share price return mentioned above. Therefore, the dividend paid by the company is total Shareholder returns.

different perspective

It’s good to see that Alsalam Real Estate Investment Trust shareholders received a total shareholder return of 18% over the last year. Of course, this includes dividends. This is certainly higher than the annual loss of about 5% over the past five years. This makes us a little wary, but the business may have turned its fortunes around. It’s always interesting to track stock performance over the long term. But to understand Al Salam Real Estate Investment Trust better, you need to consider many other factors.Case in point: we discovered 5 warning signs for Al Salam Real Estate Investment Trust Two of them make us uncomfortable.

of course Al Salam Real Estate Investment Trust may not be the best stock to buy.So you might want to see this free A collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link