[ad_1]

Semiconductor stocks are enjoying an extended period of sunshine. Driven by the rise of AI, a main theme last year, overall market sentiment turned from bearish to bullish in the final months of 2022, as many names in the space look to benefit from AI adoption. Since then, investors have been leaning heavily toward semiconductor stocks.

However, the stock market is known for being forward-thinking, so the surge in chip names actually began while the sector was still in recession. Now that the industry cycle is starting to turn around again, does that mean the share gains are already happening?

That’s not necessarily the case, said Kantar analyst CJ Muse, who points out that past trends suggest another strong year for semiconductor stocks.

“Yes, SOX bottomed on October 13, 2022 and has risen ~95% since then,” says the 5-star analyst. “However, fundamentals will bottom out in Q2 2023, leaving just three quarters before fundamentals turn around compared to the typical nine quarters over the past seven cycles. Assuming the market discounts two quarters ahead. This suggests that 2024 will be another strong year for semiconductor stocks, with investors looking for an exit strategy in late 2024 or early 2025.

So which stocks offer the biggest opportunities next year? Muse has his thoughts on that, too, with chip giants NVIDIA (NASDAQ: NVDA) and AMD (NASDAQ: AMD) among the names investors should be looking for. was nominated. And Muse isn’t the only one who thinks these stocks are worth a punt. According to the TipRanks database, the analyst consensus rating for both is a Strong Buy. Let’s see why.

Nvidia

As Muse pointed out, the Sox (PHLX Semiconductor Index – the industry’s main barometer) has delivered strong returns to investors over the past 15 months. But these have been overshadowed by his Nvidia-era accomplishments, a superstar in the field.

Since bottoming in October 2022, the stock has returned 431%. Investors are rushing in because of the company’s positioning. of AI stocks. And not in vain did it claim that title.

Simply put, Nvidia has transitioned from a graphics company primarily focused on the gaming space to a leading provider of chips used in data centers. Its best-in-class products are the first point of contact for anyone involved in AI gaming. That is, it occupies more than 80% share of the AI chip market.

Hype often helps stock prices rise regardless of real-world performance, but the stock’s advantage here is based on the huge numbers that Nvidia has been producing. Last year, Wall Street was stunned by the extent of the beat-and-raise presented in the company’s quarterly report.

The company’s most recently announced fiscal third quarter (ending October) peaked at $18.12 billion, up 205.6% year over year and beating The Street’s forecast by $2.01 billion. significantly exceeded. Within that, data center numbers were even more impressive, increasing 279% year over year to $14.51 billion. Similarly, on the other end of the equation, adjusted net income increased nearly 600% year-over-year to $1.46 billion, translating to adjusted EPS of $4.02, beating consensus by $0.63.

The company’s most recently announced fiscal third quarter (October) reported a high of $18.12 billion, an increase of 205.6% year-on-year, and a decisive jump to $2.0 billion over TheStreet’s forecast. It was over $10 million. Within that, data center numbers were even more impressive, increasing 279% year over year to $14.51 billion. Similarly, on the other end of the equation, adj. Net income increased nearly 600% year over year to $1.46 billion. EPS is $4.02, beating consensus by $0.63.

Heading into its fourth fiscal quarter (FQ4), NVIDIA expects revenue to reach $20 billion by a 2% margin, an increase of nearly 231% year-over-year. The Street expected just $17.82 billion.

Still, Muse believes the opportunity is still in its infancy given the generative AI landscape, which makes Nvidia a “top pick” for 2024.

“Generative AI is the most significant platform transition in history, much larger than previous technology cycles (PC, mobile, internet), and we are only 12 months old. Simply put. It is too early to call it a peak,” the analyst said. . “NVDA is an “AI platform” that provides both the hardware and end-to-end software stack capabilities to support this once-in-a-generation investment cycle (with an open-end TAM). Given the fact that NVDA is moving at an annual technology pace and also its historical willingness to do whatever it takes to remain competitive/remain a leader, we believe that NVDA’s key competitive position is I hope this will continue in the future. ”

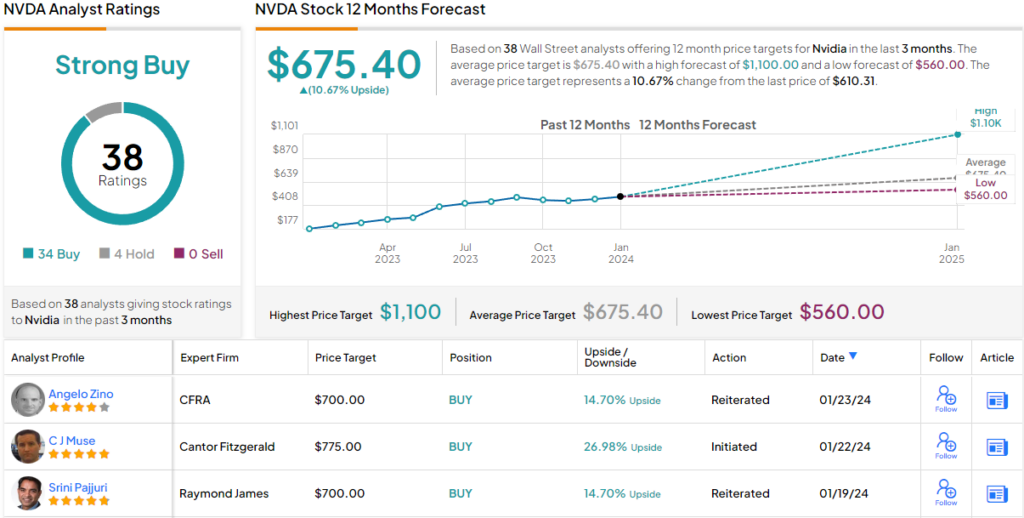

Accordingly, Muse initiated coverage on NVDA stock with an overweight (i.e. buy) rating and a price target of $775, implying that the stock will post another 27% growth next year. (To see Muse’s achievements, go to click here)

Looking at the consensus breakdown, NVDA claims a “Strong Buy” consensus rating, based on a total of 34 Buys to 4 Holds. Following the average price target of $675.40, the stock would return ~11% in one year. (look Nvidia stock price prediction)

Advanced Micro Devices

Now, Nvidia has established itself as an early and undisputed leader in the AI chip game, and its dominance is clear. But that doesn’t mean it has a space of its own. While other companies are trying to eat into the company’s market share, Advanced Micro Devices is considered by many to be its closest rival.

AMD has done similar things in the past, so don’t estimate this company’s ability to pose a serious threat. The CPU space once belonged solely to Intel, but AMD has steadily eroded Intel’s lead over the years, boosted by its own superior product line and capitalized on a series of misguided moves by the semi-giant. .

While not as surprising as Nvidia’s performance, AMD has also impressed over the past year, both in terms of stock price appreciation (up 200% since bottoming out in October 2022) and quarterly updates .

In its latest release for Q3 2023, revenue increased 4.1% year-over-year to $5.8 billion, beating consensus estimates by $110 million. In the bottom line, adjectives. EPS of $0.70 was 2 cents more than analysts expected. That said, there was some disappointment in the guide, as the company was pegging fourth-quarter revenue at the midpoint of $6.1 billion plus or minus $300 million, below the Street’s $6.39 billion estimate.

Nevertheless, as Muse points out, the prospect of the company becoming a stranglehold on Nvidia should be attractive to investors.

“We see AMD as a key beneficiary as the market eagerly seeks alternatives to NVDA in high-speed computing,” Muse explained. “Adding continued strength in DC CPUs, a gradual recovery in PC, and excellent operating leverage from high-margin data centers, we expect the buy-side to continue to push EPS to an estimated $6 as a stretch goal.”

“In our view, customers clearly want a second-source supplier to NVDA. The consensus model is that NVDA DC will be $75 billion in CY24, so as long as the supply chain can support this growth (and AMD is clearly working very hard here) ), it is not unreasonable to see an upside case approaching $5 billion or more,” the analyst said. he added.

As such, Muse initiated coverage on AMD with an Overweight (i.e. Buy) rating, in line with a $190 price target. This number incorporates his 7% growth over the year.

AMD stock also claims a consensus rating of “Strong Buy” based on a combination of 28 Buys to 8 Holds. However, some believe the stock price has overshot slightly. Thus, the average price target of $159.47 corresponds to a 10% downside from current levels. (look AMD stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.

[ad_2]

Source link