[ad_1]

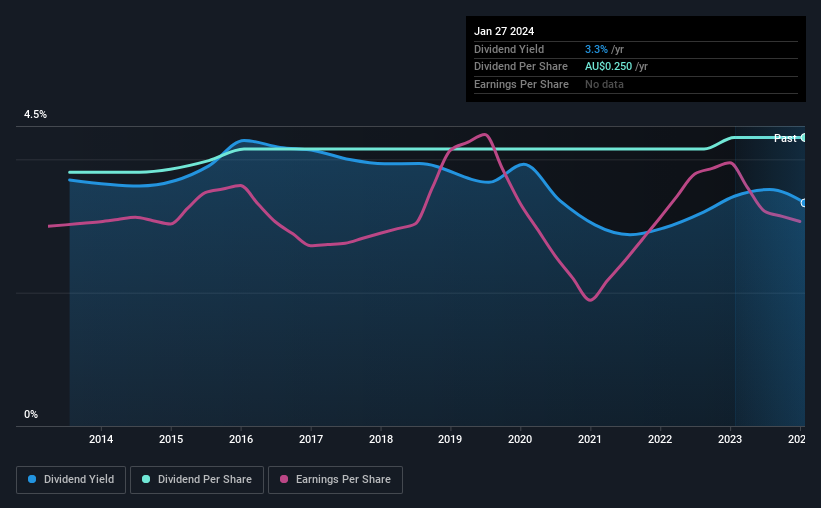

board of directors Australian Foundation Investment Company Limited (ASX:AFI) has announced that it will pay a dividend of A$0.115 per share on 26 February. This payment results in a dividend yield of 3.3%, which is in line with the industry average.

See our latest analysis for investing in Australia Foundation.

The Australia Foundation’s investments do not generate enough returns to cover payments.

I’m not very impressed with the dividend yield unless it can be maintained over the long term. Prior to this announcement, the company was paying him 107% of its revenue. It will be difficult to continue paying dividends at this level unless profits and cash flow increase.

If the company is unable to turn things around, EPS could decline by 5.9% next year. Assuming dividends continue in line with recent trends, he believes the payout ratio could reach 115%, which could put pressure on the dividend unless earnings start to improve.

Investing in Australia Foundations has a proven track record

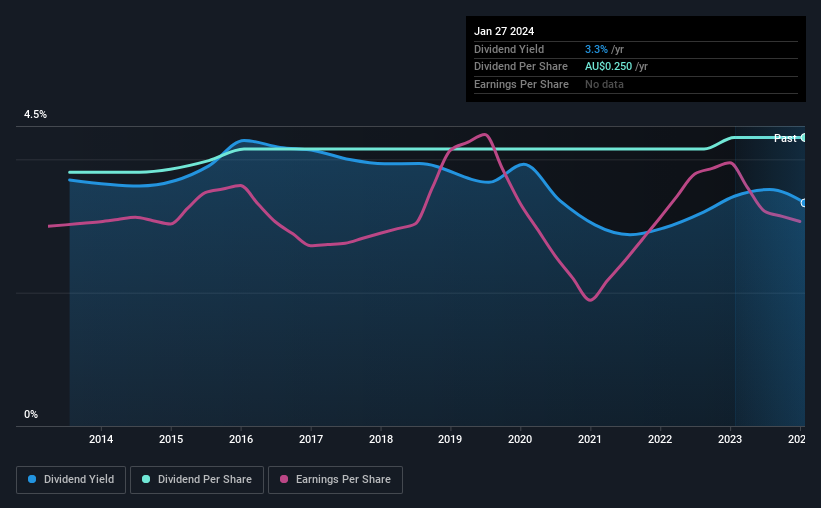

The company has a long history of paying stable dividends. Dividends totaled AU$0.22 per year in 2014, and the most recent total annual payment was AU$0.25. This works out to be a compound annual growth rate (CAGR) of approximately 1.3% over that period. Slow and steady dividend growth may not sound very appealing, but the dividend has been stable for 10 years, and we think this is a pretty attractive offer.

Increasing dividends may be difficult

Investors may be attracted to a stock based on the quality of its payment history. Unfortunately, things aren’t as good as they seem. It’s not great to see that Australian Foundation Investments’s earnings per share have fallen by around 5.9% per year over the last five years. If profits continue to decline, the company could be forced to make the difficult choice of cutting its dividend or, as opposed to increasing it, stopping it altogether.

Dividends may prove unreliable

Overall, we always hope the dividend will rise, but we don’t think Australian Foundation Investment will be a great income stock. We’ve been paid consistently so far, but we think it’s a little high to continue paying. This company is not among the top stocks that provide returns.

Companies with stable dividend policies are likely to attract more investor interest than companies that suffer from a more inconsistent approach. However, there are other things investors should consider when analyzing stock performance. I took the discussion a little further and found the following: 2 warning signs for Australian foundation investing That means investors need to be conscious moving forward. If you are a dividend investor, check out this article as well. A carefully selected list of high dividend stocks.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link