[ad_1]

Summary of recent stock trades for Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trade, Portfolio), a well-known investment management firm, recently changed its investment in Service Corp. International (NYSE:SCI), a leading provider of funeral and cemetery services. On December 1, 2023, the company reduced its holdings in SCI by 570,479 shares, impacting the portfolio by only -0.03%. This transaction reflects Baillie Gifford (Trading, Portfolio)’s ongoing portfolio adjustments in response to market conditions and investment strategy.

Investment Company Baillie Gifford (Trade, Portfolio)

With over a century of experience, Baillie Gifford (Trading, Portfolios) has established itself as a prominent investment management partnership by prioritizing the interests of existing clients and maintaining high standards of professional excellence. . The company manages assets for the world’s largest professional investors, including pension funds and financial institutions from various continents. Baillie Gifford (Trades, Portfolio)’s investment philosophy is rooted in fundamental analysis and proprietary research, with the goal of identifying companies with the potential for long-term, sustainable, above-average growth.

Service Corp International Overview

Service Corp International has been operating in the United States since its IPO on July 23, 1987 and specializes in funeral and cemetery services and products. The company’s business is classified as funeral and cemetery services, and the majority of its revenue is derived from funeral services. SCI has a market capitalization of $10.23 billion and is recognized for its significant contribution to revenue from the United States. The company’s financial performance is strong, with a P/E ratio of 21.78x, indicating profitability.

Baillie Gifford (Trades, Portfolio) trading details in SCI

Transaction details reveal that Baillie Gifford (Trading, Portfolio) executed a reduction in SCI stock at a price of $61.54 per share. After this transaction, the company’s total holdings in SCI will be 14,050,225 shares, representing 0.79% of the portfolio and 9.51% of traded shares. This adjustment is part of the company’s strategic portfolio management.

Service Corp International Stock Indicators

SCI’s current stock price of $69.26 is roughly in line with the GF value of $71.42, indicating that the stock is fairly valued. The price to GF value ratio is 0.97, suggesting that the stock is trading close to its intrinsic value. SCI’s GF score is an impressive 92 out of 100, reflecting its high potential to outperform. The company’s financial strength and profitability are further highlighted by its profitability rank of 9/10 and growth rank of 10/10.

Market performance after trade

Since the Baillie Gifford (Trade, Portfolio) transaction, SCI stock has increased by 12.54%, indicating a positive market reaction. While the year-to-date performance shows a modest increase of 0.28%, the historical performance since IPO boasts an impressive price change of 7953.49%.

Industry and sector insights

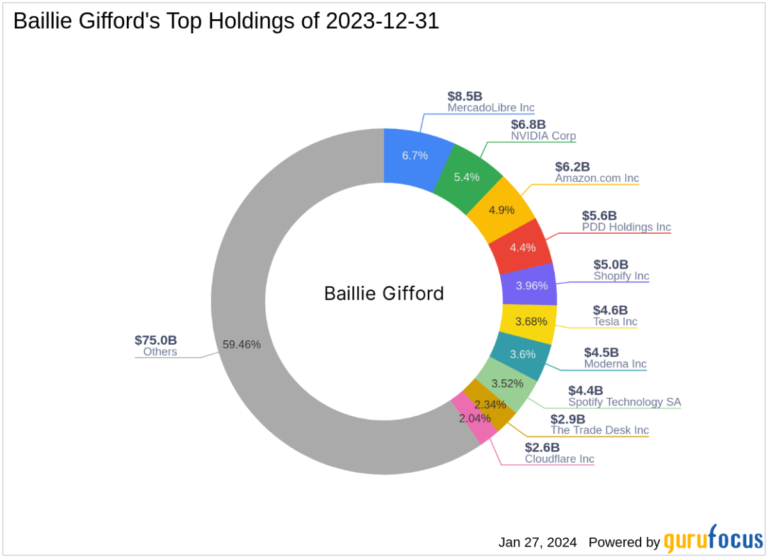

Baillie Gifford (Trades, Portfolio)’s top sectors include Technology and Consumer Cyclicals, with major holdings such as Amazon.com Inc (NASDAQ:AMZN) and NVIDIA Corp (NASDAQ:NVDA) . Within the personal services industry, SCI has a dominant presence and leverages its extensive network of funeral and cemetery services to maintain significant market share.

Shareholder comparative analysis

Compared to other major investors, Baillie Gifford (Trade, Portfolio) has a significant position in SCI, with an ownership of 9.51% of the company’s shares. His Gotham Asset Management, LLC, the largest shareholder, also maintains a significant investment in his SCI, although the exact percentage of the stake is not disclosed.

Transaction impact analysis

Baillie Gifford (Trades, Portfolio)’s decision to reduce its stake in Service Corp International is a strategic move in line with the company’s investment philosophy and market outlook. Although the transaction had minimal direct impact on the company’s portfolio, it reflects Baillie Gifford (Trade, Portfolios)’s proactive management approach and commitment to long-term value creation for its clients. Masu. As SCI continues to perform well in the market, Baillie Gifford’s (Trades, Portfolio) remaining stake in the company could contribute positively to overall portfolio performance.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link