[ad_1]

This year is a big year for the United States. Amid such political, economic, and social uncertainty, Americans may be tempted to postpone personal financial transfers until the next day. rear US presidential election in November.

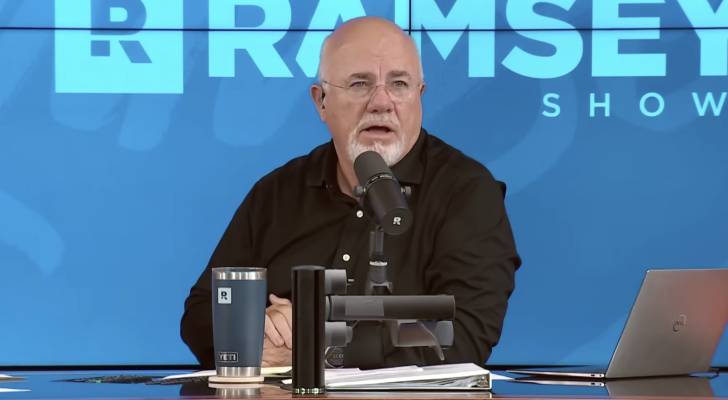

But money personality Dave Ramsey thinks it’s a “stupid idea”.

In a special feature on recent investments, ramsey show, he said: “I’m not waiting for old people, Trump and Biden, to collide. I’m not waiting for two 80-year-olds to take MMA. [fight] To decide what I will do. I mean, who the fuck knows? One of them may break a hip. ”

Do not miss it

Instead, he says he is “buying” and “investing” in the U.S. stock market, and believes 2024 could be a record year for stocks, so he also advises others ( without hesitation) encouraged them to do the same.

“Don’t wait for this…sit your butt on the bench,” Ramsey stressed. “Get in the game, shoot the ball, fire the gun, pull the trigger. Whatever metaphor you need to get them to actually get invested.”

Ramsey thinks about how you invest your pennies.

Is the S&P 500 index up by double digits?

Mr. Ramsey is a big proponent of investing in low-cost S&P 500 index funds and allowing your money to compound and grow.

The S&P 500, a powerful indicator of the overall U.S. stock market, posted an impressive annual return of 26.06% in 2023, and the market started 2024 inching closer to record highs.

Years in which the S&P 500 hits at least one all-time high typically coincide with the index’s median annual gain of about 15%, according to investment firm Ned Davis Research (NDR).

“Well…of course!” Ramsay said. “If the stock market sets a new record, there should be big gains. That’s a valid statistical correlation.”

NDR researchers said the data highlights two typical characteristics of stock markets. The idea is that strength begets more strength, and that stock prices usually don’t plummet from all-time highs.

If you want more evidence of stable returns before investing money in the S&P 500, Ramsey suggests doing this. “You can pull up historical data and see performance and trend lines. It’s not that difficult to understand.”

But if it’s too difficult, consider working with a financial advisor who can explain the basics and help you make investment decisions that are most likely to achieve your financial goals.

“All I can say is that we are on the verge of setting a new record in the history of the stock market,” Ramsey said. “If we can achieve that, it’s a great indicator that 2024 will be a great year for investing.”

read more: The Pennsylvania trio bought an abandoned school for $100,000 and converted it into a 31-unit apartment building.How to invest in real estate without all the hard work

Stop “timing the market”

When individual investors try to time the market, they often fail unless they are blessed with otherworldly foresight.

That’s because the stock market is extremely complex and responds to a myriad of variables, including economic growth, interest rates, political events, natural disasters, consumer sentiment, and corporate earnings.

And investors are often driven by emotion. Just how he reacts to one piece of good or bad news can have a huge impact on the success of his investment portfolio. It’s easy to press “sell” when things are down, but have you ever analyzed long-term trends and considered how things might improve in the future?

“If you still had the money, I would buy your mutual fund right now,” Ramsey said, strongly favoring the buy-and-hold strategy. “That’s how life is, so expect your stocks to go up and down,” he told investors. [and] That’s how the stock market works. ”

his ramsey show Co-host George Kamel chimed in with this advice: It turns out that if you just take your time riding this roller coaster, you can set new highs and set new highs. ”

To illustrate this point, Ramsey gave the example of continuing to save $100,000 in cash rather than investing that money in the S&P 500. If the market rose 15% in his one year, as NDR’s research suggests, he would lose $15,000. If you choose not to invest, resting on your laurels is a huge penalty.

The same goes for real estate.

Beyond traditional stock and bond investing, Ramsey’s ‘practical’ advice extends to real estate, and his comments are ideal for first-time homebuyers and investors looking for ways to diversify their portfolio with real estate. is heart-breaking.

“Will real estate collapse?” No [because] We have a huge housing shortage,” he said.

Housing supply in the United States has not kept up with population growth and demand in recent years. This is due in part to a decline in new construction and the lingering effects of pandemic delays and economic challenges. Limited housing inventory has kept home prices artificially high, and Ramsey doesn’t expect them to ease anytime soon.

“When you wait a year to buy a house for whatever reason to try to time the market, you get this uncanny insight that you’re on point. [prices] It’s going to decline – you’re wrong,” Ramsey said.

He warns that investors will “miss out” on opportunities if they wait a year to invest in real estate, but added: “If I’m wrong, I wouldn’t be wrong if I waited another 12 months.” He added.

What to read next

This article is for information only and should not be construed as advice. PROVIDED WITHOUT WARRANTY OF ANY KIND.

[ad_2]

Source link