[ad_1]

Li Lu, an external fund manager backed by Berkshire Hathaway’s Charlie Munger, says, “The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.” It has even been stated. In other words, financially smart people seem to know that debt (usually associated with bankruptcy) is a very important factor when assessing a company’s risk. the important thing is, Hewlett Packard Enterprise (NYSE:HPE) has debt. But the real question is whether this debt is putting the company at risk.

What risks does debt pose?

Debt and other liabilities become a risk to a company if it cannot easily meet those obligations through free cash flow or by raising capital at an attractive price. Ultimately, if a company fails to meet its legal obligations to repay debt, shareholders could walk away with nothing. But a more common (but still expensive) situation is when a company needs to dilute shareholders at a cheap share price just to manage its debt. Of course, debt can be an important tool in business, especially in capital-heavy businesses. When we think about a company’s use of debt, we first think of cash and debt together.

Check out our latest analysis for Hewlett Packard Enterprise.

What is Hewlett Packard Enterprise’s net debt?

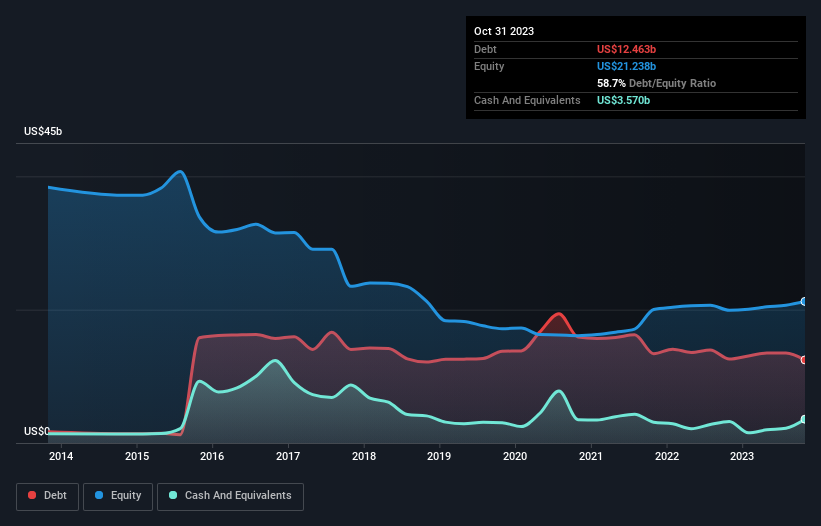

As you can see below, Hewlett Packard Enterprise had debt of US$12.5b as of October 2023, which is about the same as a year ago. Click on the graph to see details. However, he also had US$3.57b in cash, so his net debt is US$8.89b.

How healthy is Hewlett Packard Enterprise’s balance sheet?

Zooming in on the latest balance sheet data, we can see that Hewlett Packard Enterprise had liabilities of US$21.9b due within 12 months, and liabilities of US$14.0b due beyond that. . Offsetting this, it had cash of US$3.57b and receivables of US$3.48b due within 12 months. So its liabilities total US$28.9b more than its cash and short-term receivables, combined.

Given that this deficit is actually larger than the company’s massive $20.6 billion market capitalization, shareholders should really pay attention to Hewlett Packard Enterprise’s debt levels, like a parent watching their child ride a bicycle for the first time. We think it should. If the company were forced to raise capital at the current share price to pay down debt, it would require significant dilution.

By looking at net debt divided by earnings before interest, taxes, depreciation, and amortization (EBITDA) and calculating how easily earnings before interest and tax (EBIT) can cover interest, profitability can be calculated. Measures a company’s debt load against. Expenses (interest burden). Therefore, we consider debt relative to earnings, with or without depreciation.

Hewlett Packard Enterprise’s moderate net debt to EBITDA ratio (1.7) suggests that it is prudent when it comes to debt. Furthermore, the strong interest rate of 12.6 times further increases our sense of security. Hewlett Packard Enterprise’s EBIT increased by his 8.7% last year. This is not surprising, but it is good in terms of paying off debt. There’s no question that we learn most about debt from the balance sheet. But more than anything, it will be future earnings that will determine whether Hewlett Packard Enterprise can maintain a healthy balance sheet going forward.If you’re focused on the future, check this out free A report showing analyst profit forecasts.

Finally, companies can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of his EBIT that is matched by actual free cash flow. Over the last three years, Hewlett Packard Enterprise generated very solid free cash flow amounting to 91% of its EBIT. This exceeded my expectations. This puts the company in a very favorable position to repay its debt.

our view

Hewlett Packard Enterprise’s interest expense was very positive on this analysis, as was its EBIT to free cash flow conversion. But to tell you the truth, we had to be concerned about the level of total debt. Looking at all this data makes us a bit cautious about Hewlett Packard Enterprise’s debt levels. While debt has the advantage of increasing potential returns, we believe shareholders should explicitly consider how debt levels make the stock riskier. The balance sheet is clearly the area to focus on when analyzing debt. Ultimately, however, any company can contain risks that exist outside the balance sheet. For example, we discovered that 2 warning signs for Hewlett Packard Enterprise What you need to know before investing here.

At the end of the day, it’s often better to focus on companies with no net debt. You can access a special list of such companies (all with a track record of profit growth). It’s free.

Valuation is complex, but we help make it simple.

Please check it out hewlett packard enterprise Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link