[ad_1]

The artificial intelligence revolution is creating new giants in the stock market. Nvidia. But it’s also given a healthy boost to Nvidia processors and all the equipment inventory that helps produce all the memory needed for huge AI systems.

Case in point: Latest earnings release and commentary. ram research (LRCX -3.07%)which exceeded analyst expectations for the second quarter.

Although Lam is still emerging from a fairly deep downturn in its NAND flash memory business, the company has managed fairly resilient results over the past year, earning $27.33 per share at the bottom of the cycle. .

Additionally, management expects a strong recovery due to continued growth in new AI applications that require Lam’s chip manufacturing techniques.

Major semi-caps are a great business.

Lam Research is a leader in etching and deposition, fundamental steps in the manufacturing of all semiconductor and memory chips. The reassuring thing is that Lam can only really compete with one or two of his larger semi-cap competitors for these critical chip manufacturing steps.

What makes the semi-cap industry so attractive is that in many processes, the production of a single chip involves thousands of individual process steps, and just one or two companies tend to dominate those steps. “We’re very excited about this,” Rum CEO Tim Archer said on a recent conference call with analysts.

[T]Running these upgraded chambers on the next technology node tends to spark an understanding of all the ideas and challenges that need to be solved on the next node. I think that’s why it tends to be very difficult to break out of installed base positions or established positions in this industry. And we tried to invade others. And we know that very well.

This is why I have written extensively about the semiconductor equipment sector and how it is actually a wide-moat recurring revenue business, even if performance has to go through periodic ebbs and flows from year to year. about it.

Lam’s stock is on the rise as it helps customers do the same

Fortunately for Lam, the specific process steps in which it dominates are etching, deposition, and packaging techniques that facilitate vertical stacking of chip materials. This allowed Lam to start stacking his NAND modules vertically from 2012 and dominate the NAND flash industry.

Unfortunately, the NAND industry entered its worst downturn in history about two years ago. But not only is NAND finally poised to return to circularity, but AI chips in the form of both chiplet-based logic processors and high-bandwidth DRAM memory (HBM) are requiring “verticalization” for the first time. is. . So it’s kind of like the 2012 moment happening again, but there’s probably an even bigger market opportunity across logic and DRAM.

In fact, on the same conference call, Archer said, “We talked about the fact that in high-bandwidth memory, Lam has 100% market share of the key technology needed in the DRAM stack.” That’s right — 100% market share Of that important step. Archer also noted that Lamb expects HBM-related advanced packaging equipment revenues to more than triple in 2024.

HBM is currently the bottleneck for AI applications and should grow rapidly this year. Needless to say, this will be Lam’s strength, and it’s why Lam should continue to gain market share in the AI space in 2024.

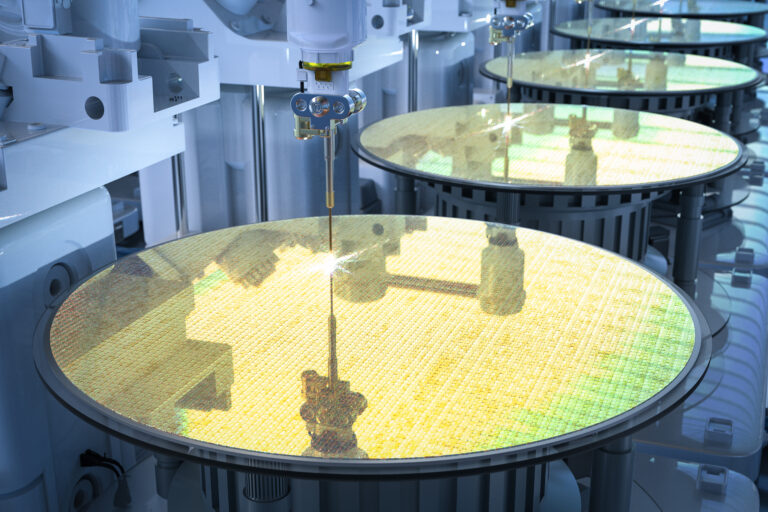

Image source: Getty Images.

Lam looks to the future

But management isn’t resting on its laurels, pointing to continued R&D investment in four key areas that will enable better AI chips in the future. These four specified technologies include the new gate all-round transistor, which all major logic customers are migrating to in the upcoming 2nm node. The new transistor structure is more complex to execute and has improved etch and deposition strength, which should help Ram’s bottom line.

Additionally, Lam is investing in technology that enables “backside power,” which moves the power I/O controller to the back of the chip and increases the surface area on the die to fit more transistors.

Lam is also investing further in state-of-the-art packaging etch and deposition equipment, which enables the “chiplet” architecture used by the company. Advanced Micro Devices’ New MI300 AI chip and possibly future AI chips intel others.

Finally, Mr. Lam will continue to cooperate closely. ASML Holdings (ASML -0.15%) Dry resist technology combined with EUV lithography. While ASML’s EUV is a key technology enabling cutting-edge chip scaling below 7nm, Lam’s breakthrough dry resist technology increases the resolution and limits defects of his EUV printed chips. , helps improve productivity.

AI will also help Ram with its high-margin services.

In addition to strong incumbency bias, another positive aspect of half-cap stocks, especially rum stocks, is their service business. Our services business includes spares, maintenance, and other software and intelligence services designed to improve the functionality of our equipment. It’s not as “repetitive” as software, but it’s much more stable than the more volatile equipment business.

For Lam, its services business accounted for 39% of its revenue last quarter, which is significantly higher than its peers. Additionally, while Tool Chamber’s installed base has increased by 50% since 2019, Ram management noted that its services business has grown by 80% in that time. This means Lam is innovating more services with each tool that customers find useful.

Management also highlighted the services business as a place that would benefit from the use of artificial intelligence. Not only has Lam developed big data applications that help customers run their tools better and limit defects, he also leverages AI to run equipment services instead of highly paid engineers. I started using a “collaborative robot” that I developed.

This should not only allow customers to innovate faster, but also limit Lam’s costs. Lam currently already earns an operating profit margin of 30%, but that margin could grow even further as AI is increasingly used to replace expensive labor.

Overall, as an enabler of AI chip manufacturing and a user of AI to improve services, Lam is incredibly well-positioned for the coming AI era. The recent surge in the stock price is not surprising, and is very likely to continue.

[ad_2]

Source link