[ad_1]

Last year was an incredible year for me. Advanced Micro Devices (NASDAQ: AMD) The chipmaker’s stock price soared an astonishing 130%, outpacing its stock price among investors. PHLX Semiconductor Division The index rose by a whopping 57%. Investors have continued to buy the stock, anticipating rapid acceleration in the company’s growth thanks to demand for artificial intelligence (AI)-driven chips.

Even Wall Street is optimistic about AMD’s prospects. Earlier this month, the company’s stock price barclays, Susquehanna Financial Group, and KeyBanc Capital Markets. Barclays raised its price target on AMD to $200 from its original estimate of $120, while KeyBank and Susquehanna raised their price targets to $195 and $170, respectively. AMD’s closing price on January 23rd was $168.

While analysts aren’t always right, these price targets suggest that AMD stock is set for a healthy upside. But analysts at Northland Capital Markets think differently. The investment banking firm recently lowered its rating on AMD stock from “outperform” to “market perform,” noting that the company’s AI business may not grow as quickly as investors expect.

Northland also said AMD’s strong rally over the past year means the stock price is already reflecting the potential for AI-driven revenue growth that the company could record through 2027. Does this mean AMD stock is priced for perfection at the moment and may struggle to maintain its blistering rise over the next three years?

AMD stock price is high, but that’s only half the story

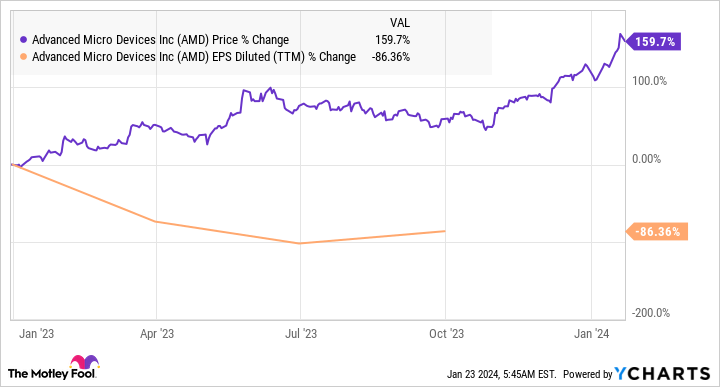

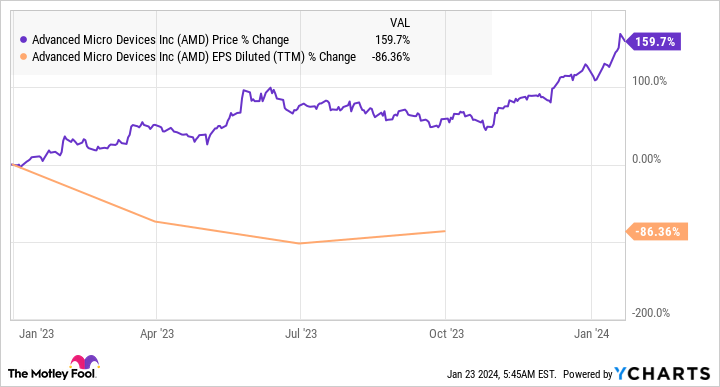

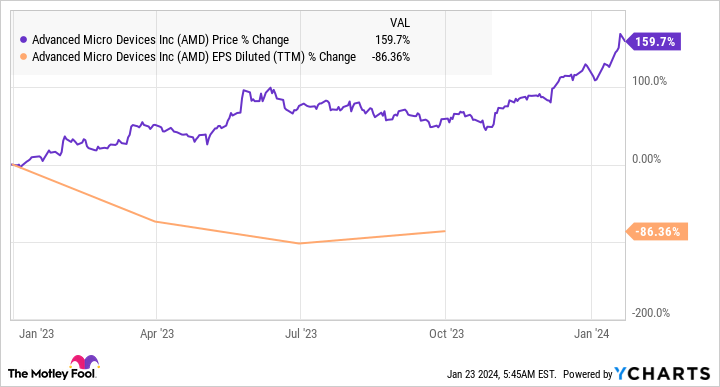

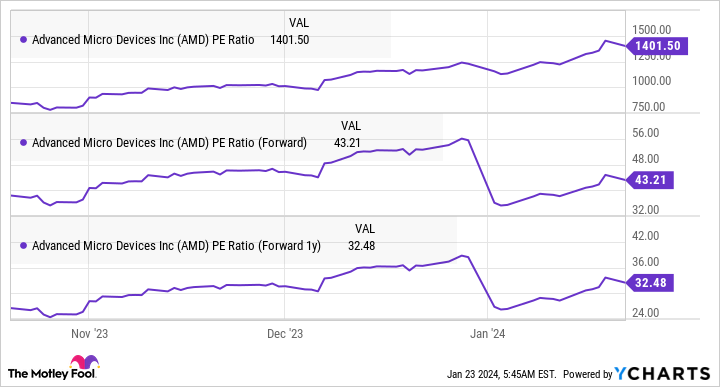

AMD trades at an impressive price-to-earnings ratio of 1,500 times. This is a result of the incredible jump in share prices over the past year, and the fact that profits have declined at the same time.

AMD’s decline in revenue is thought to be due to the slump in the personal computer (PC) market. According to him, PC sales decreased by almost 15% in 2023. gartner.

Specifically, AMD’s revenue from sales of central processing units (CPUs) found in desktops and laptops fell nearly 40% year over year to $3.2 billion in the first nine months of 2023. The division posted an operating loss of $101 million this quarter, compared to an operating profit of $3.1 billion a year earlier.

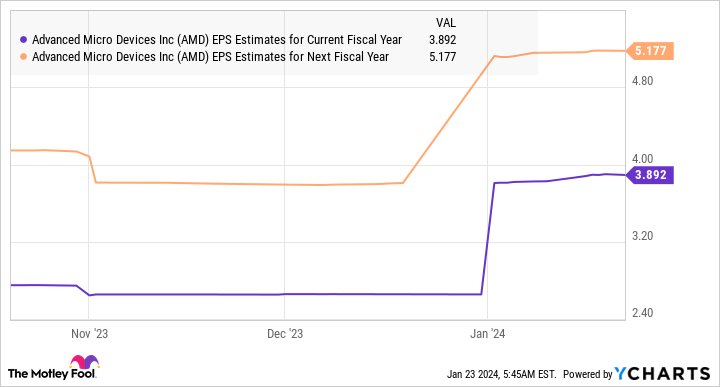

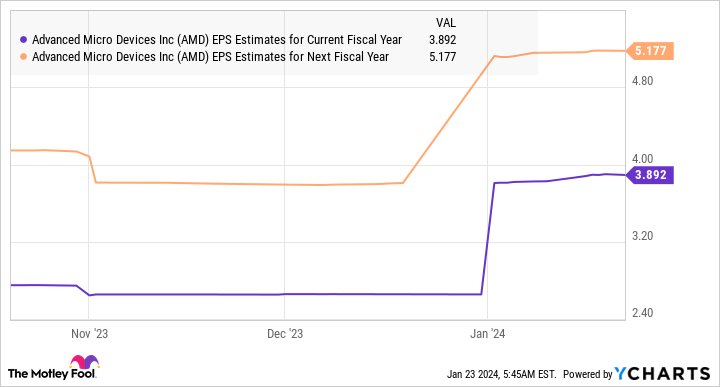

As a result, AMD’s total operating income for the first three quarters of 2023 was just $59 million, down from $1.4 billion a year earlier. The company’s 2023 earnings are expected to be $2.65 per share, down from $3.50 per share in 2022. However, as the following graph shows, AMD’s profits are expected to increase significantly starting this year.

This solid increase in AMD’s earnings is why AMD’s future earnings multiple is much cheaper than its trailing earnings multiple.

There are two reasons why consensus forecasts predict such a big turnaround for AMD in 2024.

First, the PC market is expected to grow by 8% in 2024, according to Canalys. More importantly, market research firms predict that PC shipments will increase by 10% annually in 2025, 2026, and 2027. So the biggest factor weighing on AMD’s earnings should be a thing of the past this year and beyond.

The good news is that the potential for an upturn in the PC market is already showing up in AMD’s financials, as client segment revenue in the third quarter posted an impressive 42% year-over-year increase. Additionally, operating income was reported at $140 million, compared to an operating loss of $26 million in the same period last year.

Second, AMD’s data center business is expected to experience solid growth. The segment’s revenue fell 4% to $4.2 billion in the first nine months of 2023. At this pace, AMD could finish 2023 with his $5.6 billion in data center revenue. However, analysts predict that sales of AMD’s AI-focused accelerators will increase significantly this year, potentially allowing the company’s data center business to soar.

AMD itself predicts $2 billion in revenue in 2024 from its AI GPUs (graphics processing units), while a supply chain study by KeyBanc estimates $8 billion from sales of the newly launched MI300 family of AI chips. It has been shown that it has the potential to generate revenue. It’s worth noting that AMD’s data center revenue in 2023 will consist almost entirely of server CPU sales.

That means the $8 billion in revenue AMD expects to generate from sales of AI chips will be almost entirely incremental to its data center business.

And AMD is expected to gain further share in the AI chip market, which could lead to solid long-term growth for the company.

AI could give AMD a big boost over the next three years

Northland Capital Markets analyst Gus Richard predicts that AMD could capture a 13% share of the AI chip market by 2027, generating an estimated $16 billion in revenue. There is. This suggests that AMD’s AI revenue is expected to double annually starting in 2024, based on the company’s estimate that AMD will sell $2 billion worth of AI chips this year.

However, other estimates, such as from KeyBanc, indicate that AMD could reach its $16 billion goal at a faster pace.

But even with Northland’s relatively conservative forecast that AMD’s overall revenue will rise to $45 billion in 2027, investors can still expect the stock to rise further over the next three years. AMD’s five-year average sales multiple is 8x, and its market cap could reach $360 billion in 2027, based on an estimated $45 billion in sales. This would be a 32% increase from current levels.

However, given that companies that benefit from AI tend to receive higher valuations from Wall Street, the market could reward AMD with a higher sales multiple, so even if AMD delivers further upside. Don’t be surprised.

Should you invest $1,000 in Advanced Micro Devices right now?

Before buying Advanced Micro Devices stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Advanced Micro Devices wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of January 22, 2024

Harsh Chauhan has no position in any stocks mentioned. The Motley Fool has a position in and recommends Advanced Micro Devices. The Motley Fool recommends Barclays Plc and Gartner. The Motley Fool has a disclosure policy.

What will AMD’s stock price be like in three years? Originally published by The Motley Fool

[ad_2]

Source link