[ad_1]

While some investors are already familiar with financial metrics (hat tip), this article is for those who want to learn about return on equity (ROE) and its importance. As a practical example, let’s examine National Building and Marketing Co. (TADAWUL:9510) using ROE.

Return on equity or ROE tests how effectively a company is growing its value and managing investors’ money. In other words, this reveals that the company has been successful in turning shareholder investments into profits.

Get the latest analysis on nation building and marketing.

How is ROE calculated?

Return on equity can be calculated using the following formula:

Return on equity = Net income (from continuing operations) ÷ Shareholders’ equity

So, based on the above formula, the ROE for Nation Building and Marketing is:

13% = JPY 410,000 ÷ JPY 3,030,000 (Based on the twelve months to June 2023).

“Return” is the profit over the past 12 months. One way he conceptualizes this is that for every SAR1 of his shareholders’ equity, the company made a profit of his SAR0.13.

Does nation building and marketing have a high return on equity?

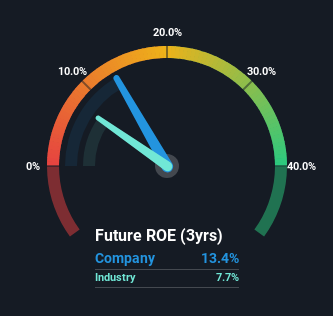

By comparing a company’s ROE with the industry average, you can easily measure how well a company performs. A limitation of this approach is that some companies are very different from others, even within the same industry classification. Pleasingly, National Building and Marketing has a better ROE than the average (7.7%) in the Trade Distribution industry.

That’s a good sign. However, keep in mind that a high ROE does not necessarily mean efficient profit generation. The higher the proportion of debt in a company’s capital structure, the higher its ROE can be, and high debt levels can pose a major risk. To learn about the four risks we have identified for National Building and Marketing, visit our risks dashboard for free.

Why you need to consider debt when considering ROE

Businesses usually need to invest money to increase their profits. Cash for investments can come from previous years’ profits (retained earnings), issuing new shares, or borrowings. In the first and second cases, ROE reflects the use of cash for investment in the business. In the latter case, using debt increases returns but does not change equity. Thus, the use of debt increases his ROE even if the core economics of the business remain unchanged.

National Building and Marketing’s debt and ROE of 13%.

National Building and Marketing’s heavy use of debt is notable, giving it a debt-to-equity ratio of 1.17. It’s hard to get excited about this business at the moment, as it has a fairly low ROE and heavy use of debt. Debt increases risk and limits a company’s options in the future, so you usually want to get some return from using debt.

summary

Return on equity is one way that you can compare the quality of business of different companies. According to our book, the highest quality companies have a higher return on equity despite having less debt. All else being equal, a higher ROE is better.

However, if the quality of your business is high, the market will often bid up to a price that reflects that. Earnings growth rates and the expectations reflected in the share price are particularly important to consider. Check out National Building and Marketing’s past profit growth by looking at this visualization of past earnings, revenue and cash flow.

of course National Building and Marketing may not be the best stock to buy.So you might want to see this free A collection of other companies with high ROE and low debt.

Valuation is complex, but we help make it simple.

Please check it out nation building and marketing Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link