[ad_1]

-

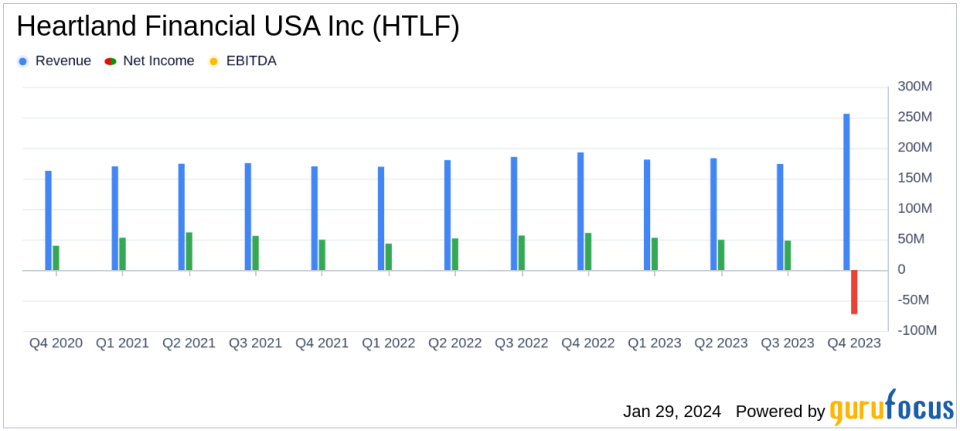

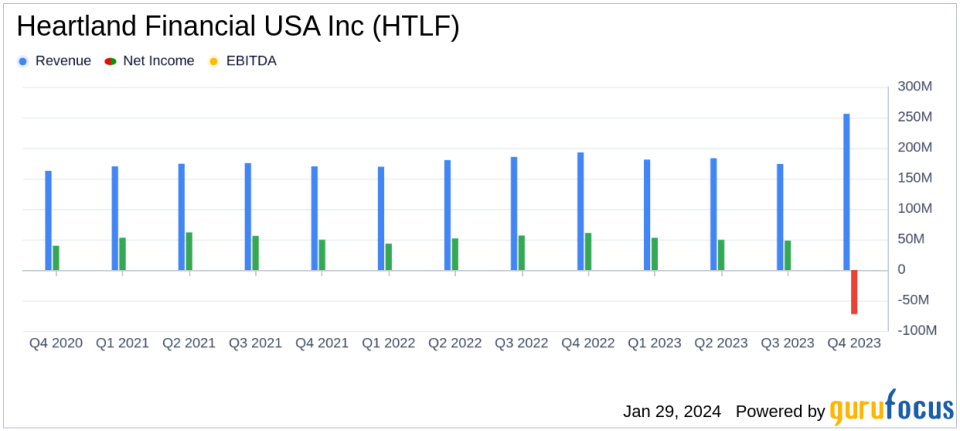

Fourth quarter net loss: Heartland Financial USA Inc reported a net loss available to common stockholders of ($72.4 million) or ($1.69) per diluted common share for the fourth quarter of 2023.

-

Adjusted profit: Adjusted earnings available to common stockholders, excluding certain losses and expenses, were $45.6 million, or $1.06 per diluted common share.

-

increase in financing: The company experienced loan growth of $196.2 million, or 2%, in the fourth quarter.

-

increase in deposits: Average customer deposits increased by $270.7 million or 2%.

-

Improvement in net interest margin: Net interest margin, full tax equivalent (non-GAAP), improved 34 basis points to 3.52%.

-

Annual results: For the year ended December 31, 2023, net income available to common stockholders was $71.9 million, a decrease of 65% from the prior year.

On January 29, 2024, Heartland Financial USA Inc. (NASDAQ:HTLF) released its 8-K filing disclosing its financial results for the fourth quarter and year ended December 31, 2023. The company, which provides banking services to a diverse customer base, faced a difficult quarter with common shareholders reporting a net loss of ($72.4 million) or ($1.69) per diluted common share. This is a significant decrease from net income of $58.6 million, or $1.37 per diluted common share, in the prior year period.

Despite the reported net loss, HTLF’s adjusted earnings, excluding losses related to balance sheet realignment and other non-recurring charges, were $45.6 million, or $1.06 per diluted common share. became. The company also reported that loan volumes increased by $196.2 million, or 2%, and average customer deposits increased by $270.7 million, or 2%. Additionally, the common equity ratio increased to 9.27% and the tangible common equity ratio (non-GAAP) improved by 80 basis points to 6.53%.

HTLF’s net interest margin improved by 34 basis points to 3.52% on a full tax-equivalent basis. However, the reported net loss significantly improved the efficiency ratio, resulting in an efficiency of 293.86% for the quarter compared to 60.05% in the year-ago quarter. The adjusted efficiency ratio on a full tax equivalent basis was 59.31%.

For the year ended December 31, 2023, HTLF reported net income available to common shareholders of $71.9 million, which was a 65% decrease compared to $204.1 million in the prior year. Adjusted earnings available to common stockholders for the year were $193.9 million, a 7% decrease from $209.5 million in the prior year.

Bruce K. Lee, President and CEO of the company, commented on the results and strategic initiatives as follows:

“2023 was a year of significant progress and successful execution of the HTLF strategic plan. With the completion of the Charter Integration Initiative in the fourth quarter, we are now driving efficiency gains and efficiency gains. HTLF 3.0 is a series of initiatives that will deliver EPS growth, higher return on assets, and more efficient use of capital. ”

HTLF’s strategic plan, HTLF 3.0, includes investing in growth through expansion of the bank’s workforce and talent acquisition, expanding financial management products and capabilities, building a digital platform for consumers and small businesses, and delivering efficient returns on capital. Includes footprint and facility optimization with an emphasis on

HTLF’s balance sheet repositioning resulted in a pre-tax loss of $140 million, and the company incurred $944,000 in restructuring charges due to the centralized scope of retail management, $1.1 million in restructuring charges and property sales/write-downs of $210 It cost me $10,000. Footprint integration.

The company’s fourth quarter net interest income was $156.1 million, a decrease of $9.1 million, or 5%, compared to the same period last year. Total non-interest income decreased by $141.8 million to $111.8 million. This was primarily due to his $140 million net securities loss related to the balance sheet repositioning strategy implemented during the quarter.

As Heartland Financial USA Inc navigates its strategic initiatives and challenges faced in the fourth quarter, investors and stakeholders will closely monitor the company’s performance and the impact of HTLF 3.0 on future growth and profitability I will do it.

For more information, please see Heartland Financial USA Inc’s full 8-K earnings release here.

This article first appeared on GuruFocus.

[ad_2]

Source link