[ad_1]

Arcus Bioscience (New York Stock Exchange: RCUS) Soared in pre-market trading after the clinical-stage biopharmaceutical company announced changes to its collaboration agreement and a separate equity investment by Gilead Sciences (guild) Arcus common stock has a value of $320 million, or $21 per share. With this investment, Gilead’s ownership in Arx increased to 33%.

This equity investment will give Gilead an additional seat on the Arcus Board of Directors, increasing the number of seats controlled by Gilead to three. This investment extends Arcus’ funding period until his 2027.

The amendments will accelerate the joint development program, allowing Gilead to advance its domvanalimab program and Arcus to focus on multiple pipeline assets. Gilead and Arcus aim to prioritize advanced Phase 3 trials in lung and gastrointestinal cancers and aim for full enrollment by the end of the year. They are planning a new phase 3 lung cancer study combining domvanalimab and zimberelimab, prioritizing the TIGIT pathway and domvanalimab design given its potential efficacy and safety benefits.

While donvanalimab and zimberelimab are investigational molecules, TIGIT is an important inhibitor of antitumor responses.

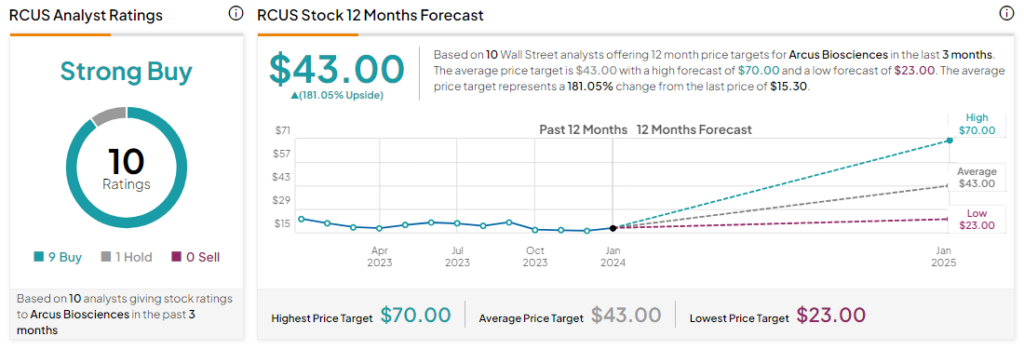

What is the target price for RCUS stock?

Analysts remain bullish on RCUS stock, with a consensus rating of Strong Buy based on 9 Buys and 1 Hold. Over the past year, he has seen RCUS stock decline over 30%, and RCUS’s average price target of $43 means it has over 100% upside potential at current levels.

[ad_2]

Source link