[ad_1]

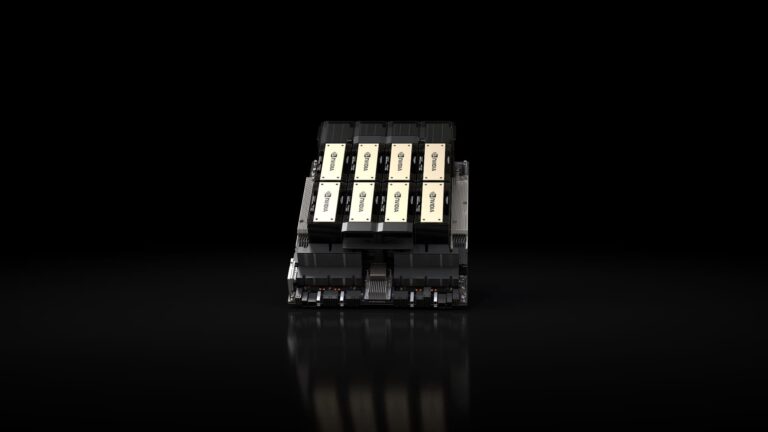

The market is officially in a new bull market, and investors are wondering which stocks can continue to outperform. After soaring 24% in 2023, the S&P 500 index is up more than 3% year-to-date and just closed above 4,900 for the first time. The broader market index has also risen more than 36% since its October 2022 low. The Dow Jones Industrial Average also reached an all-time high, along with the Nasdaq 100 index. As in 2023, supercap tech companies are driving most of the market’s rally. Will Rhind, CEO of GraniteShares, believes AI remains one of his strongest market themes in 2024. Here are his five stock picks for investors in 2024. This includes the names of several chip manufacturers and cryptocurrencies. Brands are listed in no particular order. Nvidia Nvidia is “really a leader in terms of AI stocks,” Lind said. The stock is up 26.1% year to date in 2024 and 206.7% over the past 12 months. The company is scheduled to announce its fourth quarter results on February 21st. Lind said traders will be watching to see if the company can continue the strong earnings it has achieved to date. According to Bespoke Investment Group, NVIDIA has exceeded his earnings estimates for four consecutive quarters. Over the past two quarters, the year-on-year P/E earnings have more than doubled. However, “there has been a big question mark since the end of last year, especially regarding export controls for strategic and chip technology,” Lind said. “It’s clear that companies have simply found a way to continue exporting chips to China this year, so the only question is how will that be reflected in the profit numbers that we’re going to see? I think so.” he added. AMD Another chipmaker on Rhind’s list is AMD, which he thinks is “worth talking about considering it doesn’t get as much attention as NVIDIA.” But in a market where the strongest theme is AI, this is clearly going to be a multiple winner. ” Lind said. Rhind said that within the chip sector, consumers want competition and better prices, and outside of NVIDIA, he said AMD is “the best of the bunch.” AMD stock has increased more than 20% since the beginning of the year and 135.8% in the past 12 months. AMD 1Y Mountain AMD Coinbase investors in the past 12 months named his Coinbase as the leading crypto stock. The stock rose in the last few months of 2024, but as enthusiasm around Bitcoin ETFs waned, the stock fell 23.6% in 2024. Despite this, the stock price has more than doubled in the past 12 months. Cryptocurrency wallet prices remain “significantly higher than levels in the middle of last year, and that is reflected in Coinbase’s earnings, ultimately leading to Coinbase’s rise in a market experiencing significant renewed interest in cryptocurrencies.” “I think it’s going to be another strong year for “through equity ETFs,” Lind said. Alibaba China-based tech giant Alibaba is experiencing some turmoil amid growing concerns about a weak Chinese economy and a hit stock market. But Lind said Alibaba is a “macro value play” that could surprise investors. Alibaba is “one of the highest quality companies, if not the highest quality company in the Chinese market,” Lind said. The company’s co-founders Jack Ma and Joe Tsai bought $200 million worth of stock in the fourth quarter, boosting the stock price slightly. The stock is down 5% year-to-date and 37.8% over the past 12 months. “If you’re looking for access to China, Chinese technology, and top-quality companies, Alibaba stands out for me,” Lind said. Meta Rhind also favors Meta as he moves away from the Metaverse and focuses on his AI. Meta is also one of the top gainers of 2023, up 164.2% in 12 months. By 2024, the stock price has increased by 13.3%. Indeed, for Meta and the broader Magnificent Seven, “last year’s profits were phenomenal, so it’s hard to suggest that it will be the same again, all things being equal,” Lind said. Told. “So I think we always expect the numbers to be lower than last year.” However, Lind said the company will continue to look more closely at margins and focus on cost management and AI. We are optimistic that the company will continue to invest enthusiastically.

[ad_2]

Source link