[ad_1]

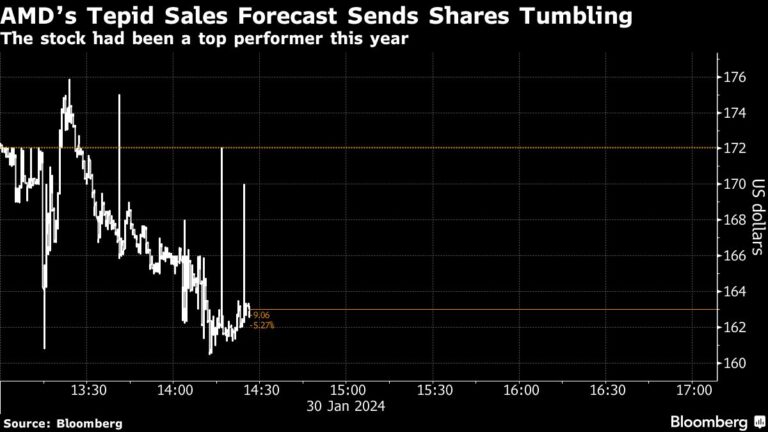

(Bloomberg) – Shares of Advanced Micro Devices Inc. pared losses Wednesday after investors hedged on downside expectations for the first quarter on optimism about new artificial intelligence processors.

Most Read Articles on Bloomberg

Revenue for the current quarter is expected to be significantly lower than analysts expected, but the company expects to generate more than $3.5 billion in revenue this year from its so-called AI accelerator product line announced last month, up from an earlier estimate of $2 billion. It has increased. Such chips are in high demand as they help companies inundate them with data to develop their AI models.

On the Bloomberg TV show, CEO Lisa Su said she was confident in the relative merits of AMD’s new chips and said the overall market was in the early stages of a huge expansion. . Total demand should improve in the second half of this year, and her company, which outsources manufacturing, has secured enough supply to exceed her $3.5 billion AI target.

“We are planning even higher numbers as it relates to the supply chain,” she said. “We have good visibility regarding exact orders for the coming quarters.”

For now, AMD’s overall business remains sluggish. The company announced Tuesday that first-quarter sales would be approximately $5.4 billion. That was lower than the $5.77 billion that analysts had expected and echoed rival Intel’s pessimistic view of the PC and data center chip market.

The outlook renewed concerns that customers are holding back on purchases in AMD’s core markets of PCs, servers, gaming consoles and programmable processors.

AMD stock has been one of the favorite stocks for investors looking for a way to bet on AI computing. The company’s stock is the second-best performing stock on the Philadelphia Stock Exchange’s Semiconductor Index this year, following a similar performance in 2023.

After Wednesday’s early decline, stocks have started to recover. As of 2:55 p.m. in York, the stock was down 1.2% at $169.91.

The big question is whether AMD’s MI300 processor can compete with the dominance of Nvidia Corp. and its H100. According to estimates, the company’s revenue doubled in the latest fiscal year. Wolfe Research analyst Chris Caso said AMD’s increased forecast for MI300 is a positive sign, but Wall Street is predicting a number as high as $8 billion.

On the other hand, Intel is experiencing sluggish demand in the programmable processor market, an area in which it also competes with AMD. Even after these chips are installed in electronic devices, their functionality may change or be updated.

Intel said in its quarterly report last week that the lucrative data center processor market was also depressed. AMD warned investors three months ago that demand for gaming consoles and embedded processors was slowing. The company reiterated that belief Tuesday, saying those markets will remain weak this year.

AMD said its gross profit margin (the percentage of sales remaining after production costs are deducted) will be around 52% in the first quarter, as expected.

Fourth-quarter earnings were 77 cents per share, excluding certain items, in line with expectations. Revenue was $6.17 billion, with the average estimate of $6.13 billion.

AMD’s PC chip division’s sales came in at $1.46 billion, compared to expectations of $1.51 billion. Data center sales were $2.28 billion, slightly short of expectations of $2.3 billion. Sales related to gaming computers were $1.37 billion. Analysts had expected the division’s sales to be $1.25 billion.

The company is the second-largest maker of chips that go into add-in graphics cards that turn PCs into gaming consoles. We also provide chips for game consoles from both Sony Group and Microsoft. Nvidia leads the PC add-in card chip market.

The Santa Clara, Calif.-based company is also Intel’s biggest rival in computer processors, a key component of laptops, desktops and server machines.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link