[ad_1]

good morning. Generative AI is transforming business, but what does that mean for employees? Linda Gratton, human capital expert and Professor of Management Practice at London Business School, says executives are I hope you keep this question in mind.

In yesterday’s interesting MIT Sloan Management Review webinar, “What AI Means for Human Capital,” Gratton talked about how generative AI, with its easily accessible nature and high degree of automation, is redefining work. We discussed whether we are providing opportunities to do so.

“For me, as a psychologist, the question is the nature of work: ‘Why do we work?’ And what do we get out of it?” she explained. “If we lose sight of that question, we become completely transactional.”

Gratton, who is also the founder of London-based research and advisory group HSM Advisory, identifies the main areas where generative AI is impacting companies’ talent strategies, based on what he hears from clients around the world. He said there are three.

first of all, talent developmentThis includes recruitment and referrals and career management. “There’s a lot of research being done right now using chatbots and generative AI to help us understand ourselves,” she said. Secondly, ProductivityThis includes managing assessments, feedback, skills, training, and collaboration. However, she is most active in Change management—or the management of internal and external knowledge.

“I’ve been studying companies for 30 years, and one of the things that we’re very concerned about is that we have so much knowledge within our organizations, but we don’t know where it is. That’s it,” Gratton explained. “I don’t know how to find that. And this seems like an area that we’re particularly focused on from a generative AI perspective.”

For example, British multinational law firm Allen & Overy LLP is experimenting with generative AI to access all of its cases and contract drafts, she said. McKinsey & Company uses Lilli for internal knowledge management. According to the company, “This is a platform that provides efficient and unbiased search and synthesis of the vast knowledge we have accumulated, delivering the best insights to our customers quickly and efficiently.” Morgan Stanley, meanwhile, is using generative AI solutions to help provide wealth management advice to clients, Gratton said.

“It would be a big mistake to view generative AI simply as an alternative technology,” she said. “As humans, if we want to get the most out of this amazing technology, we need to see it as an expansion process.”

Have a nice weekend.

Cheryl Estrada

sheryl.estrada@fortune.com

What will happen next: luckThe CFO Collaborative is an invitation-only group of CFOs from leading companies who come together virtually and in-person to have in-depth discussions about what matters most.

Next month’s topic is “Determining the GenAI Value Proposition.” This intimate dinner discussion, scheduled for February 28th in Houston and hosted in partnership with Workday and Deloitte, will explore how companies can make the most of the AI revolution and how they can incorporate GenAI. Explore necessary operational and organizational changes.

with me, luck Senior Editor Jeff Colvin speaks with Niccolo De Masi, Chairman of Futurum Group, a global technology advisory firm, and leading CFOs in Houston and beyond.

This is an invite-only event, but CFOs can apply to participate here. If you would like more information, please email CFOCollaborative@Fortune.com.

Leader board

Here are some notable developments this week:

François-Xavier Roger He will be appointed CFO of Sanofi effective April 1, succeeding Jean-Baptiste Chassleuth de Châtillon. Roger joins from Nestlé, where he has been CFO for over eight years. Prior to joining Nestlé, he served as CFO of Takeda Pharmaceutical Company, based in Japan. He also served as his CFO of Danone Asia, Danone Group’s head of finance and finance and tax, and his CFO of Millicom.

Anne Melman, EVP and CFO of casual shoe company Crocs Inc. (NASDAQ:CROX) has been promoted to EVP and President. Mehlman will succeed Michelle Poole, who has decided to retire. Poole will remain in his current role until early May and will serve as an advisor until early 2025. Mehlman will continue as CFO while Crocs searches for her successor. Melman left Crocs in 2016 to serve as CFO of Zappos.com, before she rejoined the company as CFO in 2018.

Scarlett O’Sullivan has been named CFO of Leaf Home, a direct-to-consumer provider of technology-enabled home improvement products and solutions. Prior to joining Leaf Home, Mr. O’Sullivan spent nearly eight years as CFO at Rent the Runway, where he was instrumental in taking the company public in 2021. Prior to that, Mr. O’Sullivan led technology IPOs as an investment banker and through his venture capital investing experience at SoftBank.

Lenny Gaeta Mr. Gaeta has been appointed Chief Financial Officer (CFO) of Shockwave Medical, Inc. (NASDAQ: SWAV), effective February 5, 2024. Gaeta replaces Dan Puckett, who has served as Shockwave’s CFO since 2016 and previously announced his decision to retire. Mr. Gaeta most recently served as his CFO for Eko Health. Prior to that, he was with Establishment Labs Holdings, Inc. where he served as CFO and member of the management team and played a key role in the company’s initial public offering.

philip moon Appointed CFO of Homebase, an HR and team management app. Mr. Moon previously worked with Morgan Stanley, advising clients on mergers and acquisitions, and later held investment roles at TPG and Empyrean Capital Partners. He previously served as Head of Strategic Finance at Square, Head of Strategic Finance at Eero, Head of Strategic Finance at Grove Collaborative, and most recently, Head of Finance at CloudTrucks.

Stacey McLaughlin Mr. McLaughlin was appointed CFO of Splash Beverage Group (NYSE American: SBEV), a portfolio company of beverage brands, effective January 24. Prior to joining Splash, Mr. McLaughlin served as CFO of Material Technologies. He also previously served as the company’s vice president and chief financial officer. Prior to Willdan Group, Inc., McLaughlin was a senior associate at Windes & McClawry Accountancy Corporation, and a senior audit associate at KPMG LLP.

Victor Hui He has been appointed CFO of Omnitsa, a provider of enterprise technology management solutions. Most recently, Hwei led the finance, strategy and corporate development team at Pantheon. Prior to that, he held multiple operational and financial leadership positions at New Relic. Hwei’s experience also includes positions as an investment banker at Morgan Stanley and his UBS.

big deal

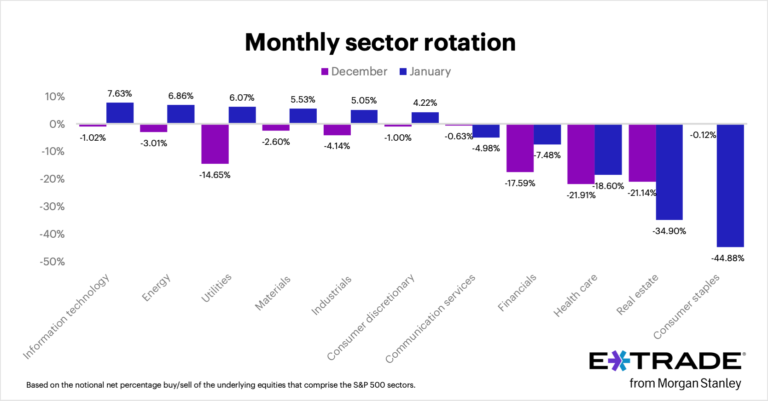

Morgan Stanley E-Trade has released data from its monthly sector rotation survey. The results are based on the assumed net percentage buying and selling behavior of the trading platform’s customers for stocks that make up the S&P 500 sectors.

Chris Larkin, managing director of trading and investments at Morgan Stanley’s E-Trade, said traders took a cautious approach, going net long in six of 11 sectors in January after being net short across the board in December. It is said that he took “While it’s not surprising that traders would gravitate toward technology, the real driver of activity was not the Magnificent Seven, but rather chips bought intensively by NVDA and AMD,” Larkin said in a statement. Stated. Traders were net buyers in the energy sector as oil prices rose. Meanwhile, prices for daily necessities, real estate, and healthcare plummeted. This means “traders are risk-on,” Larkin said.

even deeper

here are some luck weekend reading:

“Elon Musk hates Delaware now. Here’s why millions of companies love it” by Alicia Adamczyk

“Group led by Baltimore native and Carlyle’s David Rubenstein agrees to buy Orioles for more than $1.7 billion” Luisa Beltran

“Review: Venture Capitalist Chris Dixon makes serious claims about cryptocurrencies in the wake of FTX debacle on Read Write Own” by Jeff John Roberts

“Jay Shetty’s 3 daily tips to help you develop a growth mindset and achieve your goals” by Alexa Mikhail

overheard

“We estimate that there are hundreds of billions of publicly available images and videos, more than any typical crawl data set.”

– Meta CEO Mark Zuckerberg said during Thursday’s earnings call. This was his take on Microsoft, OpenAI, and Google, which are training AI models based on public web data crawled by search engines. luck report.

[ad_2]

Source link