[ad_1]

Semiconductor company has grown by a whopping 1,720% over the past five years Nvidia (NASDAQ:NVDA) It has delivered life-changing returns to investors. But it’s not a new act. The stock has risen an even more impressive 87,000% over its lifetime.

A true millionaire maker.

Currently, the market capitalization is a huge $1.5 trillion, and it is unlikely that it will continue to grow. After all, America’s total annual economic output is equivalent to her $28 trillion. But that doesn’t mean he can’t help Nvidia retire a billionaire.

Investors can buy and hold Nvidia with confidence in a diversified portfolio and enjoy the compounding returns expected over time.

Learn how Nvidia can change your financial fortunes below.

AI is here to stay, but expectations remain realistic

Nvidia built a huge company by specializing in dedicated graphics processing units (GPUs). These are computer chips designed for intense workloads such as high-end gaming. As technology advanced over time and required more powerful hardware, Nvidia’s chips began to expand into new end markets such as crypto mining, autonomous driving, and artificial intelligence (AI).

The company has become a leading AI chip supplier in a short period of time. Nvidia has built a software ecosystem that allows customers to easily implement and develop their AI models on their Nvidia chips. Currently, Nvidia has an estimated 90% market share, and the AI chip market could grow from $120 billion to $400 billion by 2027 (and beyond). It is thought that there is a possibility that it will continue.

Regardless of where the numbers end up, it’s clear that AI represents a huge opportunity. As a leading semiconductor company, Nvidia could technically capture much of that growth, but investors may want to put the brakes on. There’s no doubt that Nvidia will continue to be a key player in AI, but competition will aggressively pursue it. Additionally, some prominent AI chip users may design in-house hardware. Some are already working on it.

The bottom line is that Nvidia will continue to grow, but it’s unlikely that Nvidia will maintain its recent pace.

A dollar box is born

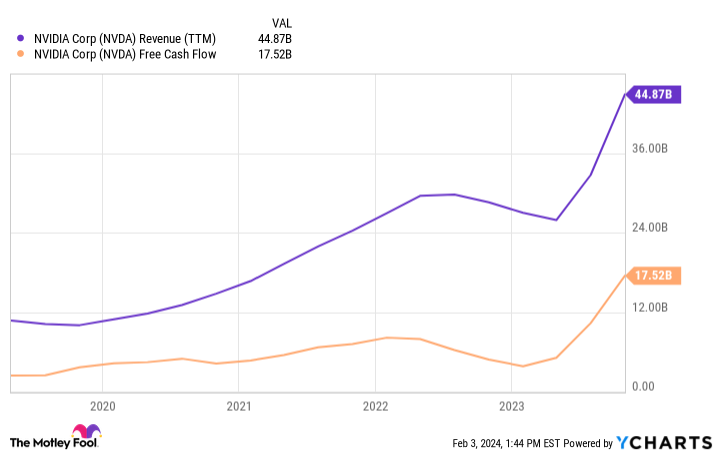

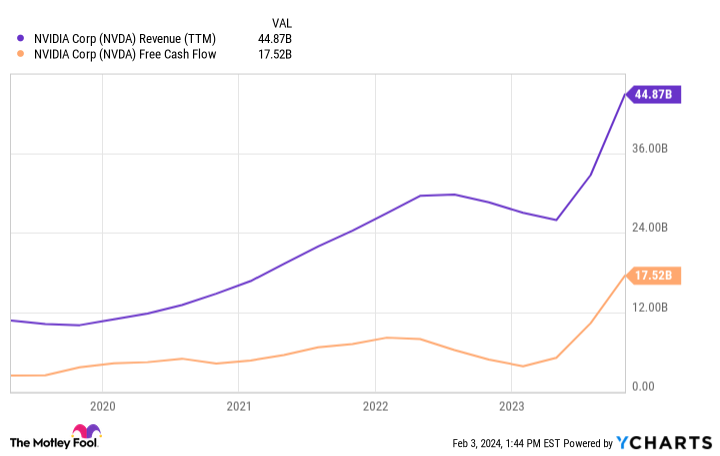

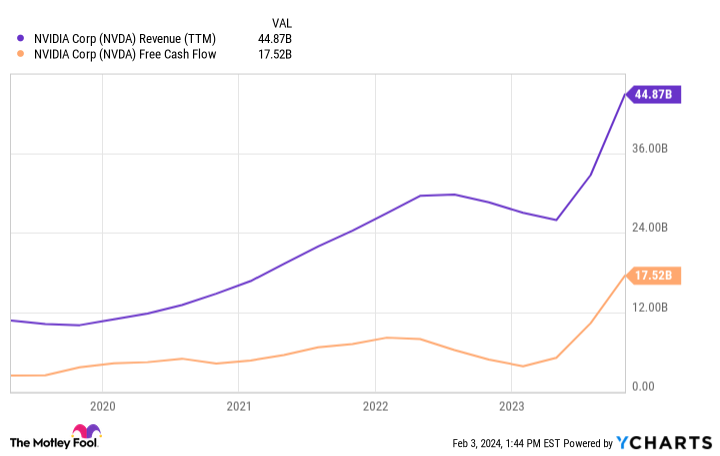

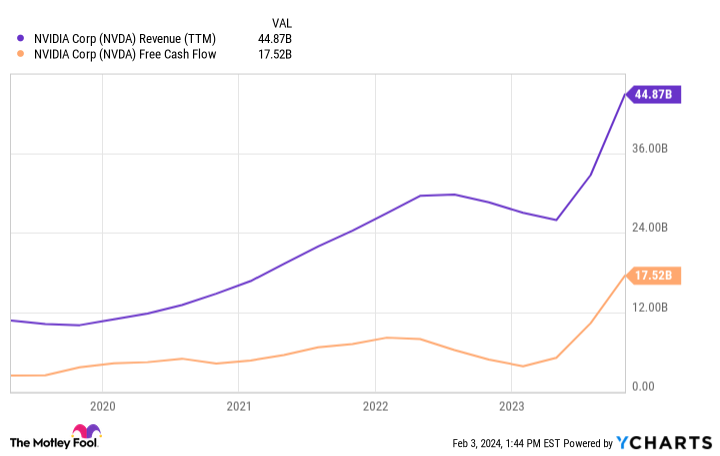

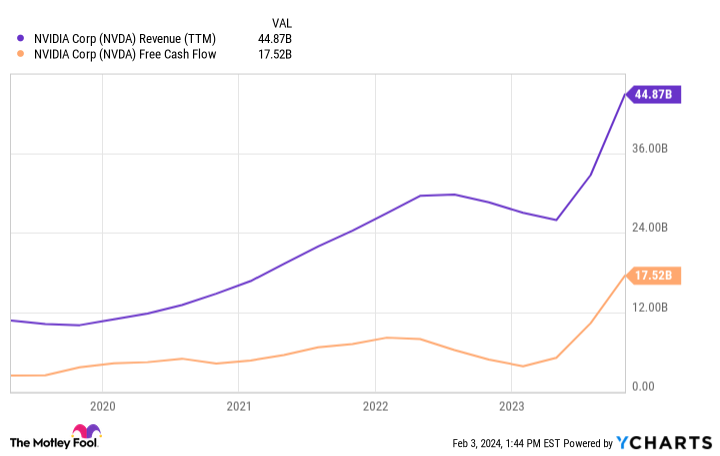

The good news is that that’s okay. Nvidia doesn’t need to be a roughly $10 trillion company to become very wealthy over the long term. Things are going to be different than what investors are used to. As we all know, Nvidia is already highly profitable and a cash cow with incredible revenue growth.

Nvidia converted 39% of its revenue into free cash flow over the past four quarters, totaling $17.5 billion. Analysts currently estimate profit of $109 billion for the fiscal year ending January 2026. Cash flow margins may improve as Nvidia grows, but even if they don’t, cash flow will remain at about $40 billion.

Use that cash to become a millionaire

Where are you going with this? There’s a good chance that Nvidia’s massive cash flow and how it spends that money will drive investment returns over the next decade and beyond. Shareholders can see Nvidia’s profits distributed to them piecemeal in the form of dividends and stock buybacks. The company already pays a dividend, but its yield is laughably low at 0.03% since the stock price has risen so much.

If management raised the dividend sooner, shareholders would be dizzy and unable to laugh. This dividend only costs Nvidia about $394 million, but that’s a rounding error for the company today. I’m optimistic that NVIDIA will eventually turn into a cannibal and buy back surprisingly large amounts of stock to boost earnings per share (EPS) as revenue growth slows.

We can see that management has recently started pushing this button. So, investors could be at the beginning of a long period where buybacks reduce the number of shares and increase the value of your stock.

Nvidia is too big to be the lottery ticket it once was. But can Nvidia help you? retire a billionaire? absolutely.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Nvidia wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of February 5, 2024

Justin Pope has no position in any stocks mentioned. The Motley Fool has a position in and recommends Nvidia. The Motley Fool has a disclosure policy.

Can Nvidia stock help billionaires retire? Originally published by The Motley Fool

[ad_2]

Source link