[ad_1]

A novel proposal from the mayor’s office to fund at least a portion of the planned renovations to Jacksonville Municipal Stadium is raising questions within the executive branch.

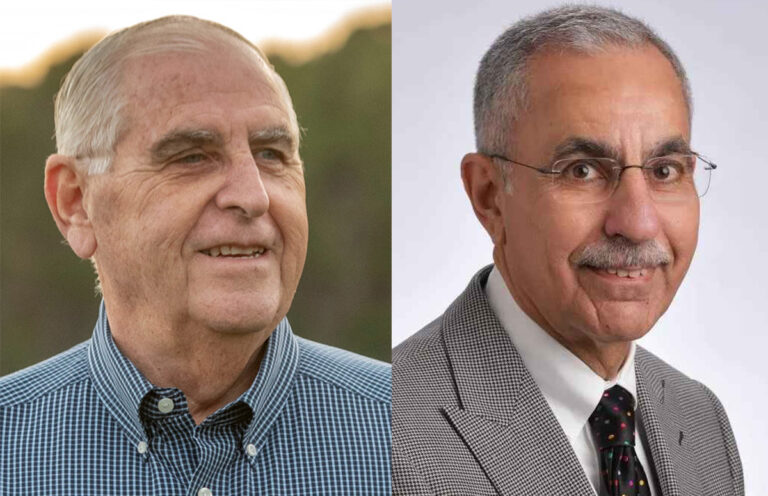

City council president Ron Salem He told Florida Politics on Saturday that he had serious questions about the move Congress is considering. donna deegan borrow from the government pension fund assets This is to help fund renovations that could reach $1 billion.

“I am concerned that this issue has come to the fore at the same time that we are negotiating pay rises. We also want to understand the cost savings of borrowing from pension funds versus borrowing money in traditional ways. “If this is indeed an alternative, there is significant work that needs to be completed,” the Republican pro tempore said.

Salem said he was briefed on the proposal by the chief negotiator. mike weinsteinis in charge of negotiations with the Jacksonville Jaguars ahead of a deal that will be presented to the City Council this summer.

randy white, the current vice president, who is likely to lead the council from July, has not been briefed by the administration. But the former Fire and Rescue Commissioner is taking a wait-and-see attitude while studying the proposal, wondering what the Fraternal Order of Police and the Jacksonville Firefighters Association, as well as the Police and Fire Pension Board, think. I’m also interested in

Weinstein said the interest rate would be higher than what could be earned with traditional financing through the bond market, but it would prevent the city from paying fees and other costs on money transferred from pension funds to infrastructure projects. said.

Weinstein said, “If you were able to invest some of it, a small portion of it, in the city, instead of investing it in land, instead of investing it in the stock market, you could take some of your money and invest it in the city. We discussed the possibility of investing in the city.” Donate it to the city. ”

“In return, the city will guarantee principal and interest at AAA revenue targets,” Weinstein said.

The agreement also includes that pension funds “have the opportunity to claim it, which means that whenever they run into financial difficulties, they can take some of it back, but they don’t have to keep the money.” That’s never going to happen because we have a lot of money.”It’s basically $5 billion in cash. ”

“So if they do this, they’re protected, they can meet their goals, they can invest in the city, and if they actually get cash-strapped, they can call back.”Cities, if you do this in the bond market. The interest rate will probably be a little higher than what you would get. ”

“But if you go to the bond market, you have fees, you have insurance, you have to buy to cover the bond. We need to look at the gap between what we guarantee and what we guarantee. If we deduct all the fees that we also have to pay, we end up paying for ourselves, but we basically end up paying for the premature closure of the pension fund. You will be contributing.”

Regarding pensions, Weinstein said that in January 2027, the half-penny sales tax currently allocated to repaying the Better Jacksonville plan will be used to repay the city’s legacy defined benefit pension plan, which was abolished in 2016. He said he expected it to be transferred by then. That would result in a transfer of $130 or $140. He said paying $1 million a year to repay old debt would fulfill the pension reform agreement signed by Japan and the United States. Lenny Curry management.

If interest rates drop to make it more profitable to borrow from outside funds, the city of Jacksonville could issue a request and “put it on the financial markets,” Weinstein said.

He said the proposal “has absolutely nothing to do with” employees or unions, and that police and fire negotiations are expected to be concluded before stadium funding becomes an issue, and that negotiations currently underway with public safety unions would be a challenge. He argued that this was a separate issue from labor negotiations. .

Post views: 0

[ad_2]

Source link