[ad_1]

Do you remember the first time you heard about this weird thing called “the cloud”? It was probably sometime in the 2010s. Many people said this would be a huge boon for technology companies, and they were right.

Spending on public cloud usage has grown from $31 billion in 2015 to nearly $200 billion in 2023. microsoftintelligent cloud and Amazon‘s (NASDAQ:AMZN) Amazon Web Services (AWS) each offer an impressive revenue stream of over $100 billion annually. This technology has been key to both stocks’ combined returns of over 900% since 2015.

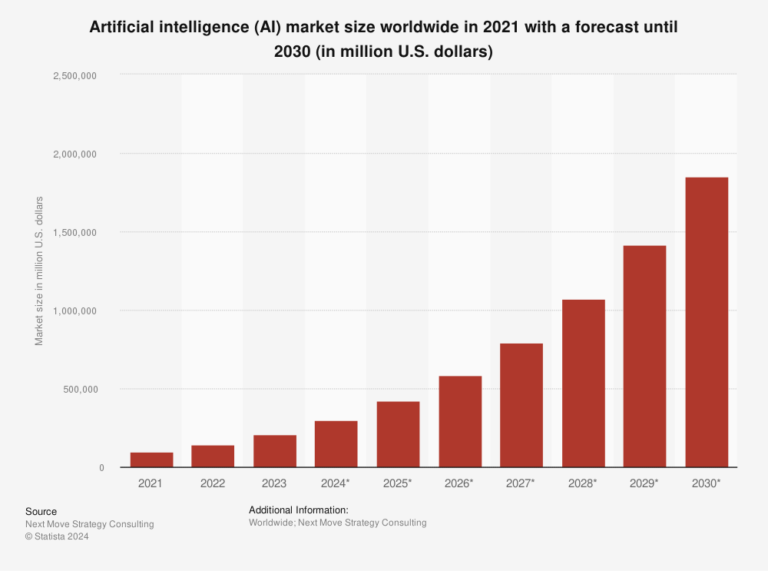

Artificial intelligence (AI) is likely to be the next big thing. Some say it will be as transformative as the Internet. The International Monetary Fund says AI will change nearly 40% of jobs around the world, and data compiled by Statista predicts the AI market will grow from $300 billion this year to more than $1.8 trillion by 2030. It is said to increase six times.

Here are four companies that are capitalizing on the growth of AI and have the potential to make investors very happy over the next six years.

Palantir

Palantir (NYSE:PLTR) is a popular stock, and much of the hype is well deserved. Managing, analyzing and using data to optimize decision-making is at the core of the company’s business. And platforms for the private sector and government are using AI to do this.

Palantir’s latest product, the Artificial Intelligence Platform (AIP), is also built for the defense and civilian sectors and is deployed on customer networks and leverages large-scale language models (LLMs). What exactly does this mean? Here is an example for Palantir:

Suppose you are a military operator commanding troops in the field and data comes in that the enemy is gathering equipment nearby. Operators can visualize the field and ask questions such as “What enemy units are nearby?” “What does the enemy formation look like?” You can then instruct a drone or satellite to capture images. This technology helps operators make planning and operational decisions.

Palantir has historically done well in defense revenue. This is a great source of income as the government has deep pockets. However, the private sector also offers a large market.

The company’s commercial revenue grew 32% year-over-year (YOY) to $284 million in Q4 2023 (accelerating from 23% YOY in Q3), and government revenue rose 11% to $300 million. The total amount was $24 million. Palantir has been profitable for five consecutive quarters under generally accepted accounting principles (GAAP), an impressive feat for a high-growth technology company.

The company’s stock trades at 25 times sales, which is not cheap, but based on future sales estimates, it would fall to 20 times sales. There are short-term risks to valuations, so consider taking your time before buying. In the long run, Palantir’s AI credentials are top-notch.

UiPath

A phrase to add to your vocabulary is robotic process automation (RPA). This performs and automates boring, non-value-added tasks.

For example, mortgage brokers may spend hours checking emails, downloading attachments, and manually entering data into applications. RPA can automate this, allowing brokers to focus on more advanced tasks such as communicating with underwriters and reaching out to customers.this is an example UiPath (NYSE:Pass) What we can do for our customers.

In terms of customers, UiPath boasts over 10,800 customers and brings in $1.4 billion in annual recurring revenue (ARR). UiPath’s revenue for the third quarter of 2024 (three months ending October 31, 2023) grew 24% to $326 million, which is impressive considering the challenging economic environment in 2023. UiPath also has a fortress-like balance. The company has $1.8 billion in cash and investments and no long-term debt.

UiPath is highly competitive in a fragmented industry, which may pose the most significant risk to investors. The company also has positive cash flow but is not profitable on a GAAP basis. The company’s stock trades at 11 times sales, which is reasonable for the industry.

RPA has the potential to save businesses huge amounts of money by automating low-level tasks, and UiPath could be a big long-term beneficiary of this trend.

Evolve Technologies

Before we dive into this company, note that this stock has a market capitalization of less than $1 billion, making it more speculative than others. Risk management is very important, so speculative stocks should only make up a certain portion of your portfolio, based on your age, the amount of time you need to cover your losses, and your risk tolerance. With that understanding, Evolve Technologies (NASDAQ:EVLV) We’re selling a fascinating technology that could potentially save your life (and possibly make investors a lot of money).

Now, when entering stadiums and other venues, people line up and pass through metal detectors one by one, emptying their pockets and often undergoing a secondary search using a cane. It’s inefficient and often misses items.

Evolv’s technology is different. Multiple people can walk inside his AI-powered machine, and the detector will identify guns and knives by looking at various features such as shape, rather than alerting you to any metal, such as car keys. Masu. Alerts show security personnel where the object was detected and take it from there.

Evolv’s target customers are schools, hospitals, and stadiums. Several major sports teams, school districts, and medical campuses are already using it. Final ARR for Q3 2023 was $66 million, representing 129% year-over-year growth, with subscriptions increasing 137% to just over 4,000. Evolv has a market cap of $676 million, trades at a reasonable 10x ARR, and has a lot of potential.

Amazon

I mentioned at least one company in this article that you may have never heard of, and it’s probably not this one. Amazon Although known for its online marketplace, AWS will also benefit greatly from AI as it is one of the world’s leading cloud service providers.

AI software requires large amounts of data, much of which is processed in the cloud. Amazon also offers other of his AI solutions, including a basic model that allows users to customize the AI software to suit their needs.

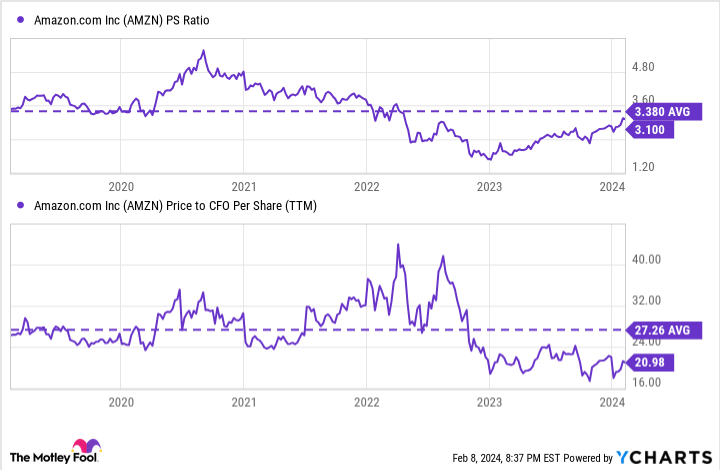

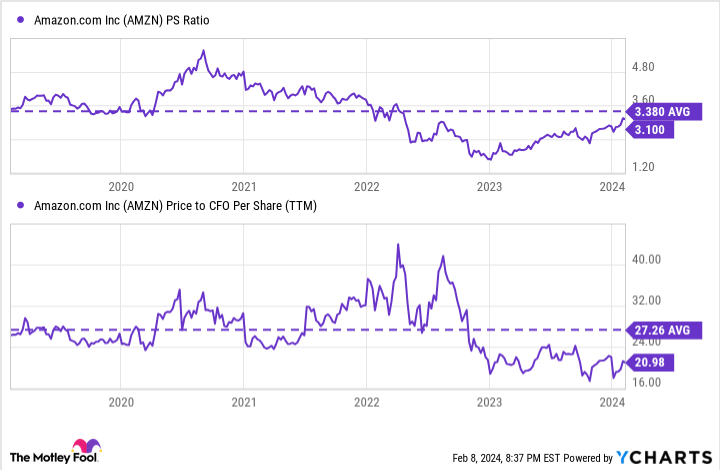

Amazon just announced its financial results for the fourth quarter of 2023, and those results were impressive. Total revenue increased by 14% to $170 billion, and cash flow and operating income also increased significantly. As you can see below, the stock price has risen, but it’s still below its average over the past five years based on sales and cash flow.

AI will give Amazon a boost and delight investors for years to come.

Should you invest $1,000 in Palantir Technologies right now?

Before buying Palantir Technologies stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Palantir Technologies wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of February 5, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Bradley Guichard has positions at Amazon and his UiPath. The Motley Fool has positions in and recommends Amazon, Microsoft, Palantir Technologies, and UiPath. The Motley Fool has a disclosure policy.

“Prediction: These could be the best-performing artificial intelligence (AI) stocks through 2030” was originally published by The Motley Fool.

[ad_2]

Source link